PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on July 19, 2024

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

BENITEC BIOPHARMA INC.

(Name of Registrant as Specified in Its Charter)

Payment of filing fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ☐ | Fee paid previously with preliminary materials: |

Table of Contents

3940 Trust Way

Hayward, California 94545

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON , 2024

, 2024

Dear Stockholders:

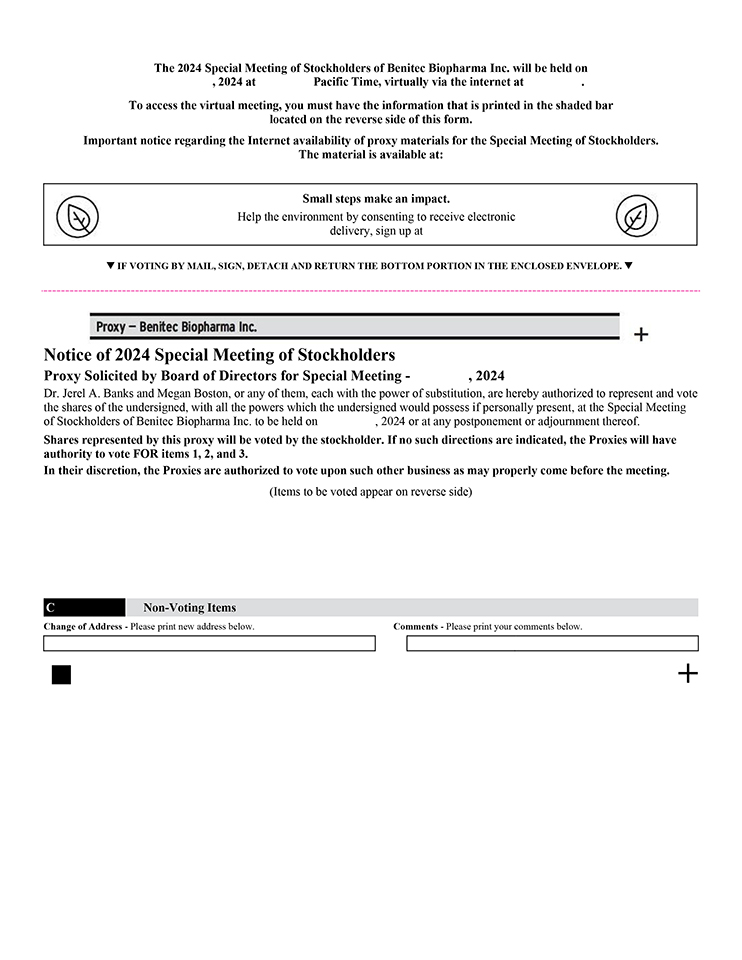

You are cordially invited to attend the Special Meeting of Stockholders (the Special Meeting) of Benitec Biopharma Inc. (the Company). The Special Meeting will be conducted exclusively via the Internet at a virtual audio web conference at on , 2024, beginning at , Pacific Time. You will be able to attend the Special Meeting and vote and submit questions during the Special Meeting by visiting the Special Meeting website. We believe that a virtual stockholder meeting provides greater access to those who may want to attend and therefore have chosen this over an in-person meeting.

The Special Meeting is being held to seek the approval of the Companys stockholders of (i) the potential issuance of shares of common stock issuable upon exercise of certain warrants for purposes of complying with Nasdaq Listing Rule 5635(b), and (ii) an amendment to the Companys 2020 Equity and Incentive Compensation Plan previously approved by the Companys Board of Directors.

The Proxy Statement describing the matters to be acted upon at the Special Meeting in more detail is contained in the following pages. Stockholders are also entitled to vote on any other matters that properly come before the Special Meeting. Your vote is important. Enclosed is a proxy that will entitle you to vote your shares on the matters to be considered at the Special Meeting, even if you are unable to attend the virtual meeting online. Regardless of the number of shares you own, please be sure you are represented at the Special Meeting either by attending virtually, voting on the Internet or by telephone, or returning a signed proxy card as soon as possible.

On behalf of Benitec Biopharma Inc., I thank you for your ongoing interest and investment in our Company.

Sincerely,

Dr. Jerel Banks

Chief Executive Officer and Chairman of the Board of Directors

Table of Contents

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON , 2024

To Our Stockholders:

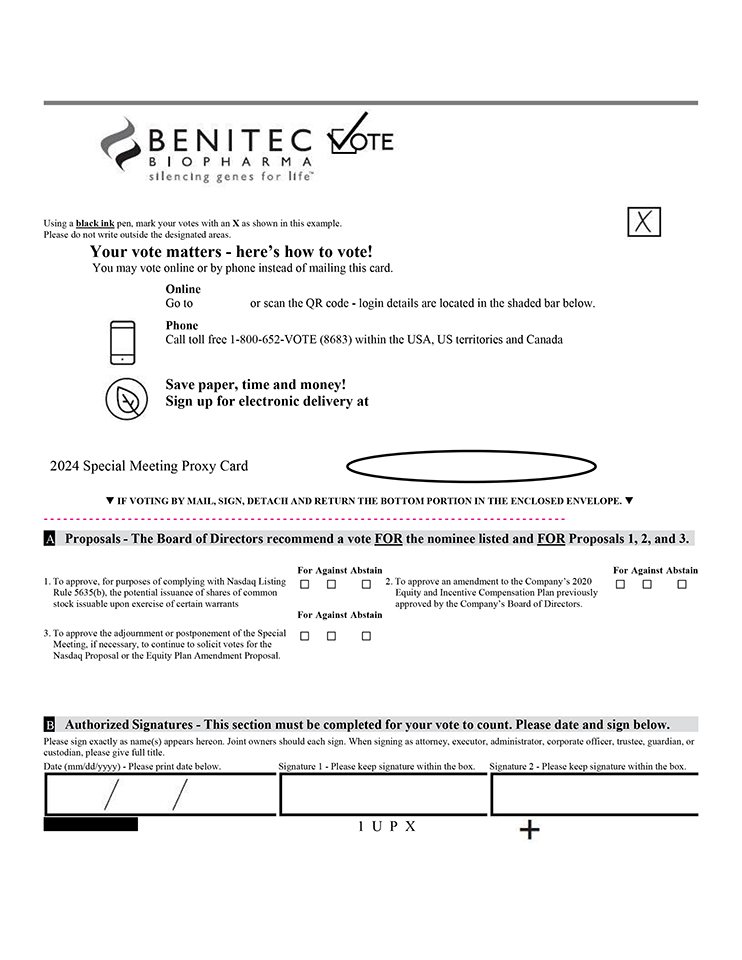

Notice is hereby given that the Special Meeting (the Special Meeting) of Benitec Biopharma Inc. (the Company) will be held virtually on , 2024, at , Pacific Time. The Special Meeting can be accessed by visiting , where you will be able to listen to the meeting live, submit questions, and vote online for the following purposes:

| (i) | To approve, for purposes of complying with Nasdaq Listing Rule 5635(b), the potential issuance of shares of common stock issuable upon exercise of certain warrants (the Nasdaq Proposal); |

| (ii) | To approve an amendment to the Companys 2020 Equity and Incentive Compensation Plan previously approved by the Companys Board of Directors (the Equity Plan Amendment Proposal); and |

| (iii) | To approve the adjournment or postponement of the Special Meeting, if necessary, to continue to solicit votes for the Nasdaq Proposal or the Equity Plan Amendment Proposal. |

Pursuant to the Companys Amended and Restated Bylaws, the Board of Directors has fixed the close of business on , 2024 as the record date for determination of the stockholders entitled to vote at the Special Meeting and any adjournments thereof. You can ensure that your shares are voted at the Special Meeting by voting via the Internet or by completing, signing and returning the enclosed proxy card. If you do attend the Special Meeting virtually, you may then withdraw your proxy and vote your shares during the virtual meeting. In any event, you may revoke your proxy prior to the Special Meeting. Shares represented by proxies that are returned properly signed but unmarked will be voted in favor of the proposals made by the Company.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND OUR SPECIAL MEETING VIRTUALLY, PLEASE VOTE VIA THE INTERNET, BY TELEPHONE, OR SIGN AND SUBMIT YOUR PROXY AS SOON AS POSSIBLE SO THAT YOUR SHARES CAN BE VOTED AT OUR SPECIAL MEETING IN ACCORDANCE WITH YOUR INSTRUCTIONS.

| By Order of the Board of Directors, |

|

|

| Dr. Jerel Banks |

| Chief Executive Officer and Chairman of the Board of Directors |

Hayward, California

, 2024

Important Notice Regarding Availability of Proxy Materials for the Special Meeting of

Stockholders to be held on , 2024

Our Proxy Statement and proxy card are available on the Internet at and at the SEC Filings section under the Investors tab on our corporate website at www.benitec.com.

