PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on October 12, 2021

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

BENITEC BIOPHARMA INC.

(Name of Registrant as Specified in Its Charter)

Payment of filing fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

|

|||

| (2) | Aggregate number of securities to which transaction applies:

|

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

| (4) | Proposed maximum aggregate value of transaction:

|

|||

| (5) | Total fee paid:

|

|||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

|

|||

| (2) | Form, schedule or registration statement no.:

|

|||

| (3) | Filing party:

|

|||

| (4) | Date filed:

|

|||

Table of Contents

3940 Trust Way

Hayward, California 94545

2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER , 2021

October , 2021

Dear Stockholders:

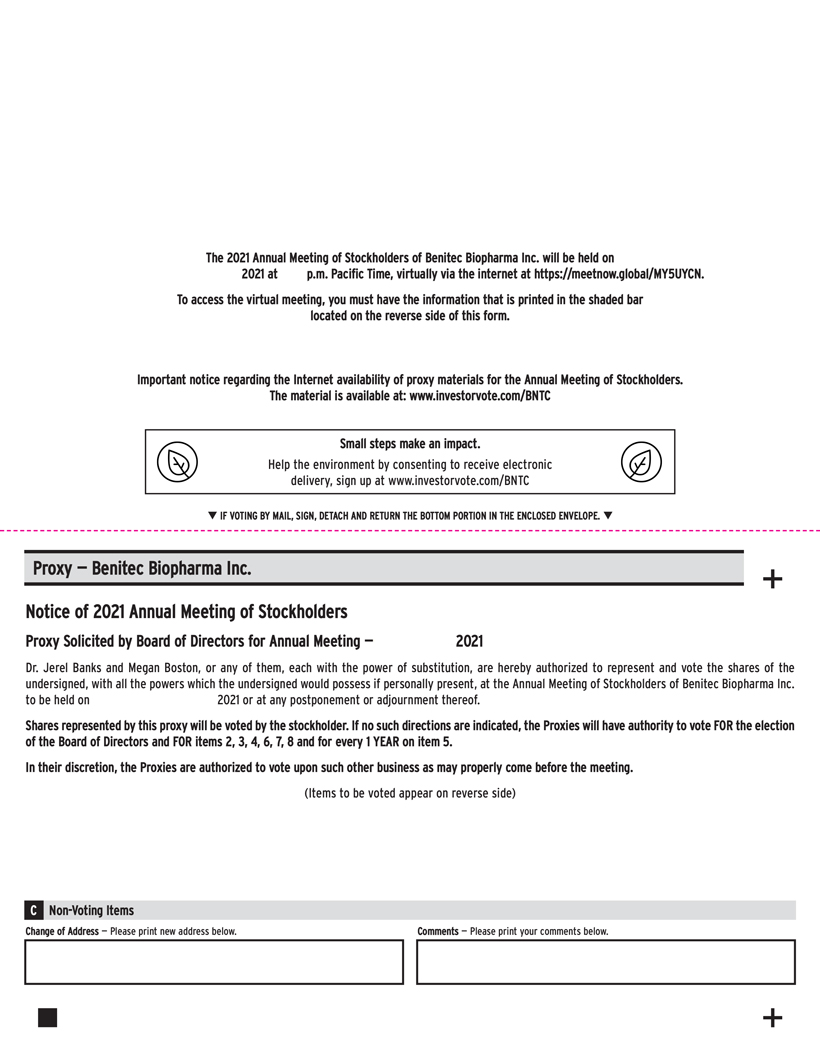

You are cordially invited to the 2021 Annual Meeting of Stockholders (the Annual Meeting) of Benitec Biopharma Inc. As a result of public health and travel guidance due to COVID-19, this years Annual Meeting will be conducted solely via live audio webcast on the Internet, and stockholders will not be able to attend the meeting in person. Our 2021 Annual Meeting will be conducted exclusively via the Internet at a virtual audio web conference at https://meetnow.global/MY5UYCN on December , 2021, beginning at , Pacific Time. You will be able to attend the annual meeting, vote and submit questions during the Annual Meeting by visiting the Annual Meeting website.

The Notice of Annual Meeting of Stockholders and Proxy Statement describing the matters to be acted upon at the Annual Meeting are contained in the following pages. Stockholders also are entitled to vote on any other matters that properly come before the Annual Meeting.

Your vote is important. Enclosed is a proxy that will entitle you to vote your shares on the matters to be considered at the Annual Meeting, even if you are unable to attend the virtual meeting online. Regardless of the number of shares you own, please be sure you are represented at the Annual Meeting either by attending virtually voting on the Internet or by telephone or returning a signed proxy card as soon as possible.

On behalf of Benitec Biopharma Inc., I thank you for your ongoing interest and investment in our company.

Sincerely,

Dr. Jerel Banks

Chief Executive Officer and Chairman of the Board of Directors

Table of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER , 2021

The Annual Meeting of Stockholders (Annual Meeting or 2021 Annual Meeting) of Benitec Biopharma Inc. will be held virtually on December , 2021, at , Pacific Time. The Annual Meeting can be accessed by visiting https://meetnow.global/MY5UYCN, where you will be able to listen to the meeting live, submit questions, and vote online for the following purposes:

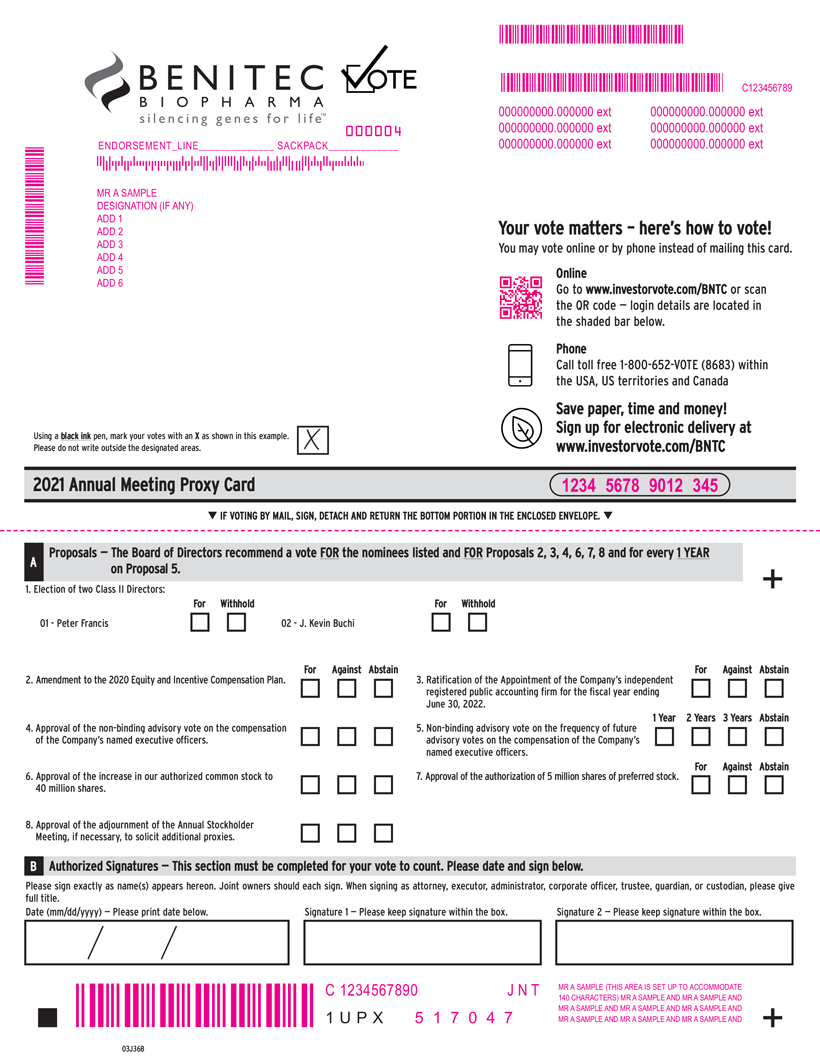

| 1. | Election of Directors. The election of two Class II directors to hold office until our 2024 Annual Meeting of Stockholders or until their successors are elected and qualified. |

| 2. | Approval of Amendment to the Equity Plan. To approve an amendment to the Companys 2020 Equity and Incentive Compensation Plan previously approved by the Companys Board of Directors. |

| 3. | Ratification of Appointment of Independent Accounting Firm. Ratification of the appointment of the Companys independent registered public accounting firm for the fiscal year ending June 30, 2022. |

| 4. | Say-on-Pay Vote. A non-binding advisory vote on the compensation of the Companys named executive officers as disclosed in the attached proxy statement. |

| 5. | Say-on-Frequency Vote. A non-binding advisory vote on the frequency of future advisory votes on the compensation of the Companys named executive officers. |

| 6. | Approval of Increase in Authorized Common Stock. To approve an amendment to the Companys Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 10,000,000 shares to 40,000,000 shares, and to make a corresponding change to the number of authorized shares of capital stock. |

| 7. | Approval of Preferred Stock. To approve an amendment to the Companys Amended and Restated Certificate of Incorporation to authorize 5,000,000 shares of preferred stock, par value $0.0001 per share, and to make a corresponding change to the number of authorized shares of capital stock. |

| 8. | Adjournment. To approve an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the other proposals in this Proxy Statement. |

| 9. | Other Matters. The transaction of such other business as may lawfully come before the Annual Meeting or any adjournment(s) thereof. |