Table of Contents

SPECIAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

i

Table of Contents

3940 Trust Way

Hayward, California 94545

SPECIAL MEETING PROXY STATEMENT

We are making these proxy materials available to you in connection with the solicitation of proxies by the Board of Directors (the Board) of Benitec Biopharma Inc. (the Company) for the Special Meeting of Stockholders (the Special Meeting) to be held virtually on , 2024 at , Pacific Time, and for any adjournment or postponement of the Special Meeting. The Special Meeting can be accessed by visiting , where you will be able to listen to the meeting live, submit questions, and vote online. The mailing of the Proxy Statement will commence on or about , 2024.

The purpose of the Special Meeting is to ask our stockholders to approve proposals to:

| (i) | To approve, for purposes of complying with Nasdaq Listing Rule 5635(b), the potential issuance of shares of common stock issuable upon exercise of certain warrants (Proposal 1, or the Nasdaq Proposal); |

| (ii) | To approve an amendment to the Companys 2020 Equity and Incentive Compensation Plan previously approved by the Companys Board (Proposal 2, or the Equity Plan Amendment Proposal); and |

| (iii) | To approve the adjournment or postponement of the Special Meeting, if necessary, to continue to solicit votes for the Nasdaq Proposal or the Equity Plan Amendment Proposal (Proposal 3, or the Adjournment Proposal). |

Electronic copies of this Proxy Statement are available at and on the Internet through the Securities and Exchange Commissions (SEC) electronic data system called EDGAR at www.sec.gov or through the Investor section of our website at www.benitec.com.

In this Proxy Statement, we, us, our, Benitec and the Company refer to Benitec Biopharma Inc., a Delaware corporation, and its subsidiaries.

This Proxy Statement is being made available to you because you own shares of our common stock as of the Record Date, which entitles you to vote at the Special Meeting. By use of a proxy, you can vote whether or not you attend the virtual Special Meeting. This Proxy Statement describes the matters we would like you to vote on and provides information on those matters.

INFORMATION CONCERNING SOLICITATION AND VOTING

Only holders of record of our common stock at the close of business on , 2024 (the Record Date) are entitled to notice of the Special Meeting and to vote at the Special Meeting. As of the Record Date, we had shares of our common stock issued and outstanding.

1

Table of Contents

Each share of our common stock is entitled to one vote on all matters presented at our Special Meeting.

Shares of common stock represented by properly executed proxies will, unless such proxies have been previously revoked, be voted in accordance with the instructions indicated thereon. In the absence of specific instructions to the contrary, properly executed unrevoked proxies will be voted: (i) FOR Proposal 1, the potential issuance of shares of common stock issuable upon exercise of certain warrants in compliance with Nasdaq Listing Rule 5635(b), (ii) FOR Proposal 2, the approval of the amendment to the Companys 2020 Equity and Incentive Compensation Plan, and (iii) FOR Proposal 3, the approval of an adjournment or postponement of the Special Meeting, if necessary, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve Proposal 1 or Proposal 2. No other business is expected to come before stockholders at the Special Meeting. Should any other matter requiring a vote of stockholders properly arise, the persons named in the enclosed proxy card will vote such proxy in accordance with their best judgement (including the recommendation of our Board).

Directors, officers, agents and employees and the Company may communicate with stockholders, banks, brokerage houses and others by mail, telephone, e-mail, in person or otherwise to solicit proxies. We may hire a proxy solicitation firm at standard industry rates to assist in the solicitation of proxies. All expenses incurred in connection with this solicitation will be borne by us.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to our offices, at or before the taking of the vote at our Special Meeting, a written notice of revocation or a duly executed proxy bearing a later date or by attending our Special Meeting and voting at such meeting. If not revoked, the proxy will be voted at the Special Meeting in accordance with the stockholders instructions indicated on the proxy card.

Quorum and Voting Requirements

Quorum. The required quorum for the transaction of business at our Special Meeting is the holders of a majority of shares of common stock issued and outstanding on the Record Date and entitled to vote at our Special Meeting, present in person, by remote communication, or by proxy. Shares that are voted FOR or AGAINST a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares entitled to vote at our Special Meeting with respect to such matter. Abstentions and broker non-votes will also count toward the presence of a quorum. An abstention is the voluntary act of not voting by a stockholder who is present at a meeting in person or by proxy and entitled to vote. Below is a discussion of the effect of abstentions and broker non-votes on the results of each proposal.

Voting Requirements to Approve Proposals.

Proposal 1: The approval of Proposal 1, the Nasdaq Proposal, requires the affirmative vote of a majority of shares present in person, by remote communication, if applicable, or represented by duly authorized and executed proxy at the meeting and entitled to vote on the proposal (meaning that of the shares represented at the meeting and entitled to vote, a majority of them must be voted FOR Proposal 1 for it to be approved). Abstentions will have the same effect as a vote AGAINST Proposal 1. Broker non-votes, if any, will have no effect on Proposal 1. Suvretta Capital Management, LLC will not be entitled to vote the shares of common stock held by it or its affiliates, or the shares of common stock underlying the warrants that it or its affiliates currently hold and can be exercised prior to the Record Date, with respect to Proposal 1.

Proposal 2: The approval of Proposal 2, the Equity Plan Amendment Proposal, requires the affirmative vote of a majority of shares present in person, by remote communication, if applicable, or represented by duly

2

Table of Contents

authorized and executed proxy at the meeting and entitled to vote on the proposal (meaning that of the shares represented at the meeting and entitled to vote, a majority of them must be voted FOR Proposal 2 for it to be approved). Abstentions will have the same effect as a vote AGAINST Proposal 2. Broker non-votes, if any, will have no effect on Proposal 2.

Proposal 3: The approval of Proposal 3, the Adjournment Proposal, requires the affirmative vote of a majority of shares present in person, by remote communication, if applicable, or represented by duly authorized and executed proxy at the meeting and entitled to vote on the proposal (meaning that of the shares represented at the meeting and entitled to vote, a majority of them must be voted FOR Proposal 3 for it to be approved). Abstentions will have the same effect as a vote AGAINST Proposal 3. Broker non-votes, if any, will have no effect on Proposal 3.

New York Stock Exchange rules grant your broker discretionary authority to vote on routine proposals. Where a proposal is not routine, a broker who has received no instructions from its clients does not have discretion to vote its clients uninstructed shares on that proposal, and the unvoted shares are referred to as broker non-votes. For the Special Meeting, each of Proposal 1, Proposal 2, and Proposal 3 are not considered routine proposals, and brokers will not have discretionary authority to vote on the proposals without explicit instructions from the beneficial owners of such shares. Because none of the three proposals to be submitted for stockholder approval at the Special Meeting are routine, we do not anticipate any broker non-votes at the Special Meeting.

In the event that sufficient votes in favor of Proposal 1 or Proposal 2 is not received by the date of the Special Meeting, and Proposal 3 is approved, we may adjourn the Special Meeting to permit further solicitations of proxies.