Pursuant to the Companys Amended and Restated Bylaws, the Board of Directors has fixed the close of business on October , 2021 as the record date for determination of the stockholders entitled to vote at the Annual Meeting and any adjournments thereof. You can ensure that your shares are voted at the Annual Meeting by voting via the Internet or by completing, signing and returning the enclosed proxy card. If you do attend the Annual Meeting virtually, you may then withdraw your proxy and vote your shares during the virtual meeting. In any event, you may revoke your proxy prior to the Annual Meeting. Shares represented by proxies that are returned properly signed but unmarked will be voted in favor of the proposals made by the Company.

Table of Contents

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND OUR ANNUAL MEETING VIRTUALLY, PLEASE VOTE VIA THE INTERNET, BY TELEPHONE, OR SIGN AND SUBMIT YOUR PROXY AS SOON AS POSSIBLE SO THAT YOUR SHARES CAN BE VOTED AT OUR ANNUAL MEETING IN ACCORDANCE WITH YOUR INSTRUCTIONS.

| By Order of the Board of Directors, |

|

|

| Dr. Jerel Banks |

| Chief Executive Officer |

Hayward, California

October , 2021

Important Notice Regarding Availability of Proxy Materials for the 2021 Annual Meeting of

Stockholders to be held on December , 2021

Our Proxy Statement, Annual Report on Form 10-K, as amended, and proxy card are available on the Internet at www.edocumentview.com/BNTC and at the SEC Filings section under the Investors tab on our corporate website at www.benitec.com.

Table of Contents

2021 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

| Page | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| Deadline for Receipt of Stockholder Proposals for 2022 Annual Meeting of Stockholders |

4 | |||

| 5 | ||||

| 7 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 16 | ||||

| 16 | ||||

| 18 | ||||

| 18 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| PROPOSAL 2APPROVAL OF AMENDMENT TO THE 2020 EQUITY AND INCENTIVE COMPENSATION PLAN |

21 | |||

| 21 | ||||

| Background and Purpose of the Amended Plan; Stockholder Dilution Considerations |

21 | |||

| 24 | ||||

| 27 | ||||

i

Table of Contents

| Page | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| PROPOSAL 3RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

31 | |||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| Potential Adverse Effects of Increase in Authorized Common Stock |

37 | |||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 39 | ||||

| Effects of Preferred Stock Amendment on Current Stockholders |

39 | |||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

ii

Table of Contents

Table of Contents

3940 Trust Way

Hayward, California 94545

2021 ANNUAL MEETING PROXY STATEMENT

We are making these proxy materials available to you in connection with the solicitation of proxies by the Board of Directors (the Board) of Benitec Biopharma Inc. for the 2021 Annual Meeting of Stockholders (the Annual Meeting or 2021 Annual Meeting) to be held virtually on December , 2021 at , Pacific Time, and for any adjournment or postponement of the Annual Meeting. The Annual Meeting can be accessed by visiting https://meetnow.global/MY5UYCN, where you will be able to listen to the meeting live, submit questions, and vote online. The mailing of the Notice of Internet Availability of Proxy Materials and the Proxy Statement and Annual Report will commence on or about October , 2021.

Electronic copies of this Proxy Statement and the Annual Report for the year ended June 30, 2021 are available at www.edocumentview.com/BNTC and on the Internet through the Securities and Exchange Commissions electronic data system called EDGAR at www.sec.gov or through the Investor section of our website at www.benitec.com.

In this Proxy Statement, we, us, our, Benitec and the Company refer to Benitec Biopharma Inc., a Delaware corporation, and its subsidiaries.

This Proxy Statement is being made available to you because you own shares of our common stock, par value $0.0001 per share, as of the Record Date, which entitles you to vote at the Annual Meeting. By use of a proxy, you can vote whether or not you attend the virtual Annual Meeting. This Proxy Statement describes the matters we would like you to vote on and provides information on those matters.

INFORMATION CONCERNING SOLICITATION AND VOTING

Only holders of record of our common stock at the close of business on October , 2021 (the Record Date) are entitled to notice of our Annual Meeting and to vote at our Annual Meeting. As of the Record Date, we had shares of our common stock issued and outstanding.

Each share of our common stock is entitled to one vote on all matters presented at our Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of directors.

Shares of common stock represented by properly executed proxies will, unless such proxies have been previously revoked, be voted in accordance with the instructions indicated thereon. In the absence of specific instructions to the contrary, properly executed unrevoked proxies will be voted: (i) FOR the election of the director nominees named in this Proxy Statement as Class II directors (Proposal 1), (ii) FOR the approval of the amendment to the 2020 Equity and Incentive Compensation Plan (Proposal 2), (iii) FOR the ratification of

Table of Contents

the appointment of the Companys independent registered public accounting firm for the fiscal year ended June 30, 2022 (Proposal 3), (iv) FOR the approval of the non-binding advisory vote on the compensation of the Companys named executive officers as disclosed in this Proxy Statement (Proposal 4), (v) FOR the adoption of an ANNUAL advisory vote on the compensation of the Companys named executive officers (Proposal 5), (vi) FOR the approval of the increase in our authorized common stock (Proposal 6), (vii) FOR the approval of the authorization of preferred stock (Proposal 7), and (viii) FOR the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the other proposals in this Proxy Statement (Proposal 8). No other business is expected to come before stockholders at our Annual Meeting. Should any other matter requiring a vote of stockholders properly arise, the persons named in the enclosed proxy card will vote such proxy in accordance with their best judgement (including the recommendation of our Board).

Directors, officers, agents and employees and the Company may communicate with stockholders, banks, brokerage houses and others by mail, telephone, e-mail, in person or otherwise to solicit proxies. We may hire a proxy solicitation firm at standard industry rates to assist in the solicitation of proxies. All expenses incurred in connection with this solicitation will be borne by us. We request that brokerage houses, nominees, custodians, fiduciaries and other like parties forward the soliciting materials to the underlying beneficial owners of our common stock. We will reimburse reasonable charges and expenses in doing so.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to our Secretary, at or before the taking of the vote at our Annual Meeting, a written notice of revocation or a duly executed proxy bearing a later date or by attending our Annual Meeting and voting at such meeting. If not revoked, the proxy will be voted at the Annual Meeting in accordance with the stockholders instructions indicated on the proxy card.

Quorum and Voting Requirements

Quorum. The required quorum for the transaction of business at our Annual Meeting is the holders of a majority of shares of common stock issued and outstanding on the Record Date and entitled to vote at our Annual Meeting, present in person, by remote communication, or by proxy. Shares that are voted FOR or AGAINST a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares entitled to vote at our Annual Meeting with respect to such matter. Abstentions and broker non-votes will also count toward the presence of a quorum. An abstention is the voluntary act of not voting by a stockholder who is present at a meeting in person or by proxy and entitled to vote. Below is a discussion of the effect of abstentions and broker non-votes on the results of each proposal.