If you are a registered holder, meaning that you hold our stock directly rather than through a broker, bank, or other nominee, you may vote online at the Special Meeting, by telephone or electronically through the Internet by following the instructions included on your proxy card, or by completing, dating, signing and promptly returning your proxy card. All signed, returned proxies that are not revoked will be voted in accordance with the instructions contained therein. Signed proxies that give no instructions as to how they should be voted on a particular proposal at the Special Meeting will be counted as votes for such proposal.

In order to vote via the virtual meeting website, any registered holder of our common stock may attend the Special Meeting by visiting , where stockholders may vote and submit questions during the meeting. Please have your 16-digit control number to join the Special Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at .

The telephone and Internet voting procedures are designed to authenticate stockholders identities, to allow stockholders to give their voting instructions and to confirm that stockholders instructions have been recorded properly. Stockholders voting via the telephone or Internet should understand that there may be costs associated with telephonic or electronic access, such as usage charges from telephone companies and Internet access providers, which must be borne by the stockholder.

If your shares are held through a bank, broker or other nominee (in street name), you are considered the beneficial owner of those shares. You may be able to vote by telephone or electronically through the Internet in accordance with the voting instructions provided by that nominee. You may also vote by completing, dating, signing and promptly returning the voting instruction form sent by that nominee. You must obtain a legal proxy from the nominee that holds your shares if you wish to vote online at the Special Meeting. If you do not provide voting instructions to your broker in advance of the Special Meeting, your shares will not be voted.

3

Table of Contents

Information about the Virtual Meeting

The virtual Special Meeting is accessible on any Internet-connected device and stockholders will be able to submit questions and comments and to vote online during the meeting. We believe these benefits of a virtual meeting are in the best interests of our stockholders. In the event of a technical malfunction or other problem that disrupts the Special Meeting, the Company may adjourn, recess, or expedite the Special Meeting, or take such other action that the Company deems appropriate considering the circumstances. If you encounter any difficulties accessing the virtual meeting during the meeting, a toll free number will be available to assist.

In order to vote via the virtual meeting website, any registered holder of our common stock may attend the Special Meeting by visiting , where stockholders may vote and submit questions during the meeting. Please have your 16-digit control number to join the Special Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at .

Only holders of our common stock at the close of business on , 2024, the Record Date, will be permitted to ask questions during the Special Meeting. If you wish to submit a question, on the day of the Special Meeting, you may log into the virtual meeting platform and type your question for consideration into the field provided in the web portal. To allow us to answer questions from as many stockholders as possible, we may limit each stockholder to two (2) questions. Questions from multiple stockholders on the same topic or that are otherwise related may be grouped, summarized and answered together. More information on submitting questions at the Special Meeting will be posted on the Internet at in advance of the meeting.

For the 10 days prior to our Special Meeting, a list of registered holders entitled to vote at our Special Meeting will be available for inspection in our offices at 3940 Trust Way, Hayward, California 94545. Stockholders will also be able to access the list of registered holders electronically during the Special Meeting through the virtual meeting website at .

Deadline for Receipt of Stockholder Proposals for 2024 Annual Meeting of Stockholders

Pursuant to Rule 14a-8 of the SEC, proposals by eligible stockholders that are intended to be presented at our 2024 Annual Meeting of Stockholders (the 2024 Annual Meeting) must have been received by our Corporate Secretary at Benitec Biopharma Inc., 3940 Trust Way, Hayward, California 94545 not later than June 22, 2024 in order to be considered for inclusion in our proxy materials.

Stockholders intending to present a proposal or nominate a candidate to our Board at our 2024 Annual Meeting of Stockholders must comply with the requirements and provide the information set forth in our amended and restated bylaws (the Bylaws). Under our Bylaws, in order for a stockholder to bring business before an annual meeting of our stockholders, the stockholders notice must be timely received, which means that a proposal must be delivered to or mailed to our Corporate Secretary not later than 90 days prior, and not earlier than 120 days prior to the first anniversary of the preceding years annual meeting. Because our 2023 annual meeting was held on December 6, 2023, this means that such notice for the 2024 Annual Meeting must be received by the Company between August 8, 2024 and September 7, 2024. In the event that the date of the 2024 Annual Meeting of Stockholders is more than 30 days before or more than 70 days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company.

In addition to satisfying the requirements noted above, if a stockholder intends to comply with the SECs universal proxy rules and to solicit proxies in support of director nominees other than the Companys nominees, the stockholder must provide notice that provides the information required by Rule 14a-19 under the Exchange Act, which notice must be postmarked or transmitted electronically to the Company at the Companys principal

4

Table of Contents

executive offices no later than 60 calendar days prior to the one-year anniversary date of the prior annual meeting of stockholders (for the 2024 Annual Meeting, no later than October 7, 2024). If the date of the 2024 Annual Meeting is changed by more than 30 calendar days from such anniversary date, however, then the stockholder must provide notice by the later of 60 calendar days prior to the date of the 2024 Annual Meeting and the 10th calendar day following the date on which public announcement of the date of the 2024 Annual Meeting is first made.

Electronic Delivery of Proxy Materials to Stockholders

If you received an electronic copy of our proxy materials and would prefer to receive paper copies of the proxy materials, or if you received paper copies of the proxy materials and would prefer to receive a notice for future annual meetings, you may notify us by telephone, email or mail at the telephone number, email address and mailing address provided above.

5

Table of Contents

VOTING SECURITIES OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Companys common stock as of , 2024, the Record Date, by (i) each person or group of persons known by us to beneficially own at least five percent of our common stock, (ii) each of our named executive officers, (iii) each of our directors, and (iv) all of our directors and executive officers as a group.

The following table gives effect to the shares of common stock issuable within 60 days of , 2024, the Record Date, upon the exercise of all options and other rights beneficially owned by the indicated stockholders on that date. Beneficial ownership is determined in accordance with Rule 13d-3 promulgated under Section 13 of the Securities Exchange Act of 1934, as amended, (the Exchange Act) and includes voting and investment power with respect to shares. Percentage of beneficial ownership is based on shares of common stock outstanding at the close of business on , 2024, and, for each individual holder, gives effect to the shares of common stock that stockholder could acquire after the exercise of warrants held by such holder, subject to the limitations on beneficial ownership contained in such warrants. Except as otherwise noted below, each person or entity named in the following table has sole voting and investment power with respect to all shares of our common stock that he, she or it beneficially owns.

Unless otherwise indicated below, the address for each beneficial owner listed is c/o 3940 Trust Way, Hayward, California 94545.

| Name of Beneficial Owner | Number of Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

||||||

| 5% or Greater Stockholders: |

||||||||

| Entities affiliated with Franklin Resources Inc. (1) |

2,320,935 | 19.9 | % | |||||

| Entities Affiliated with Suvretta Capital Management, LLC (2) |

2,097,395 | 19.9 | % | |||||

| Nemean Asset Management, LLC (3) |

1,027,399 | 9.9 | % | |||||

| Adage Capital Partners, LP (4) |

1,026,050 | 9.9 | % | |||||

| HBM Healthcare Investments (Cayman) Ltd. (5) |

1,026,050 | 9.9 | % | |||||

| Entities Affiliated with Nantahala Capital Management, LLC (6) |

1,026,050 | 9.9 | % | |||||

| Entities Affiliated with Special Situations Fund (7) |

625,000 | 6.2 | % | |||||

| Directors and Named Executive Officers: |

||||||||

| Jerel A. Banks (8) |

23,723 | * | ||||||

| Megan Boston (9) |

63,196 | * | ||||||

| J. Kevin Buchi (10) |

106,003 | 1.0 | ||||||

| Peter Francis (11) |

2,390 | * | ||||||

| Kishen Mehta (12) |

| | ||||||

| Edward Smith (13) |

2,093 | * | ||||||

| All Executive Officers and Directors As a Group (6 persons) (14) |

197,405 | 1.9 | % | |||||

| * | Represents beneficial ownership of less than one percent of the Companys outstanding common stock. |

| (1) | Includes 573,221 shares of Common Stock held by Franklin Strategic Series Franklin Biotechnology Discovery Fund (FSS) and 223,350 shares of Common Stock held by Franklin Biotechnology Discovery Fund, a sub-fund of Franklin Templeton Investment Funds (Franklin Templeton) and assumes the exercise of Warrants held by FSS and Franklin Templeton for an additional 1,524,364 shares of Common Stock. FSS holds (i) Common Warrants exercisable for an aggregate of 588,236 shares of Common Stock at an exercise price of $1.93 per share, (ii) Pre-Funded Warrants exercisable for an aggregate of 1,554,404 shares of Common Stock at an exercise price of $0.0001 per share and (iii) Common Warrants exercisable |

6

Table of Contents

| for an aggregate of 1,554,404 shares of Common Stock at an exercise price of $3.86 per share, subject to the limitations on beneficial ownership contained in such Warrants. The address of the principal business office of Franklin Resources Inc., FSS and Franklin Templeton is One Franklin Parkway, San Mateo, CA 94403. |

| (2) | Based on information included in the Schedule 13D filed by Suvretta Capital Management, LLC (Suvretta Capital), Averill Master Fund, Ltd. (Averill), Averill Madison Master Fund, Ltd. (Averill Madison) and Aaron Cowen on April 29, 2024. Includes 1,470,179 shares of Common Stock held by Averill and 221,111 shares of Common Stock held by Averill Madison, and assumes the exercise of Warrants held by Averill and Averill Madison for an additional 406,105 shares of Common Stock. Averill and Averill Madison hold, respectively (x)(i) Pre-Funded Warrants exercisable for 6,331,203 and 852,700 shares of Common Stock at an exercise price of $0.0001 per share and (ii) Common Warrants exercisable for 4,605,000 and 576,347 shares of Common Stock at an exercise price of $3.86, subject to the limitations on beneficial ownership contained in such Warrants. Averill also holds (y) Common Warrants exercisable for 588,236 shares of Common Stock at an exercise price of $1.93 and (z) Pre-Funded Warrants exercisable for an aggregate of 588,235 shares of Common Stock at an exercise price of $0.0017 per share, subject to the limitations on beneficial ownership contained in such Warrants. Suvretta Capital is the investment manager of Averill and Averill Madison. Aaron Cowen is a control person of Suvretta Capital and as such may be deemed to beneficially own these shares. The address of the principal business office of Suvretta Capital, Mr. Cowen, Averill and Averill Madison is 540 Madison Avenue, 7th Floor, New York, NY 10022. |

| (3) | Based on information included in the Schedule 13G filed by Nemean Asset Management, LLC (Nemean), IRA financial trust FBO Steven M. Oliveira Roth IRA (the Oliveira IRA), and Steven M. Oliveira on April 29, 2024. Includes 764,324 shares of Common Stock held by Nemean and 64,911 shares of Common Stock held by the Oliveira IRA, and assumes the exercise of Warrants held by Nemean and Mr. Oliveira for an additional 198,164 shares of Common Stock. Mr. Oliveira holds Common Warrants exercisable for 63,793 shares of Common Stock at an exercise price of $1.93 per share. Nemean holds Pre-Funded Warrants exercisable for 625,000 shares of Common Stock at an exercise price of $0.0001 per share and Common Warrants exercisable for 1,000,000 shares of Common Stock at an exercise price of $3.86 per share, subject to the limitations on beneficial ownership contained in such Warrants. The address of the principal business office of Nemean, the Oliveira IRA, and Steven M. Oliveira is 207 Commodore Drive, Jupiter, FL 33477. |

| (4) | Includes 841,395 shares of Common Stock and assumes the exercise of Warrants held by Adage Capital Partners, LP (the Fund) for an additional 184,655 shares of Common Stock. The Fund holds Pre-Funded Warrants exercisable for 3,186,751 shares of Common Stock at an exercise price of $0.0001 per share and Common Warrants exercisable for 3,108,808 shares of Common Stock at an exercise price of $3.86 per share, subject to the limitations on beneficial ownership contained in such Warrants. Adage Capital Partners, GP, LLC (ACPGP) serves as the general partner of the Fund and as such has discretion over the portfolio of securities beneficially owned by the Fund. Adage Capital Advisors, LLC, a Delaware limited liability company (ACA), is managing member of ACPGP and directs ACPGPs operations. Robert Atchinson and Phillip Gross are the managing members of ACPGP and ACA and general partners of the Fund. Robert Atchinson and Phillip Gross disclaim beneficial ownership of the reported securities except to the extent of their pecuniary interest therein. The address of the principal business office of the Fund, ACPGP, ACA, Mr. Atchinson and Mr. Gross is 200 Clarendon St., 52nd Floor, Boston, MA 02116. |

| (5) | Based on information included in the Schedule 13G filed by HBM Healthcare Investments (Cayman) Ltd.s (HBM) on April 29, 2024. Includes 841,395 shares of Common Stock and assumes the exercise of Pre-Funded Warrants held by HBM for an additional 184,655 shares of Common Stock. HBM holds Pre-Funded Warrants exercisable for 200,276 shares of Common Stock at an exercise price of $0.0001 per share, subject to the limitations on beneficial ownership contained in such Pre-Funded Warrants. The address of the principal business office of HBM is Governors Square, 23 Lime Tree Bay Avenue, PO Box 30852, Grand Cayman, KY1-1204, Cayman Islands. |

| (6) | Includes 151,451 shares of Common Stock held by Pinehurst Partners, L.P. (Pinehurst), 16,828 shares of Common Stock held by Corbin Sustainability & Engagement Fund, L.P. (Corbin), 140,192 shares of Common Stock held by Nantahala Capital Partners Limited Partnership (NCPLP), 118,075 shares of Common Stock held by NCP RFM LP (NCP RFM), and 414,849 shares of Common Stock held by |

7

Table of Contents

| Blackwell Partners LLC Series A (Blackwell), and assumes the exercise of Warrants held by Pinehurst, Corbin, NCPLP, NCP RFM and Blackwell for an additional 184,655 shares of Common Stock. Pinehurst, Corbin, NCPLP, NCP RFM and Blackwell hold, respectively, Pre-Funded Warrants exercisable for 36,050, 4,006, 33,370, 28,105, and 98,745 shares of Common Stock at an exercise price of $0.0001 per share, subject to the limitations on beneficial ownership contained in such Pre-Funded Warrants. Nantahala is a Registered Investment Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of Pinehurst, Corbin, NCPLP, NCP, RFM and Blackwell as a General Partner, Investment Manager, or Sub-Advisor and would be considered the beneficial owner of such securities. The above shall not be deemed to be an admission by the record owners or the selling stockholder that they are themselves beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot Harkey and Daniel Mack are managing members of Nantahala and may be deemed to have voting and dispositive power over the shares held by the selling stockholder. The Pre-Funded Warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling stockholder from exercising that portion of the pre-funded warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of the principal business office of Nantahala is 130 Main St., 2nd Floor, New Canaan, CT 06840. |

| (7) | Includes 241,918 shares of Common Stock held by Special Situations Fund III QP, L.P., 70,582 shares of Common Stock held by Special Situations Cayman Fund, L.P. and 312,500 shares of Common Stock held by Special Situations Life Sciences Fund, L.P. AWM Investment Company, Inc. (AWM) is the investment adviser to each of the Special Situations Funds. David Greenhouse and Adam Stettner are the principal owners of AWM. Through their control of AWM, Messrs. Greenhouse and Stettner share voting and investment control over the portfolio securities of each of the Special Situations Funds. Messrs. Greenhouse and Stettner disclaim any beneficial ownership of the reported shares other than to the extent of any pecuniary interest each of them may have therein. The address of the principal business office of Special Situations Fund is 527 Madison Avenue, Suite 2600, New York, New York 10022. |