Voting Requirements to Approve Proposals. The election of our Class II directors pursuant to Proposal 1 will be by a plurality of the shares voted (meaning that the nominees with the largest number of votes is elected), up to the maximum number of directors to be chosen (in this case, two directors). Withhold votes and broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on the results of Proposal 1. The approval of Proposal 2, the approval of the amendment to the 2020 Equity and Incentive Compensation Plan (the 2020 Plan), Proposal 3, the ratification of Baker Tilly LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2022, Proposal 4, the Say-on-Pay Vote, Proposal 5, the Say-on-Frequency Vote, and Proposal 8, the Adjournment Proposal, requires the affirmative vote of a majority of the votes present and entitled to vote at the Annual Meeting (meaning that of the shares represented at the meeting and entitled to vote, a majority of them must be voted FOR Proposals 2, 3, 4, and 8 for such proposal to be approved and for every one year, two years, or three years for a particular alternative to be approved with respect to Proposal 5). Abstentions will have the same effect as a vote AGAINST Proposal 2, Proposal 3, Proposal 4, and Proposal 8 and the alternatives to be vote upon with respect to Proposal 5, and broker non-votes will have no effect on the results of Proposals 2, 3, 4, 5, or 8. As discussed below, because brokers will have discretionary voting authority with respect to Proposal 3, we do not expect any

2

Table of Contents

broker non-votes with respect to this proposal. The approval of the amendments to our Certificate of Incorporation pursuant to Proposal 6 and Proposal 7 each require the affirmative vote of a majority of our outstanding shares of common stock. Abstentions will have the same effect as a vote AGAINST Proposal 6 and Proposal 7. Broker non-votes will have the same effect as a vote AGAINST Proposal 6 and 7. As discussed below, because brokers will have discretionary voting authority with respect to Proposal 6, we do not anticipate any broker non-votes with respect to Proposal 6.

If you are a registered holder, meaning that you hold our stock directly rather than through a broker, bank, or other nominee, you may vote online at the Annual Meeting, by telephone or electronically through the Internet by following the instructions included on your Notice of Internet Availability of Proxy Materials or proxy card, or by completing, dating, signing and promptly returning your proxy card. All signed, returned proxies that are not revoked will be voted in accordance with the instructions contained therein. Signed proxies that give no instructions as to how they should be voted on a particular proposal at the Annual Meeting will be counted as votes for such proposal, and, in the case of the election of the Class II directors, as a vote for the election of the nominees presented by the Board and in the case of the frequency of say-on-pay proposal for the say-on-pay proposal to be submitted once every year.

In order to vote via the virtual meeting website, any registered holder of our common stock may attend the Annual Meeting by visiting https://meetnow.global/MY5UYCN, where stockholders may vote and submit questions during the meeting. Please have your 16-digit control number to join the Annual Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.investorvote.com/BNTC.

If your shares are held through a bank, broker or other nominee (in street name), you are considered the beneficial owner of those shares. You may be able to vote by telephone or electronically through the Internet in accordance with the voting instructions provided by that nominee. You may also vote by completing, dating, signing and promptly returning the voting instruction form sent by that nominee. You must obtain a legal proxy from the nominee that holds your shares if you wish to vote online at the Annual Meeting. If you do not provide voting instructions to your broker in advance of the Annual Meeting, New York Stock Exchange rules grant your broker discretionary authority to vote on routine proposals. Where a proposal is not routine, a broker who has received no instructions from its clients does not have discretion to vote its clients uninstructed shares on that proposal, and the unvoted shares are referred to as broker non-votes. For the Annual Meeting, Proposals 1, Proposal 2, Proposal 4, Proposal 5, Proposal 7, and Proposal 8 are not considered routine proposals, and Proposal 3 and Proposal 6 are considered routine proposals.

In the event that sufficient votes in favor of the adoption of any proposal set forth in this Proxy Statement are not received by the date of the Annual Meeting, we may adjourn the Annual Meeting to permit further solicitations of proxies if Proposal 8 is approved.

The telephone and Internet voting procedures are designed to authenticate stockholders identities, to allow stockholders to give their voting instructions and to confirm that stockholders instructions have been recorded properly. Stockholders voting via the telephone or Internet should understand that there may be costs associated with telephonic or electronic access, such as usage charges from telephone companies and Internet access providers, which must be borne by the stockholder.

Information about the Virtual Meeting

The virtual Annual Meeting is accessible on any internet-connected device and stockholders will be able to submit questions and comments and to vote online during the meeting. We believe these benefits of a virtual meeting are in the best interests of our stockholders. In the event of a technical malfunction or other problem that disrupts the Annual Meeting, the Company may adjourn, recess, or expedite the Annual Meeting, or take such other action that the Company deems appropriate considering the circumstances. If you encounter any difficulties accessing the virtual meeting during the meeting, a toll free number will be available to assist.

3

Table of Contents

You may virtually attend the Annual Meeting by visiting https://meetnow.global/MY5UYCN, where stockholders may vote and submit questions during the Meeting. Please have your 16-Digit Control Number to join the Annual Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.investorvote.com/BNTC.

Only holders of our common stock at the close of business on October , 2021, the record date, will be permitted to ask questions during the Annual Meeting. If you wish to submit a question, on the day of the Annual Meeting, you may log into the virtual meeting platform and type your question for consideration into the field provided in the web portal. To allow us to answer questions from as many stockholders as possible, we may limit each stockholder to two (2) questions. Questions from multiple stockholders on the same topic or that are otherwise related may be grouped, summarized and answered together. More information on submitting questions at the Annual Meeting will be posted on the Internet www.investorvote.com/BNTC in advance of the meeting.

In accordance with Delaware law, for the 10 days prior to our Annual Meeting, a list of registered holders entitled to vote at our Annual Meeting will be available for inspection in our offices at 3940 Trust Way, Hayward, California 94545. Stockholders will also be able to access the list of registered holders electronically during the Annual Meeting through the virtual meeting website at https://meetnow.global/MY5UYCN.

Deadline for Receipt of Stockholder Proposals for 2022 Annual Meeting of Stockholders

Pursuant to Rule 14a-8 of the Securities and Exchange Commission (SEC), proposals by eligible stockholders that are intended to be presented at our 2022 Annual Meeting of Stockholders must be received by our Corporate Secretary at Benitec Biopharma Inc., 3940 Trust Way, Hayward, California 94545 not later than , 2022 in order to be considered for inclusion in our proxy materials.

Stockholders intending to present a proposal or nominate a candidate to our Board of directors at our 2022 Annual Meeting of Stockholders must comply with the requirements and provide the information set forth in our amended and restated bylaws (the Bylaws). Under our Bylaws, in order for a stockholder to bring business before an annual meeting of our stockholders, the stockholders the stockholders notice must be timely received, which means that a proposal must be delivered to or mailed to our Secretary not later than 90 days prior, and not earlier than 120 days prior to the first anniversary of the preceding years annual meeting. Because our 2021 Annual Meeting is scheduled for December , 2021, this means that such notice for the 2022 Annual Meeting must be received by the Company between , 2022 and , 2022. In the event that the date of the 2022 Annual Meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company.

4

Table of Contents

VOTING SECURITIES OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Companys common stock as of September 7, 2021 by (i) each person or group of persons known by us to beneficially own more than five percent of our common stock, (ii) each of our named executive officers, (iii) each of our directors and (iv) all of our directors and executive officers as a group.

The following table gives effect to the shares of common stock issuable within 60 days of September 7, 2021 upon the exercise of all options and other rights beneficially owned by the indicated stockholders on that date. Beneficial ownership is determined in accordance with Rule 13d-3 promulgated under Section 13 of the Securities Exchange Act and includes voting and investment power with respect to shares. Percentage of beneficial ownership is based on 8,171,690 shares of common stock outstanding at the close of business on September 7, 2021. Except as otherwise noted below, each person or entity named in the following table has sole voting and investment power with respect to all shares of our common stock that he, she or it beneficially owns.