| (8) | Represents stock options to acquire 23,723 shares of common stock that have vested or will vest within 60 days of , 2024. |

| (9) | Includes 20 shares of common stock held by Boston Super Invest Pty A/C Boston Family Super and 25,907 shares that are held by Ms. Boston that Ms. Boston has sole voting power over and stock options to acquire 11,362 shares of common stock that have vested or will vest within 60 days of , 2024. Assumes the exercise of Warrants held by Megan Boston for an additional 25,907 shares of common stock. |

| (10) | Includes 52,097 shares of common stock held directly by Mr. Buchi and stock options to acquire 2,093 shares of common stock that have vested or will vest within 60 days of , 2024. Assumes the exercise of Warrants held by Mr. Buchi for an additional 51,813 shares of common stock. |

| (11) | Includes 279 shares of common stock held by the Francis Family Superannuation Fund, 18 shares of common stock held directly by Mr. Francis, and stock options to acquire 2,093 shares of common stock that have vested or will vest within 60 days of , 2024. |

| (12) | Does not include the shares beneficially owned by Suvretta Capital and its affiliates reported in this table and described in footnote 2. Mr. Mehta is a Portfolio Manager at Suvretta Capital. |

| (13) | Represents stock options to acquire 2,093 shares of common stock that have vested or will vest within 60 days of , 2024. |

| (14) | Includes 78,321 shares of common stock and stock options to acquire 41,364 shares of common stock that have vested or will vest within 60 days of , 2024, and assumes the exercise of Warrants for an additional 77,720 shares of common stock. |

8

Table of Contents

APPROVAL OF THE POTENTIAL ISSUANCE OF SHARES OF COMMON STOCK ISSUABLE UPON EXERCISE OF WARRANTS PURSUANT TO NASDAQ LISTING RULE 5635(B)

We are submitting this Proposal 1 to you in order to obtain the requisite stockholder approval which would be required under Nasdaq Listing Rules 5635(b) if potential issuances of shares of our common stock upon the exercise of certain of our outstanding warrants were to constitute a change of control.

Background

On September 15, 2022, the Company completed an underwritten public offering of common stock, warrants and pre-funded warrants for gross proceeds of approximately $14.3 million (the September 2022 Offering). On August 11, 2023, the Company completed an underwritten public offering of common stock, warrants and pre-funded warrants for gross proceeds of approximately $30.9 million (the August 2023 Offering, and together with the September 2022 Offering, the Underwritten Offerings). On April 22, 2024, the Company completed a private placement of common stock and pre-funded warrants for gross proceeds of approximately $40.0 million (the Private Offering, and, together with the Underwritten Offerings, the Offerings). All of the warrants issued in the Offerings (the Warrants) and the pre-funded warrants issued in the Offerings (the Pre-Funded Warrants) were immediately exercisable at the time of issuance, subject to the Beneficial Ownership Limitations (as defined below).

After giving effect to the Companys reverse stock-split completed in July of 2023 and subsequent exercises of Warrants and Pre-Funded Warrants since the completion of the Offerings, the Company currently has outstanding Warrants and Pre-Funded Warrants issued in the Offerings as set forth in the following table:

| Warrants |

Expiration Date | Exercise Price | Number of Shares Issuable Upon Exercise |

|||||||

| September 2022 Warrants |

September 15, 2027 | $ | 1.93 | 1,655,464 | ||||||

| September 2022 Pre-Funded Warrants |

| $ | 0.0017 | 588,236 | ||||||

| August 2023 Warrants |

August 11, 2028 | $ | 3.86 | 15,263,988 | ||||||

| August 2023 Pre-Funded Warrants |

| $ | 0.0001 | 14,172,919 | ||||||

| April 2024 Pre-Funded Warrants |

| $ | 0.0001 | 2,584,239 | ||||||

Under the terms of the Pre-Funded Warrants and Warrants, certain of the warrant holders that purchased securities in the Offerings may not exercise the Pre-Funded Warrants or Warrants to the extent such exercise would cause such holder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99%, 9.99%, or 19.99% of the Companys then outstanding shares of common stock following such exercise (the Beneficial Ownership Limitation). Consistent with Nasdaq Listing Rule 5635(b), no holder of warrants may eliminate or increase its Beneficial Ownership Limitation above 19.99% unless the Companys stockholders have approved the potential issuance of the Companys shares of common stock in an amount that could cause a change of control under the rules of the Nasdaq Stock Market (Nasdaq).

In connection with the Private Offering, we entered into a Voting Commitment Agreement with the purchasers in the Private Offering (the Voting Commitment Agreement). Pursuant to the Voting Commitment Agreement, the Company is obligated to use its reasonable best efforts to obtain stockholder approval of the exercise of the Warrants and the Pre-Funded Warrants issued in the Offerings in accordance with Nasdaqs rules which otherwise would be subject to the Beneficial Ownership Limitation (the Stockholder Approval). If the Stockholder Approval is not obtained at the Special Meeting, the Company is obligated to use its reasonable best efforts to obtain the Stockholder Approval at its 2024 Annual Meeting, and if stockholder approval is not obtained at the 2024 Annual Meeting, its 2025 annual meeting of stockholders (the 2025 Annual Meeting). If the Stockholder Approval is not obtained before or at the 2025 Annual Meeting, then the Company would no

9

Table of Contents

longer be obligated to seek to obtain the Stockholder Approval. The purchasers in the Private Offering agreed that the Company will not be liable for any penalty, damages, or other remedy if the Company fails, after using its reasonable best efforts in accordance with the Voting Commitment Agreement to obtain the Stockholder Approval. Pursuant to the Voting Commitment Agreement, the purchasers in the Private Offering agreed to vote or cause to be voted any and all shares of the Companys common stock over which such purchaser or its affiliates has or shares voting control on the Record Date for shares eligible to vote at any Company Special Meeting or Annual Meeting seeking the Stockholder Approval where such proposal is presented in favor of approving the proposal or proposals seeking the Stockholder Approval.

We also entered into a Board Designation Side Letter with Suvretta Capital at the closing of the Private Offering whereby the Company agreed to consider for appointment and appoint Kishan (Kishen) Mehta to the Companys Board. The Board appointed Mr. Mehta as a director of the Company effective June 26, 2024.

Requirement to Seek Stockholder Approval

As a result of our listing on the Nasdaq Capital Market, issuances of our common stock are subject to the Nasdaq Listing Rules. Nasdaq Listing Rule 5635(b) generally requires us to obtain stockholder approval prior to the issuance of securities when the issuance or potential issuance will result in a change of control. Pursuant to applicable Nasdaq guidance, a change of control may generally be deemed to occur when a stockholder would own or have the right to acquire 20% or more of the outstanding shares of common stock or voting power and such ownership or voting power would be the largest ownership position of the issuer. However, in determining if a change of control has occurred (and stockholder approval is required), Nasdaq will consider all circumstances concerning the transaction and may determine that a change of control has occurred even if the number of shares of common stock or voting power that a stockholder has a right to acquire is less than 20%. Stockholders should note that a change of control as described under Nasdaq Listing Rule 5635(b), applies only with respect to the application of such rule, and does not necessarily constitute a change of control for purposes of Delaware law, our organizational documents or any other agreements to which we may be a party.

Pursuant to the terms of the Warrants and Pre-Funded Warrants, if our stockholders approve this Proposal 1, holders of the Warrants and Pre-Funded Warrants may elect to have the Beneficial Ownership Limitations in their Warrants and Pre-Funded Warrants eliminated so that the holder of such warrants would then be able to exercise their Warrants and Pre-Funded Warrants even if upon exercise such holder would own 20% or more of our outstanding shares of common stock.