Unless otherwise indicated below, the address for each beneficial owner listed is c/o 3940 Trust Way, Hayward, California 94545.

| Name of Beneficial Owner | Number of Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

||||||

| 5% or Greater Stockholders: |

||||||||

| Entities affiliated with Suvretta Capital Management, LLC (1) |

769,000 | 9.4 | % | |||||

| Entities affiliated with Lincoln Park Capital, |

423,529 | 5.1 | % | |||||

| Directors and Named Executive Officers: |

||||||||

| Jerel A. Banks (3) |

33,333 | * | ||||||

| Megan Boston (4) |

11,444 | * | ||||||

| J. Kevin Buchi (5) |

4,827 | * | ||||||

| Peter Francis (6) |

5,037 | * | ||||||

| Edward Smith |

| * | ||||||

| All Executive Officers and Directors As a Group |

54,641 | * | ||||||

| * | Represents beneficial ownership of less than one percent of the Companys outstanding common stock. |

| (1) | Based on the information included in the Schedule 13G filed by Suvretta Capital Management, LLC (Suvretta) on May 7, 2021, Averill Master Fund, Ltd. (Averill) and Aaron Cowen. The address of the principal business office of Suvretta and Mr. Cowen is c/o Suvretta Capital Management, LLC, 540 Madison Avenue, 7TH Floor, New York, New York 10022. The address of the principal business office of Averill is c/o Maples Corporate Services Limited, P.O. Box 309, Ugland House, Grand Cayman KY1-1104, Cayman Islands. |

| (2) | Based on information included in the Schedule 13G filed by Lincoln Park Capital, LLC and its affiliates on April 28, 2021. Represents 423,529 shares held directly by Lincoln Park Capital Fund, LLC (LPC Fund). Alex Noah and Joshua B. Scheinfeld have shared voting and shared investment power over the shares held by LPC Fund. The address of the principal business office of Lincoln Park Capital, LLC and its affiliates is 440 North Wells, Suite 410, Chicago, Illinois 60654. |

| (3) | Represents stock options to acquire 33,333 that have vested or will vest within 60 days of September 7, 2021. |

| (4) | Includes 333 shares held by Boston Super Invest Pty A/C Boston Family Super that Megan Boston has sole voting power over and stock options to acquire 11,111 shares of common stock that have vested or will vest within 60 days of September 7, 2021. |

5

Table of Contents

| (5) | Includes 4,827 shares of common stock held by Mr. Buchi. |

| (6) | Includes 4,737 shares of common stock held by the Francis Family Superannuation Fund and 300 shares held directly by Mr. Francis. |

| (7) | Includes 10,197 shares of common stock and stock options to acquire 44,444 shares of common stock that have vested or will vest within 60 days of September 7, 2021. |

6

Table of Contents

The following table sets forth certain information regarding those individuals currently serving as our directors (or nominated to serve as a director) and executive officers as of October , 2021:

| Name |

Age | Position |

||

| Dr. Jerel Banks |

46 | Chief Executive Officer, Director | ||

| Megan Boston |

49 | Executive Director, Director | ||

| J. Kevin Buchi (1)(2)(3) |

66 | Director | ||

| Peter Francis (1)(2)(3) |

65 | Director | ||

| Edward Smith (1)(2)(3) |

50 | Director |

| (1) | Member of our Audit Committee. |

| (2) | Member of our Compensation Committee. |

| (3) | Member of our Nominating Committee. |

Dr. Jerel Banks has been a Director since October 2016, Chairman of our Board since October 2017 and Chief Executive Officer since June 2018. Dr. Banks was formerly the Chief Investment Officer of Nant Capital, LLC. Prior to joining Nant Capital, LLC, Dr. Banks served as vice president, portfolio manager and research analyst for the Franklin Biotechnology Discovery Fund at Franklin Templeton Investments from 2012 to 2015. Prior to his tenure at Franklin Templeton Investments, he worked as a biotechnology senior equity research analyst at Sectoral Asset Management from 2011 to 2012. From 2008 to 2011, Dr. Banks worked as a biotechnology equity research analyst at Apothecary Capital, the healthcare investment management team for the family investment office of the Bass Family of Fort Worth, Texas. Dr. Banks began his career in investment management as a healthcare equity research associate at Capital Research Company where he was a member of the equity research team from 2006 to 2008. Dr. Banks earned an M.D. from the Brown University School of Medicine and a Ph.D. in Organic Chemistry from Brown University, and he holds an A.B. in Chemistry from Princeton University.

Dr. Banks experience in the healthcare industry and finance provides valuable experience and guidance to the Board.

Megan Boston has previously been Chief Executive Officer and Managing Director of several companies, including entities listed on the Australian Stock Exchange. With over 13 years of experience, Ms. Boston has been a director across a range of industries where she chaired company boards as well as board sub-committees particularly in the area of finance and risk management. Specifically, Ms. Boston has been a Director of Benitec since August 2016 and Executive Director since June 2018. From 2014 until joining Benitec, Ms. Boston was CEO of listed companies on the Australian Stock Exchange, Omni Market Tide Ltd and Rision Ltd. Previously, Ms. Boston held senior executive roles at various banking institutions in the area of risk and compliance, as well as working for PricewaterhouseCoopers. Ms. Boston holds a Bachelor of Commerce and is an Australian Chartered Accountant. Ms. Boston has also completed the company directors course diploma administered by the Australian Institute of Company Directors.

We believe Ms. Bostons operational and financial infrastructure experience gives her the necessary skills and qualifications to serve as a member of the Board.

J. Kevin Buchi has been a Director since April 2013. Mr. Buchi previously served as Chief Executive Officer of BioSpecifics Technologies Corp. and of TetraLogic Pharmaceuticals Corporation. Mr. Buchi served as Chief Executive Officer of Cephalon, Inc., or Cephalon, from December 2010 through its acquisition by Teva Pharmaceutical Industries Ltd in October 2011. After the acquisition Mr. Buchi served as Corporate Vice President, Global Branded Products of Teva Pharmaceuticals Industries Ltd. Mr. Buchi joined Cephalon in 1991 and held various positions, including Chief Operating Officer, from January 2010 to December 2010, Chief

7

Table of Contents

Financial Officer and Head of Business Development prior to being appointed Chief Executive Officer. Mr. Buchi is also on the board of directors of Amneal Pharmaceuticals, Inc. (NYSE: AMRX) and Dicerna Pharmaceuticals, Inc. (Nasdaq: DRNA. Mr. Buchi has a B.A. in chemistry from Cornell University and a Masters in Management from Kellogg Graduate School of Management at Northwestern University. He is also a Certified Public Accountant.

Based on his broad executive experience in the biotechnology industry, we believe Mr. Buchi has the appropriate skills and qualifications to serve on the Board.

Peter Francis has been a director since February 2006 and was previously Chairman of the Board until October 2017. Since 1993, Mr. Francis has been a partner at Francis Abourizk Lightowlers, a firm of commercial and technology lawyers with offices in Melbourne, Australia. He is a legal specialist in the areas of intellectual property and licensing and provides legal advice to corporations and research bodies. Mr. Francis completed his studies in law and jurisprudence at Monash University.

Based on his substantive intellectual property background and experience with our company, we believe Mr. Francis has the appropriate skills and qualifications to serve on the Board.

Edward Smith has been a director since April 2020. Edward brings more than 20 years of experience in executive finance and operations leadership in the biotechnology industry to our Board. Edward currently serves as the Chief Financial Officer of LAVA Therapeutics N.V. (Nasdaq: LVTX), a clinical stage pharmaceutical company focused on developing novel immuno-oncology therapeutics. Prior to that, he served as Chief Financial Officer of Marinus Pharmaceuticals, Inc. (Nasdaq: MRNS), a clinical-stage pharmaceutical company focused on developing and commercializing innovative therapeutics to treat patients suffering from rare seizure disorders, and PolyMedix, Inc., a clinical stage pharmaceutical company focused on developing a novel class of antibiotics for the treatment of infectious diseases. Before his time at PolyMedix, Inc. he served as the executive director of finance at InKine Pharmaceutical Company, Inc. and held various positions in public accounting, most recently in the audit practice of Deloitte.

Based on his extensive finance and operations background in the biotechnology industry, we believe Mr. Smith has the appropriate skill and qualifications to serve on the Board.

There are no family relationships among any of our directors or executive officers and no arrangements or understandings with major stockholders, customers, suppliers or others pursuant to which any of our directors or members of senior management was selected as such, except Dr. Banks was appointed by Nant Capital as a Director in October 2016 following the acquisition by Nant Capital, LLC of a significant percentage of Benitecs then-outstanding ordinary shares.

The business addresses for each of our directors and executive officers is 3940 Trust Way, Hayward, California 94545.

8

Table of Contents

CORPORATE GOVERNANCE AND BOARD MEETINGS AND COMMITTEES

The Companys business and affairs are managed under the direction of the Board. The Board currently consists of five directors, comprising the Companys Chief Executive Officer, Executive Director and three outside directors. Our Board has determined that three of our directors are independent as defined by the rules of the SEC and The Nasdaq Stock Market LLC (Nasdaq). Our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee each consists entirely of independent directors under the rules of the SEC and Nasdaq. The number of directors is fixed from time to time by resolution of the Board pursuant to the Companys amended and restated certificate of incorporation (the Certificate of Incorporation).

Each of the Companys current directors will continue to serve as a director until the election and qualification of his or her successor, or until his or her earlier death, resignation, or removal.

The Companys Certificate provides that the Board is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective terms. The Board is designated as follows:

| | Mr. Smith is a Class I director, and his current term will expire at the annual meeting of stockholders to be held in 2023; |

| | Messrs. Buchi and Francis are Class II directors, and their initial terms will expire at the 2021 Annual Meeting; and |

| | Dr. Banks and Ms. Boston are Class III directors, and their terms will expire at the annual meeting of stockholders to be held in 2022. |

Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the Companys directors.

Attendance at Annual Meetings of Stockholders

We expect that all of our Board members attend our annual meetings of stockholders in the absence of a showing of good cause for failure to do so. All of the members of our Board attended our 2020 annual meeting of stockholders in person or by telephone.

During our last fiscal year, each of our directors attended at least 75% of the aggregate of (i) the total number of Board meetings and (ii) the total number of meetings of the committees on which the director served.

Board of Directors

Our Board held a total of six meetings during the last fiscal year. Our Board has three standing committees an Audit Committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934 (our Audit Committee), a Compensation Committee (our Compensation Committee) and a Nominating and Corporate Governance Committee (our Nominating Committee). Our Audit Committee, Compensation Committee and Nominating Committee each have a charter, which is available at the Corporate Governance section under the Investors tab on our website at www.benitec.com.

Audit Committee

The purpose of the Audit Committee is to assist the board in fulfilling its oversight responsibilities with respect to (i) the integrity of the Companys financial statements, (ii) the Companys compliance with legal and

9

Table of Contents

regulatory requirements, and (iii) the independent auditors qualifications, independence and performance. The Audit Committee is also responsible for preparing a report to be included with this proxy statement. The Audit Committee also advises and consults with the management and the Board regarding the Companys financial affairs, and appoints, oversees and approves compensation for the work of the Companys independent auditors. The Audit Committee also is responsible for reviewing and approving any related party transaction that is required to be disclosed. Our Audit Committee met five times during the last fiscal year. The current members of our Audit Committee are Messrs. Buchi (Chairman), Francis and Smith.

Our Board has determined that Messrs. Buchi, Francis and Smith each meet the independence requirements of Rule 10A-3 under the Exchange Act and the applicable Nasdaq rules. Our Board has determined that Mr. Smith is an audit committee financial expert as defined by applicable SEC rules and has the requisite financial sophistication as defined under the applicable Nasdaq rules.

Compensation Committee

The Compensation Committee establishes and administers the Companys policies, programs and procedures for compensating and providing benefits to the Companys executive officers, and makes recommendations to the Board with respect to non-employee director compensation. The Compensation Committees responsibilities and duties are set forth in the Compensation Committee Charter (a copy of the Compensation Committee Charter is available on the Companys website as noted above). The Compensation Committees responsibilities specifically include reviewing and approving the goals and objectives relevant to the chief executive officers and other executive officers compensation, evaluating the performance of the chief executive officer and other executive officers in light of those goals and objectives, and making recommendations to the Board with respect to non-employee director compensation. The Compensation Committee is also responsible for making recommendations to the Board with respect to incentive compensation plans and equity-based incentive compensation plans.

Our Compensation Committee met four times during the last fiscal year. The current members of our Compensation Committee are Messrs. Francis (Chairman), Buchi and Smith. Our Board has determined that all members of our Compensation Committee are independent as defined under the rules of the SEC and the listing standards of Nasdaq.

No member of our Compensation Committee is or has been our current or former officer or employee. None of our executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers served as a director or member of our Compensation Committee during the fiscal year ended June 30, 2021.

Role of Compensation Consultant

Pursuant to its charter, the Compensation Committee has the authority to engage consultants or other advisors, including independent counsel and compensation advisors, as it deems necessary or appropriate to carry out its duties. With respect to the fiscal year ended June 30, 2021, the Compensation Committee retained Radford (AON) (Radford) to provide advice to the Compensation Committee with respect to the compensation of our non-employee directors and executive officers. Radford also provided advice with respect to the proposed amendment to the Companys 2020 Equity and Incentive Compensation Plan (the 2020 Plan), which is described below under the heading Proposal 2: Amendment to the 2020 Equity and Incentive Compensation Plan, the Companys peer group, certain governance matters, and market trends.

Nominating Committee

The Nominating Committee reviews the Companys Corporate Governance Guidelines and recommends appropriate revisions to the Companys governing documents to the Board. The Nominating Committees

10

Table of Contents

responsibilities include identifying individuals qualified to become members of the Board, recommending candidates to fill Board vacancies and newly created director positions, recommending whether incumbent directors should be nominated for re-election upon the expiration of their terms, recommending corporate governance guidelines applicable to the Board and to the Companys employees, overseeing the evaluation of the Board and its committees, and assessing and recommending Board members to the Board for committee membership. This assessment includes factors such as judgement, skill, integrity, experience with businesses and other organizations of comparable size and/or in comparable industries, the interplay of the candidates experience with the experience of other Board members, the extent to which the candidate would be a desirable addition to the Board and any committees of the Board and any other factors that the committee deems relevant to the current needs of the Board, including those that promote diversity.

The current members of our Nominating Committee are Messrs. Francis (Chairman), Buchi and Smith. Our Nominating Committee met one time during the last fiscal year. Our Board has determined that all members of our Nominating Committee are independent as defined under the rules of the SEC and the listing standards of Nasdaq.

Corporate Governance Guidelines

Our Board of Directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of our Company and our stockholders. The guidelines provide: that the role of the Board is to oversee the performance of the Companys Chief Executive Officer and other senior management of the company; a set of qualifications for director skills, experience, and independence; a process for related-person transaction review by the Audit Committee; and succession planning for management. Under the Guidelines, the Board considers the management of significant risks to the Company.

Code of Ethics and Business Conduct

We have established a Code of Ethics and Business Conduct as of April 14, 2020, which sets out the standards of behavior that apply to every aspect of our dealings and relationships, both within and outside the company. The following standards of behavior apply to all directors, executive officers and employees of the company: comply with all laws that govern us and our operations; act honestly and with integrity and fairness in all dealings with others and each other; avoid or manage conflicts of interest; use our assets responsibly and in the best interests of the company; and be responsible and accountable for our actions. The Code of Ethics and Business Conduct is available on our website at www.benitec.com. Any amendments made to the Code of Ethics and Business Conduct will also be available on our website, within four business days of any such amendment.

Hedging and Pledging Policy

Employees (including officers) and directors of the Company are prohibited from entering into hedging transactions with respect to the Companys securities, or engaging in transactions with respect to the Companys securities that are of a speculative nature, including, but not limited to, put or call options, margining Company securities, or otherwise pledging Company securities as collateral.

Stockholder Communications with Directors

Stockholders who want to communicate with our Board or with a particular director or committee may send a letter to our Secretary at Benitec Biopharma Inc., 3940 Trust Way, Hayward, California 94545. The mailing envelope should contain a clear notation indicating that the enclosed letter is a Board Communication or Director Communication. All such letters should state whether the intended recipients are all members of our Board or just certain specified individual directors or a specified committee. The Secretary will circulate the communications (with the exception of commercial solicitations) to the appropriate director or directors. Communications marked Confidential will be forwarded unopened.

11

Table of Contents

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Company has not had been a participant since July 1, 2020 in a transaction in which the amount involved exceeded or will exceed the lesser of $120,000 or one percent of the average of the Companys total assets at year end for the last two completed fiscal years, and in which any of our directors, executive officers or, to our knowledge, beneficial owners of more than 5% of our capital stock or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest, other than equity and other compensation, termination, change in control and other arrangements, which are described under Executive Compensation and Director Compensation. We also describe below certain other transactions with our directors, executive officers and stockholders.