Based on of shares of our common stock outstanding as of , 2024, the Record Date, (1) excluding shares of common stock issuable upon conversion or exercise of derivative securities owned by other stockholders or shares of common stock issued under our equity incentive plans, and assuming no changes otherwise to our capitalization, (2) assuming the following holders of our Warrants and Pre-Funded Warrants, individually and not in the aggregate, exercise all of their Warrants and Pre-Funded Warrants in full and no other holder exercises any Warrants or Pre-Funded Warrants, and (3) without giving effect to the Beneficial Ownership Limitations in the Warrants and Pre-Funded Warrants, entities affiliated with Suvretta Capital, entities affiliated with Franklin, entities affiliated with Adage, and entities affiliated with Nemean would beneficially own approximately %, %, %, and % of our common stock, respectively. However, if all of the holders of the Warrants and Pre-Funded Warrants exercised their Warrants and Pre-Funded Warrants in full, entities affiliated with Suvretta Capital would beneficially own approximately % of our then outstanding common stock, and none of the other holders of our Warrants or Pre-Funded Warrants would beneficially own more than 19.9% of our outstanding common stock. Currently, we anticipate that Suvretta Capital will exercise all of the Warrants and Pre-Funded Warrants it holds; further, we do not anticipate that Adage or Nemean will elect to have the 9.9% Beneficial Ownership Limitations in their Warrants or Pre-Funded Warrants eliminated or changed. Accordingly, we anticipate that only Suvretta Capital will beneficially own 20% or more of our outstanding shares of common stock if this Proposal 1 is approved by our stockholders and holders of our Warrants and Pre-Funded Warrants are able to then remove the Beneficial Ownership Limitations in their warrants and exercise such warrants.

10

Table of Contents

Potential Adverse Effects

If our stockholders approve this Proposal 1, up to approximately shares would be issuable in connection with the exercise of the Warrants and Pre-Funded Warrants, so our stockholders could experience substantial dilution of their interests as a result of such exercises. In addition, entities affiliated with Suvretta Capital and other holders of our Warrants and Pre-Funded Warrants will potentially be able to exercise warrants that will give them significant ownership positions.

Consequences of Failure to Obtain Stockholder Approval

If our stockholders do not approve this Proposal 1, then the aggregate number of shares of common stock issuable upon the exercise of the Pre-Funded Warrants and Warrants will be limited to no more than 19.9% of our common stock for each holder of warrants. Accordingly, each holder would not be able to exercise its Pre-Funded Warrants and Warrants to receive additional shares in excess of the relevant Beneficial Ownership Limitation (unless such holder otherwise sells shares of our common stock owned by such holder whereby such issuance would not result in such holder beneficially owning (1) in excess of 19.99% of the number of shares of common stock outstanding and (2) the largest ownership position of the Company immediately after giving effect to such sale or issuance) and we may not receive the additional gross proceeds we would receive if the Warrants or Pre-Funded Warrants were exercised in full. Such funds would not be available to pursue the activities described below, potentially limiting our growth potential.

In such case, we may need to seek additional capital to pursue the activities described below, which may include, but are not limited to, equity issuances, assets sales, alternative debt for equity conversions or other restructuring transactions, which may not be on commercially reasonable terms and may negatively impact stockholders at that time. If we elect to seek additional capital with the issuance of new shares, it is also likely that we may again need to seek stockholder approval at a future special or annual meeting of stockholders for the issuance of those shares, may need to seek alternative means to finance the payment, or may take such other actions as the Board deems advisable and in the best interests of the Company and our stockholders at that time.

Use of Proceeds

We may receive proceeds from the exercise of the Warrants as well as the nominal exercise price upon the exercise of the Pre-Funded Warrants to the extent the Warrants and Pre-Funded Warrants are exercised. We can make no assurances that any of the Warrants or Pre-Funded Warrants will be exercised, or if exercised, the quantity that will be exercised or the period in which such Warrants or Pre-Funded Warrants will be exercised. We intend to use the net proceeds from any exercise of the Warrants and Pre-Funded Warrants to fund the clinical development and related commercialization of BB-301, including the natural history lead-in study and the Phase 1b/2a BB-301 treatment study, and for general corporate purposes.

The approval of this Proposal 1 requires the affirmative vote of a majority of shares present in person, by remote communication, if applicable, or represented by duly authorized and executed proxy at the meeting and entitled to vote on the proposal (meaning that of the shares represented at the meeting and entitled to vote, a majority of them must be voted FOR Proposal 1 for it to be approved). Abstentions will have the same effect as a vote AGAINST Proposal 1. Broker non-votes, if any, will have no effect on Proposal 1. Suvretta Capital will not be entitled to vote the shares of common stock held by it or its affiliates, or the shares of common stock underlying the warrants that it or its affiliates currently hold and can be exercised prior to the Record Date.

Board Recommendation

Our Board Recommends a Vote For Proposal 1.

11

Table of Contents

APPROVAL OF AMENDMENT TO THE 2020 EQUITY AND INCENTIVE COMPENSATION PLAN

The Board is asking our stockholders to approve an amendment (the Amendment) to the 2020 Equity and Incentive Compensation Plan (as amended by the first amendment thereto, dated as of December 8, 2021 (the First Amendment) and the second amendment thereto, dated as of December 6, 2023 (the Second Amendment), the 2020 Plan, and as proposed to be amended by the Amendment, the Amended Plan) to increase the number of shares authorized for issuance under the 2020 Plan. Our 2020 Equity and Incentive Compensation Plan was adopted by the Board on October 21, 2020 and approved by stockholders on December 9, 2020, the First Amendment was adopted by the Board on October 6, 2021 and approved by stockholders on December 8, 2021, the Second Amendment was adopted by the Board on October 11, 2023 and approved by stockholders on December 6, 2023, and the Amended Plan was approved by the Board, subject to stockholder approval, on July 17, 2024. The Amendment increases the maximum number of shares that may be issued pursuant to the 2020 Plan by 7,000,000 shares (increasing the maximum number of shares that may be issued under the 2020 Plan to an aggregate of 8,204,537 shares).

Key Reasons Why You Should Vote to Approve the Amendment

The 2020 Plan is the Companys only compensation plan under which equity or equity-linked awards may be made, and the share reserve under the 2020 Plan has been nearly exhausted. If our stockholders do not approve the increase in the share reserve contemplated by the Amendment, the share reserve under the 2020 Plan will be depleted and we will lose access to an important compensation tool in the labor markets in which we compete, a compensation tool that is key to our ability to attract, motivate, reward and retain our non-employee directors, officers, employees, and consultants while aligning their interests with those of our stockholders. An inability to grant equity or equity-linked awards would have significant negative consequences to us and our stockholders. For example, we would likely be pressed to shift our compensation programs to increase the cash-based components of our compensation programs in order to attract and retain qualified personnel. Such a shift in our compensation programs would lose the benefit of aligning our employee and stockholder interests through delivery of equity or equity-linked awards while also limiting Company cash available for other purposes.

The Amendment increases the maximum number of shares that may be issued pursuant to the 2020 Plan by 7,000,000 shares (to an aggregate of 8,204,537 shares). If stockholders do not approve this Proposal 2, the Amendment will not become effective, the proposed additional shares will not become available for issuance under the 2020 Plan, and the 2020 Plan will continue as in effect prior to the Amendment, subject to previously authorized share limits.

A copy of the Amendment is attached as Annex A to this Proxy Statement and a conformed copy of the 2020 Plan, as amended by the First Amendment, Second Amendment, and the Amendment, is attached as Annex B to this Proxy Statement. Other than the limited amendment to the share reserve described herein, we are not making any other changes to the 2020 Plan.