Review and approval of related party transactions

Our related parties include our directors, director nominees, executive officers, holders of more than five percent of the outstanding shares of our common stock and the foregoing persons immediate family members. We review relationships and transactions in which the Company and our related parties are participants to determine whether such related persons have a direct or indirect material interest. As required under SEC rules, transactions that are determined to be directly or indirectly material to a related party are disclosed in the appropriate SEC filing. In addition, the Audit Committee reviews and approves any related party transaction that is required to be disclosed.

Indemnification and Severance Agreements

We have entered into indemnification agreements with our directors and executive officers which require us to indemnify such individuals to the fullest extent permitted by Delaware law. Our indemnification obligations under such agreements are not limited in amount or duration. Certain costs incurred in connection with such indemnities may be recovered under certain circumstances under various insurance policies. Given that the amount of any potential liabilities related to such indemnities cannot be determined until a lawsuit has been filed against a director or executive officer, we are unable to determine the maximum amount of losses that we could incur relating to such indemnities. Historically, any amounts payable pursuant to such director and officer indemnities have not had a material negative effect on our business, financial condition or results of operations.

We have also entered into severance and change in control agreements with certain of our executives. These agreements provide for the payment of specific compensation benefits to such executives upon the termination of their employment with us.

12

Table of Contents

As a smaller reporting company we have opted to comply with the scaled executive compensation disclosure rules applicable to smaller reporting companies (as such term is defined under applicable securities laws).

Our named executive officers, or our NEOs, for the fiscal year ended June 30, 2021 were Dr. Jerel A. Banks, our Executive Chairman and Chief Executive Officer, and Megan Boston, our Executive Director.

The Companys named executive officer compensation program is designed to incentivize our named executive officers to grow our business and further link the interests of our named executive officers with our stockholders. We provide our named executive officers with an annual base salary as a fixed, stable form of compensation, certain cash incentive opportunities as noted below to reward achievement of short-term goals, and we have granted our named executive officers stock options with multi-year vesting schedules to further align their compensation with our stockholders long-term interests. We have also entered into employment agreements with our named executive officers that provide for a fixed notice period in connection with certain terminations of employment.

Our Compensation Committee reviews our named executive officers overall compensation packages to help ensure that we continue to attract and retain highly talented executives and provide appropriate incentive to create additional value for our stockholders.

The description of our compensation program prior to the completion of the re-domiciliation of Benitec Limited (Limited), resulting in the Company becoming the ultimate parent company of the Benitec group of companies (the Re-Domiciliation) reflects the compensation program of Limited, and of the Company for periods following the completion of the Re-Domiciliation. This discussion may contain forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs.

The following table sets forth information regarding compensation earned by our NEOs during the fiscal year ended June 30, 2021 and the fiscal year ended June 30, 2020:

| Named Executive Officer and Principal Position |

Fiscal Year |

Salary ($)(1) |

Bonus ($)(2) |

Option Awards ($)(3) |

All Other Compensation ($) |

Total ($)(7) |

||||||||||||||||||

| Dr. Jerel A. Banks, M.D. Ph.D. |

2021 | 439,583 | 225,000 | 705,375 | 33,105 | (5) | 1,403,063 | |||||||||||||||||

| Executive Chairman and Chief Executive Officer |

2020 | 400,000 | 200,000 | | 31,704 | (5) | 631,704 | |||||||||||||||||

| Megan Boston |

2021 | 269,837 | 113,933 | (4) | 352,686 | 17,928 | (6) | 754,384 | ||||||||||||||||

| Executive Director |

2020 | 221,430 | 110,715 | (4) | | 16,775 | (6) | 348,920 | ||||||||||||||||

| (1) | Ms. Bostons salary was paid in Australian dollars and has been converted to U.S. dollars using a conversion rate of A$1.00 to $0.747, and A$1.00 to $0.671, for the fiscal years ended June 30, 2021 and June 30, 2020, respectively. From July 1, 2020 through September 15, 2020, Dr. Bankss and Ms. Bostons salary was $400,000 and $246,510 respectively. As of September 16, 2020 through the remainder of the fiscal year ended June 30, 2021, Dr. Bankss and Ms. Bostons salary was, $450,000 and $284,831, respectively. |

| (2) | Reflects annual discretionary bonuses paid to Dr. Banks and Ms. Boston for the fiscal years ending June 30, 2021 and June 30, 2020, respectively. |

| (3) | Amount represents the aggregate grant date fair value of stock and option awards granted by the Company in the fiscal year ended June 30, 2021, computed in accordance with FASB ASC Topic 718. For further |

13

Table of Contents

| information on how we account for stock-based compensation, see Note 10 to the Companys consolidated financial statements for the year ended June 30, 2021 included in this Annual Report. These amounts reflect the Companys accounting expense for these awards and do not correspond to the actual amounts, if any, that will be recognized by the NEOs. |

| (4) | Ms. Bostons performance-based cash bonus was paid in Australian dollars and has been converted to U.S. dollars using a conversion rate of A$1.00 to $0.747 for 2021 and A$1.00 to $0.671 for 2020. |

| (5) | Amounts reflect company-paid health and life insurance premiums. |

| (6) | Amounts reflect the Companys compulsory contributions to Ms. Bostons superannuation account. The superannuation contributions were paid in Australian dollars and were converted to U.S. dollars using a conversion rate of A$1.00 to $0.747, and A$1.00 to $0.671, for the fiscal years ended June 30, 2021 and June 30, 2020, respectively. |

| (7) | The amounts reported in this table include compensation paid by Limited prior to the completion of the Re-Domiciliation. |

Narrative Disclosure to Summary Compensation Table

Annual Base Salary

We use base salaries to recognize the experience, skills, and responsibilities required of all of our employees, including our NEOs. Base salaries for our NEOs are reviewed annually by our Compensation Committee. From July 1, 2020 through September 15, 2020, the annual base salaries for each of Dr. Banks and Ms. Boston were $400,000 and A$330,000 ($246,510) (Ms. Bostons salary has been converted using a conversion rate of A$1.00 to $0.747), respectively. As part of its annual base salary review process, the Compensation Committee may approve annual base salary increases to our NEOs to bring salaries in line with market compensation for similarly situated executives. Effective September 16, 2020, Dr. Bankss and Ms. Bostons annual base salaries were increased to $450,000 and A$381,300 ($284,831) (Ms. Bostons salary has been converted using a conversion rate of A$1.00 to $0.747), respectively. In addition, on September 15, 2021, the Compensation Committee approved increases of Dr. Banks and Ms. Bostons annual base salaries to $520,000 and $A435,000 ($317,550) (Ms. Bostons salary has been converted using a conversion rate of A$1.00 to $0.73), respectively, each effective as of September 16, 2021.

Bonus Compensation

We have awarded our NEOs annual discretionary bonuses. Prior to the completion of the Re-Domiciliation, the Remuneration Committee determined the amount of any annual discretionary bonus payment following the completion of the applicable fiscal year, based on Limiteds overall performance and the achievement of key strategic objectives. For the fiscal year ended June 30, 2020, performance bonuses were based on achieving certain clinical, development and operational milestones. The actual annual cash bonuses awarded to our NEOs for fiscal year ended June 30, 2020 performance are set forth above in the Summary Compensation Table in the column titled Bonus.

In October 2020, the Compensation Committee further determined that the target annual discretionary bonus with respect to the fiscal year ended June 30, 2021 would be 50% and 40% of base salary for each of Dr. Banks and Ms. Boston, respectively.

In September 2021, the Compensation Committee awarded our NEOs discretionary bonuses in respect of performance for the fiscal year ended June 30, 2021 based on the Companys achievement of certain clinical, development and operational milestones. For the fiscal year ended June 30, 2021, the discretionary bonuses paid to our NEOs were based on a target of 50% and 40% of base salary for each of Dr. Banks and Ms. Boston, respectively. The actual annual cash bonuses awarded to our NEOs for fiscal year ended June 30, 2021 performance are set forth above in the Summary Compensation Table in the column titled Bonus.

14

Table of Contents

Equity or Equity-Linked Incentive Awards

Although we do not have a formal policy with respect to the grant of equity incentive awards to our NEOs, we believe that equity grants provide our NEOs with a strong link to our long-term performance, create an ownership culture and help to align the interests of our NEOs and our stockholders.

On December 9, 2020, the Companys stockholders approved the Companys 2020 Equity and Incentive Compensation Plan (the 2020 Plan). On December 9, 2020, the Compensation Committee granted our NEOs stock options under the 2020 Plan. The stock options vest in increments of one-third on each anniversary of the applicable grant date over three years. If an NEO dies or terminates employment or service due to Disability (as defined in the 2020 Plan), the NEO generally has 12 months to exercise their vested options or the options are cancelled. If an NEO otherwise leaves the Company, other than for a termination by the Company for Cause (as defined in the 2020 Plan), the NEO generally has 90 days to exercise their vested options or the options are cancelled. Upon the consummation of a Change in Control (as defined in the 2020 Plan), all unvested stock options will immediately vest as of immediately prior to the Change in Control.

We believe that equity grants with a time-based vesting feature promote executive retention because this feature incentivizes our NEOs to remain in our employment during the vesting period.

Employment Agreements with our NEOs.

We are a party to employment agreements with each of our NEOs. These employment agreements provide for at will employment and may be terminated at any time.

Employment Agreement with Dr. Jerel A. Banks, M.D. Ph.D.

In September 2018, Tacere Therapeutics, Inc., a subsidiary of the Company, entered into an employment agreement with Dr. Banks setting forth the terms of his employment as Executive Chairman and Chief Executive Officer of Limited. In connection with the Re-Domiciliation, Dr. Banks was appointed Executive Chairman and Chief Executive Officer of the Company. The agreement provides for Dr. Banks employment and sets forth his (i) annual base salary, (ii) discretionary annual bonus, (iii) eligibility to participate in employee benefit plans, (iv) eligibility for accrued paid vacation, (v) expense reimbursements in accordance with Company policy, (vi) eligibility to participate in the Companys Share Option Plan (as defined below), (vii) post-employment obligations to refrain from soliciting our employees for one year following the end of employment, and (viii) certain non-disparagement obligations. Dr. Banks employment agreement also provides for confidentiality of information and ownership of proprietary property restrictions.

Pursuant to the employment agreement, Dr. Banks employment is at will and can be terminated at any time. However, the Company must provide Dr. Banks with at least six months prior notice (or pay in lieu of notice) prior to any termination. Dr. Banks may terminate his employment on no fewer than six months prior written notice to the Company.

Notwithstanding any provisions in the employment agreement, the Company may terminate Dr. Banks employment immediately without prior notice to Dr. Banks if he (a) commits any serious or persistent breach of any of the provisions of the employment agreement, (b) commits any act of willful or serious misconduct or negligence in the discharge of his duties, (c) becomes of unsound mind or under the control of any committee or officer under any law relating to mental health, (d) is convicted of a felony, which in our reasonable opinion affects Dr. Banks position, or (e) becomes permanently incapacitated by accident or illness from performing duties under the employment agreement for a period aggregating more than three months in any six-month period, or for any period beyond three consecutive months.

Employment Agreement with Megan Boston

In July 2018, Limited entered into an employment agreement with Megan Boston for the position of Executive Director. In connection with entering into the employment agreement, Ms. Boston ceased serving as a

15

Table of Contents

Non-Executive Director of the Company. Ms. Boston remains on the Board as an Executive Director. The employment agreement provides for Ms. Bostons employment and sets forth her (i) annual base salary, (ii) discretionary annual bonus, (iii) superannuation contribution, (iv) eligibility for accrued paid vacation, (v) expense reimbursements in accordance with Company policy, and (vi) post-employment obligations to refrain from soliciting our employees for one year following the end of employment. Ms. Bostons employment agreement also provides for confidentiality of information and ownership of proprietary property restrictions.

Pursuant to the employment agreement, Ms. Bostons employment is at will and can be terminated at any time However, the Company must provide Ms. Boston with at least six months prior notice (or pay in lieu of notice) prior to any termination. Ms. Boston may terminate her employment on no fewer than six months prior written notice.

Notwithstanding any provisions in the employment agreement, the Company may terminate Ms. Bostons employment immediately without prior notice to Ms. Boston if she (a) commits any serious or persistent breach of any of the provisions of the employment agreement, (b) commits any act of willful or serious misconduct or negligence in the discharge of her duties, (c) becomes bankrupt or makes any arrangement or composition with her creditors, (d) becomes of unsound mind or under the control of any committee or officer under any law relating to mental health, (e) is convicted of any criminal offense other than an offense which in our reasonable opinion does not affect Ms. Bostons position, or (f) becomes permanently incapacitated by accident or illness from performing her duties under the employment agreement for a period aggregating more than three months in any six-month period, or any period beyond three consecutive months.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information regarding outstanding equity or equity-linked awards for each of our NEOs as of June 30, 2021.

| Option Awards | ||||||||||||||||||||

| Named Executive Officer | Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

|||||||||||||||

| Dr. Jerel A. Banks, M.D. Ph.D. |

12/9/2020 | (1)(2) | | 284,345 | 2.98 | 12/9/2030 | ||||||||||||||

| Executive Chairman and Chief Executive Officer |

6/26/2018 | (2)(3) | 33,333 | | 50.73 | 6/26/2023 | ||||||||||||||

| Megan Boston |

12/9/2020 | (1)(2) | | 142,172 | 2.98 | 12/9/2030 | ||||||||||||||

| Executive Director |

3/12/2019 | (2)(3) | 11,111 | 5,555 | 42.33 | 3/12/2024 | ||||||||||||||

| (1) | The option awards were granted under the 2020 Plan. |

| (2) | The shares subject to each of the option awards vest in substantially equal installments on each of the first, second and third anniversaries of the grant date, generally subject to continued employment through the applicable vesting date. |

| (3) | The option awards were granted under the Benitec Officers and Employees Share Option Plan prior to the Re-Domiciliation. The share amounts and exercise prices of the awards shown in this table have been adjusted to reflect the terms of the Re-Domiciliation. |

Other Elements of Compensation

Other Benefits and Perquisites

We offer participation in broad-based retirement, health and welfare plans to all of our colleagues, including our NEOs.

16

Table of Contents

We maintain a tax-qualified defined contribution retirement plan that provides eligible U.S. employees (including Dr. Banks) with an opportunity to save for retirement on a tax-advantaged basis. Plan participants are eligible to defer eligible compensation subject to applicable annual Internal Revenue Code limits. The 401(k) plan is intended to be qualified under Section 401(a) of the Internal Revenue Code with the 401(k) plans related trust intended to be tax exempt under Section 501(a) of the Internal Revenue Code. As a tax-qualified retirement plan, contributions to the 401(k) plan and earnings on those contributions are not taxable to the employees until distributed from the 401(k) plan.

We contribute to the Australian superannuation scheme that provides eligible Australian employees (including Ms. Boston) with an opportunity to save for retirement on a tax-advantaged basis. We pay superannuation in accordance with legislative requirements and our minimum contribution is set by legislation. We offer flexibility for salary sacrifice to be added to the superannuation scheme and any actual increase in our contribution to the superannuation scheme is subject to legislative rules at the time.

Termination or Change in Control Benefits

The employment agreements with our NEOs provide for specified notice periods (or pay in lieu of notice) if the Company terminates the employment of our NEOs under certain circumstances, as described above in the Employment Agreements with our NEOs section. Upon the consummation of a Change in Control (as defined in the 2020 Plan), all unvested stock options granted pursuant to the 2020 Plan will immediately vest as of immediately prior to the Change in Control. Our NEOs are not eligible to receive any additional payments or benefits in connection with their termination of employment or in connection with the Companys change in control.