Background and Purpose of the Amended Plan; Stockholder Dilution Considerations

The Compensation Committee of the Board (the Compensation Committee) and the Board are asking our stockholders to approve the Amendment because the Compensation Committee and the Board believe that it is in the best interests of the Company and its stockholders to provide, through the 2020 Plan as amended by the Amendment, a comprehensive equity compensation program that allows us to grant incentive equity and equity- linked awards to our non-employee directors, officers, employees, and consultants. In connection with the Offerings, the share reserve pool has been diluted and is insufficient to make grants to existing employees or to retain additional personnel, which will be needed to continue to drive the Companys growth and success. The

12

Table of Contents

Compensation Committee and the Board believe that long-term equity and equity-linked incentives are essential to align our compensation program with long-term stockholder value creation. Moreover, as described above, an inability to grant equity or equity-linked awards as a key element of our compensation programs would likely result in a shift in our compensation programs towards an increased cash-based component, thus losing the benefit of alignment of our employees interests with long-term stockholder value creation and limiting availability of Company cash for other purposes.

To protect stockholder interests from the potential dilutive impact of incentive equity and equity-linked awards, we seek to actively manage our equity plan resources. The total number of shares that are subject to award grants in any one year or from year-to-year may change based on any number of variables, including, without limitation, the value of our common stock, changes in competitors compensation practices or changes in compensation practices in the market generally, changes in the number of employees, changes in the number of directors and officers, the extent to which vesting conditions applicable to equity-based awards are satisfied, the need to attract, retain and incentivize key talent in a competitive labor market, the type of awards we grant, and how we choose to balance total compensation between cash and equity or equity-linked awards. When considering the number of additional shares to add to the 2020 Plan, and in recommending to stockholders the number of additional shares to authorize under the Amended Plan, the Compensation Committee and the Board reviewed, among other things, the historical number of equity awards granted under the 2020 Plan, the potential dilution to our current stockholders as measured by fully diluted overhang, and projected future share usage.

The 2020 Plan is the only active plan under which we can grant equity or equity-linked awards. The current share reserve under the 2020 Plan is 1,204,537 shares and, currently, only 22,397 shares remain available for issuance under the 2020 Plan.

Since approval of the 2020 Plan in December 2020, the Compensation Committee approved or, with respect to grants to directors, recommended that the Board approve grants of stock options to our non-employee directors, officers and employees (the Option Grants). Prior to the Option Grants, those equity incentive grants that were granted by our predecessor Benitec Limited under its Officers and Employees Share Option Plan (the Share Option Plan) (which was assumed by us and frozen in connection with the re-domiciliation resulting in the Company becoming the ultimate parent company of the Benitec group of companies ) to our non-employee directors, officers and employees were significantly underwater, with limited value as an incentive and retention tool, and as of July 1, 2024, all outstanding options under the Share Option Plan expired by their terms. The Equity Grants were intended to provide the grantees with a strong link to our long-term performance, create an ownership culture and help to align the interests of the grantees and our stockholders, and to incentivize continued service through the applicable vesting period, particularly in light of the lack of incentive and retention value of the remaining outstanding awards under the Share Option Plan.

The following table sets forth information with respect to the number of outstanding stock options that have been granted to our non-employee directors, officers, and employees under the 2020 Plan as of June 30, 2024.

| Name and Principal Position |

Stock Options | |||

| Dr. Jerel A. Banks, M.D. PH.D |

504,274 | |||

| Megan Boston |

217,367 | |||

| J. Kevin Buchi |

37,798 | |||

| Peter Francis |

37,798 | |||

| Edward F. Smith |

37,798 | |||

| All other employees |

347,105 | |||

| Total shares granted under the 2020 Plan |

1,182,140 | |||

13

Table of Contents

Impact of Amendment on Shares

The aggregate number of shares shown in the table above represents an adjusted overhang of approximately % based on Company common shares outstanding as of June 30, 2024. If the Amendment is approved, the additional 7,000,000 shares to be added to the 2020 Plan would increase the overhang to approximately %. The Company calculates the adjusted overhang as (a) the total number of shares underlying outstanding awards plus shares available for issuance under the Companys equity plans, divided by (b) the total number of common shares outstanding, shares underlying outstanding awards and shares available for issuance under the Companys equity plans. The calculation of our adjusted overhang is based on common shares and common share equivalents outstanding as of June 30, 2024 and includes (i) common shares outstanding as of June 30, 2024 and (ii) pre-funded warrants outstanding as of June 30, 2024 to purchase up to common shares (without giving effect to any exercise limitations included in the Pre-Funded Warrants).

Depending on assumptions, the 7,000,000 shares to be added to the 2020 Plan pursuant to the Amendment, in combination with the remaining authorized shares and shares added back to the 2020 Plan from forfeitures of awards granted under the 2020 Plan, are projected to satisfy our regular equity compensation needs for several years. In light of the factors considered by the Board and Compensation Committee, including that our ability to continue to grant equity and equity-based compensation is vital to our ability to continue to attract and retain key personnel in the labor markets in which we compete, the Board and Compensation Committee believe that the size of the share reserve under the Amended Plan is appropriate and represents reasonable potential stockholder dilution while providing a significant incentive for our non-employee directors, officers, employees, and consultants to increase the value of the Company for all stockholders.

If our stockholders do not approve the proposed Amendment to the 2020 Plan, the shares available for future awards under the 2020 Plan will be exhausted, and our ability to grant equity and equity-based compensation to our non-employee directors, officers, employees (including new hires), and consultants will be impaired.

To permit us to continue to make grants of equity and equity-based compensation to our non-employee directors, officers, employees and consultants, our Board recommends that you vote FOR the approval of this Proposal 2.

The inclusion of the above information in this Proxy Statement should not be regarded as an indication that the assumptions used to determine the number of shares will be predictive of actual future equity grants. These assumptions are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These statements involve risks and uncertainties that could cause actual outcomes to differ materially from those in the forward-looking statements, including our ability to attract and retain talent, the extent of option exercise activity, and others described in our Form 10-K for the fiscal year ended June 30, 2023, Quarterly Reports on Form 10-Q, and its other filings with the SEC after that date, as such risks, uncertainties and other important factors may be updated from time to time in the Companys subsequent reports.

Summary of the Amended Plan

If our stockholders approve the Amendment, the 2020 Plan will remain unchanged in all respects other than the increase to the number of shares authorized for issuance under the 2020 Plan (including the number of shares that may be issued as incentive stock options) by 7,000,000 shares (to an aggregate of 8,204,537 shares). The principal features of the Amended Plan are described below. However, this summary of the Amended Plan does not purport to be exhaustive and is expressly qualified in its entirety by reference to (i) a copy of the Amendment attached as Annex A to this Proxy Statement and (ii) a copy of the conformed copy of the 2020 Plan, as amended by the First Amendment, Second Amendment, and the Amendment attached as Annex B to this Proxy Statement. Other than the limited amendment to the share reserve described herein, we are not making any other changes to the 2020 Plan.

14

Table of Contents

Administration

The Amended Plan is administered and interpreted by the Compensation Committee, which is comprised of three non-employee directors, each of whom meets the independence requirements imposed by Nasdaq and is a non-employee director within the meaning of applicable federal securities laws. Subject to the provisions of the Amended Plan, the Compensation Committee has full power and authority to select the participants to whom awards will be granted, to make any combination of awards to participants, to determine the specific terms and conditions of each award, including the conditions for the vesting and exercisability of the award, and to accelerate the vesting or exercisability of any award.

Eligibility

Subject to selection by the Compensation Committee, all of our non-employee directors, employees, and consultants are eligible to participate in the Amended Plan as well as the officers, employees and consultants of our subsidiaries. All participants may receive all types of awards under the Amended Plan, except that incentive stock options may be granted only to employees (including executive officers and directors who are also employees). The Compensation Committee determines which persons eligible to participate will receive awards and the terms of their individual awards.

As of June 30, 2024, we had 16 employees (including officers and directors who are also employees) and three non-employee directors who would have been eligible to participate in the Amended Plan. The actual number of persons who will receive awards from time to time cannot be determined in advance because the Compensation Committee has the discretion to select the award recipients.

Maximum Shares Reserved

The maximum number of shares of our common stock available for issuance under the Amended Plan will be 8,204,537 shares. This includes the maximum number of shares that may be granted as incentive stock options under the Amended Plan, which also will be 8,204,537 shares.