17

Table of Contents

The following table shows the total compensation paid to the Companys directors for the year ended June 30, 2021.

| Name | Fees Earned or Paid in Cash ($)(2) |

Option Awards ($)(3) |

All Other Compensation ($)(4) |

Total ($) |

||||||||||||

| J. Kevin Buchi |

62,939 | 58,547 | | 121,486 | ||||||||||||

| Peter Francis |

59,173 | 58,547 | 5,231 | 122,951 | ||||||||||||

| Edward F. Smith |

53,057 | 58,547 | | 111,604 | ||||||||||||

| (1) | For information regarding the compensation of Dr. Banks and Ms. Boston, see Summary Compensation Table. |

| (2) | Fees paid to Mr. Buchi (until February 2021) and Francis were paid in Australian dollars and have been converted to U.S. dollars using a conversion rate of A$1.00 to $0.747 for the fiscal year ended June 30, 2021. Fees paid between February 2021 and June 2021 were paid in USD. |

| (3) | Amount represents the aggregate grant date fair value of stock and option awards granted by the Company in the fiscal year ended June 30, 2021, computed in accordance with FASB ASC Topic 718. For further information on how we account for stock-based compensation, see Note 10 to the Companys consolidated financial statements for the year ended June 30, 2021 included in this Annual Report. These amounts reflect the Companys accounting expense for these awards and do not correspond to the actual amounts, if any, that will be recognized by the directors. |

| (4) | For information regarding other compensation of all directors, see Narrative Disclosure to Director Compensation Table |

For each director, the aggregate number of option awards outstanding at fiscal year-end for the year ended June 30, 2021 is set forth below:

| Name | Option Awards (#) |

|||

| J. Kevin Buchi |

23,601 | |||

| Peter Francis |

23,601 | |||

| Edward F. Smith |

23,601 | |||

Narrative Disclosure to Director Compensation Table

Upon their appointment as executive officers and employees, Dr. Banks and Ms. Boston no longer receive annual fees with respect to their service on the Board.

From July 1, 2020 through September 15, 2020, Mr. Buchis annual fee was $51,432. Mr. Franciss annual fee was $46,970, and Mr. Smiths annual fee was $50,000.

Effective September 16, 2020, the annual fees through the end of the fiscal year ended June 30, 2021 paid to our non-employee directors were:

| | an annual cash retainer of $40,000; |

| | an additional annual cash retainer of $15,000 to the chair of the Audit Committee; |

| | an additional annual cash retainer of $10,000 to the chair of the Compensation Committee; |

| | an additional annual cash retainer of $7,500 to the chair of the Nominating Committee; |

18

Table of Contents

| | an additional annual cash retainer of $7,500 to a non-chair member of the Audit Committee; |

| | an additional annual cash retainer of $5,000 to a non-chair member of the Compensation Committee; and |

| | an additional annual cash retainer of $4,000 to a non-chair member of the Nominating Committee. |

In addition to the cash fees paid to our non-employee directors, the Board granted each of Messrs. Buchi, Francis and Smith 26,301 option award on December 9, 2020. The option awards vest in three substantially equal installments on the day prior to each of the Companys next three annual stockholder meetings occurring immediately following December 9, 2020.

19

Table of Contents

ELECTION OF DIRECTORS

Our Board currently consists of five directors divided into three classes Class I (Mr. Smith), Class II (Mr. Buchi and Mr. Francis) and Class III (Dr. Banks and Ms. Boston) with the directors in each class holding office for staggered terms of three years each or until their successors have been duly elected and qualified. Mr. Buchis and Mr. Francis terms expire at the Annual Meeting. Accordingly, two Class II directors will be elected at the Annual Meeting. The nominees for election as the Class II directors are Mr. Buchi and Mr. Francis. The Class II directors will serve until our 2024 Annual Meeting of Stockholders and until his successor is elected and qualified. Assuming the nominees are elected, we will have five directors serving as follows:

| Class I directors : Edward Smith |

Term expires at our 2023 annual meeting of stockholders. | |

| Class II director : J. Kevin Buchi and Peter Francis |

Terms expire at our 2024 annual meeting of stockholders. | |

| Class III director : Dr. Jerel Banks and Megan Boston |

Term expires at our 2022 annual meeting of stockholders. |

The accompanying proxy card grants the proxy holder the power to vote the proxy for a substitute nominee in the event that one or both of the nominees becomes unavailable to serve as a Class II director. Management presently has no knowledge that the nominees will refuse or be unable to serve as Class II directors for their prescribed term.

Director Nominees: J. Kevin Buchi and Peter Francis

See above under Our Management for the biographical information of Mr. Buchi and Mr. Francis.

Directors are elected by a plurality of the shares voted. Plurality means that the nominees with the largest number of votes are elected, up to the maximum number of directors to be chosen (in this case, two directors). Stockholders can either vote for the nominee or withhold authority to vote for the nominee. However, shares that are withheld will have no effect on the outcome of the election of director. Abstentions and broker non-votes also will not have any effect on the outcome of the election of the director.

Our Board Recommends a Vote For the Election of each of Mr. Buchi and Mr. Francis.

20

Table of Contents

APPROVAL OF AMENDMENT TO

THE 2020 EQUITY AND INCENTIVE COMPENSATION PLAN

The Board is asking our stockholders to approve, assuming the approval by our stockholders of Proposal 6 to amend our Certificate of Incorporation to increase the number of authorized shares of the Companys common stock, as included in this Proxy Statement (defined in Proposal 6 included in this Proxy Statement as the Common Stock Amendment), an amendment (the Amendment) to the 2020 Equity and Incentive Compensation Plan (the 2020 Plan, and as proposed to be amended, the Amended Plan) to increase the number of shares authorized for issuance under the 2020 Plan. Our 2020 Plan was adopted by the Board on October 21, 2020 and approved by stockholders on December 9, 2020, and the Amended Plan was approved by the Board, subject to stockholder approval, on October 6, 2021. The Amendment increases the maximum number of shares that may be issued pursuant to the 2020 Plan by 1,150,000 shares (increasing the maximum number of shares that may be issued under the 2020 Plan to an aggregate of 1,850,000 shares). Assuming the Common Stock Amendment is approved, the Companys stockholders are also being asked to approve this Proposal 2. Stockholder approval of the Amendment is not contingent on stockholder approval of the Common Stock Amendment. If stockholders do not approve the Common Stock Amendment, we will not be able to increase the share reserve under the 2020 Plan, even if stockholders approve this Proposal 2.

Key Reasons why you Should Vote to Approve the Amendment

The 2020 Plan is the Companys only compensation plan under which equity or equity-linked awards may be made, and the share reserve under the 2020 Plan has been nearly exhausted. If our stockholders do not approve the increase in the share reserve contemplated by the Amendment, the share reserve under the 2020 Plan will be depleted and we will lose access to an important compensation tool in the labor markets in which we compete, a compensation tool that is key to our ability to attract, motivate, reward and retain our non-employee directors, officers, employees, and consultants while aligning their interests with those of our stockholders. An inability to grant equity or equity-linked awards would have significant negative consequences to us and our stockholders. For example, we would likely be pressed to shift our compensation programs to increase the cash-based components of our compensation programs in order to attract and retain qualified personnel. Such a shift in our compensation programs would lose the benefit of aligning our employee and stockholder interests through delivery of equity or equity-linked awards while also limiting Company cash available for other purposes.

The Amendment increases the maximum number of shares that may be issued pursuant to the 2020 Plan by 1,150,000 shares (to an aggregate of 1,850,000 shares). If stockholders do not approve this Proposal 2, the Amendment will not become effective, the proposed additional shares will not become available for issuance under the 2020 Plan, and the 2020 Plan will continue as in effect prior to the Amendment, subject to previously authorized share limits.

A copy of the Amendment is attached as Appendix A to this Proxy Statement, and a conformed copy of the 2020 Plan, as amended by the Amendment, is attached as Appendix B to this Proxy Statement. Other than the limited amendment to the share reserve described herein, we are not making any other changes to the 2020 Plan.

Background and Purpose of the Amended Plan; Stockholder Dilution Considerations

The Compensation Committee and the Board are asking our stockholders to approve the Amendment because the Compensation Committee and the Board believe that it is in the best interests of the Company and its stockholders to provide, through the 2020 Plan as amended by the Amendment, a comprehensive equity

21

Table of Contents

compensation program that allows us to grant incentive equity and equity-linked awards to our non-employee directors, officers, employees, and consultants. The Compensation Committee and the Board believe that long-term equity and equity-linked incentives are essential to align our compensation program with long-term stockholder value creation. Moreover, as described above, an inability to grant equity or equity-linked awards as a key element of our compensation programs would likely result in a shift in our compensation programs towards an increased cash-based component, thus losing the benefit of alignment of our employees interests with long-term stockholder value creation and limiting availability of Company cash for other purposes.