Shares issued with respect to awards to which a share of stock is subject will be counted as one share. The following rules apply for counting shares against the maximum share limit under the Amended Plan:

| | Shares of common stock underlying any awards that are canceled, forfeited, expired, are settled for cash or are unearned (other than by exercise) are added back to the shares of common stock available for issuance under the Amended Plan. |

| | Shares tendered or held back upon exercise of an option or settlement of an award to cover the exercise price or tax withholding are not available for future issuance under the Amended Plan. |

| | Upon exercise of stock appreciation rights, the gross number of shares exercised are deducted from the total number of shares remaining available for issuance under the Amended Plan. |

| | Shares of common stock and stock equivalents repurchased with any cash proceeds from option exercises are not added back to the shares available for grant under the Amended Plan. |

Director Individual Annual Maximums

In order to provide a meaningful and specific limit on the compensation that may be provided to non-employee directors under the Amended Plan, the maximum compensation, including awards granted under the Amended Plan, to any non-employee director in any one calendar year may not exceed $500,000, with equity awards determined based on the grant date fair value for financial reporting purposes.

Terms of Awards

The Compensation Committee determines the types of awards to be granted from among those provided under the Amended Plan and the terms of such awards, including the number of shares of our common stock or other securities underlying the awards; restrictions and vesting requirements, which may be time-based vesting or

15

Table of Contents

vesting upon satisfaction of performance goals and/or other conditions; the exercise price for options and stock appreciation rights, which may not be less than 100% of the fair market value of a share on the grant date; and, where applicable, the expiration date of awards, which for options and stock appreciation rights may not be more than 10 years after the grant date.

Types of Awards

Our Amended Plan provides the Compensation Committee with the authority to grant a variety of types of equity awards:

Incentive Stock Options or Non-Qualified Stock Options. Options entitle the participant to purchase shares of our common stock over time for an exercise price fixed on the date of the grant. The exercise price may not be less than 100% of the fair market value of our common stock on the date of the grant. The exercise price may be paid in cash, by the transfer of shares of our common stock meeting certain criteria, by applying the value of a portion of the shares acquired upon exercise and issuing only the net balance of the shares, by a combination of these methods, or by such other methods as may be approved by the Compensation Committee. The participant has no rights as a stockholder with respect to any shares covered by the option until the option is exercised by the participant and shares are issued by us. Although we expect to grant only non-qualified stock options, our Amended Plan permits the grant of options that qualify as an incentive stock option under the Code (as defined below).

Stock Appreciation Rights. Stock appreciation rights entitle the participant to receive the appreciation in the fair market value of our common stock between the date of grant and the exercise date either in cash or in the form of shares of our common stock. For cash-settled stock appreciation rights, the participant will have no rights as a stockholder. For stock-settled stock appreciation rights, the participant will have no rights as a stockholder with respect to any shares covered by the stock appreciation right until the award is exercised by the participant and we issue the shares.

Restricted Stock Awards. Restricted stock awards are shares of our common stock that vest in accordance with terms and conditions established by the Compensation Committee. Shares of restricted stock awards that do not satisfy any vesting conditions are subject to our right of repurchase or forfeiture. In either case, the vesting conditions may be based on continued employment (or other service) with us and our affiliates and/or achievement of performance goals. Unless otherwise provided in the applicable award agreement, a participant granted restricted stock will have the rights of a stockholder for the common stock subject to restrictions, including voting and dividend rights, but not the right to sell or transfer the shares. Dividends or other distributions on restricted stock will be deferred until, and paid contingent upon, the vesting of such restricted stock.

Restricted Stock Unit Awards. Restricted stock unit awards are an agreement by the Company to deliver shares or cash, or a combination thereof, to a participant in the future in consideration of the performance of service, and vest in accordance with terms and conditions established by the Compensation Committee. For cash-settled restricted stock units, the participant will have no rights as a stockholder. For stock-settled restricted stock units, the participant will have no rights as a stockholder with respect to any shares covered by the restricted stock units until we issue the shares. The Compensation Committee may authorize the payment of dividend equivalents on restricted stock units on a deferred and contingent basis, either in cash or in additional shares of our common stock. However, dividend equivalents or other distributions on our common stock underlying restricted stock units will be deferred until and paid contingent upon the vesting of such restricted stock units.

Cash Incentive Awards, Performance Shares and Performance Units. Cash incentive awards, performance shares, and performance units will grant a number of shares or amount of cash payable upon the vesting of the applicable award, such awards vest in accordance with the terms and conditions established by the Compensation Committee, including performance goals. The Compensation Committee may determine at the time of award of performance shares or performance units that the payment of dividends, if any, will be

16

Table of Contents

deferred until the underlying restricted stock unit awards vest. The Compensation Committee may provide for the payment of dividend equivalents on performance shares or performance units either in cash or in additional shares of our common stock. Dividend equivalents will be subject to deferral and payment on a contingent basis based on the earning and vesting of the performance shares or performance units, as applicable, with respect to which such dividend equivalents are paid.

Other Awards. The Compensation Committee may grant to any participant shares or such other awards that may be denominated or payable in, valued in whole or in part by reference to, or otherwise based on, or related to, shares or factors that may influence the value of such shares, and awards valued by reference to the book value of the shares or the value of securities of, or the performance of specified subsidiaries or affiliates or other business units of the Company. Other awards vest in accordance with the terms and condition established by the Compensation Committee. The Compensation Committee may provide for the payment of dividends or dividend equivalents on these types of awards on a deferred and contingent basis, either in cash or in additional shares of our common stock, based upon the earning and vesting of such awards.

Performance-Based Awards

Vesting of awards under the Amended Plan may be made subject to the satisfaction of Management Objectives (as defined in the Amended Plan), which are measurable performance objectives or objectives established pursuant to the Amended Plan for participants receiving grants of awards under the Amended Plan. If the Compensation Committee determines that a change in the business, operations, corporate structure or capital structure of the Company, or the manner in which it conducts its business, or other events or circumstances render the Management Objectives unsuitable, the Compensation Committee may in its discretion modify such Management Objectives or the goals or actual levels of achievement regarding the Management Objectives, in whole or in part, as the Compensation Committee deems appropriate and equitable.

Transferability of Awards

Awards under the Amended Plan generally are not transferable by the participant other than by will or the laws of descent and distribution and are generally exercisable, during the participants lifetime, only by the participant. Any amounts payable or shares issuable pursuant to an award generally will be paid only to the participant or the participants estate or legal representative or guardian. The Compensation Committee has discretion, however, to permit the transfer of awards other than incentive stock options to a participants immediate family members or to trusts or partnerships for their benefit.

Adjustments and Substitute Awards

The share limits and the number and kind of shares available under the Amended Plan, and the shares subject to any outstanding awards, as well as the exercise or purchase prices of such awards, are subject to adjustment in the event of certain reorganization, recapitalization, reclassification, stock dividend, stock split, reverse stock split or other similar change in our capital stock or the number or kind of shares outstanding.

In the event of any such transactions or events or in the event of a Change in Control (as defined in the Amended Plan), the Compensation Committee may provide in substitution for any or all outstanding awards under the Amended Plan such alternative consideration (including cash), if any, as it, in good faith, may determine to be equitable in the circumstances and shall require in connection therewith the surrender of all awards so replaced in a manner that complies with Section 409A of the Internal Revenue Code of 1986, as amended (the Code).

Clawback of Awards

Awards granted under the Amended Plan may be subject to recovery or clawback if the Compensation Committee later determines that the participant engaged in detrimental activity during the participants employment with or service to the Company, or for a specified time thereafter. In addition, the Compensation

17

Table of Contents

Committee may provide that any award, including any shares subject to or issued under an award, is subject to any other clawback policy maintained by the Company from time to time, including the Companys Dodd-Frank Clawback Policy.

Amendment and Termination

The Board may amend or terminate the Amended Plan at any time, provided that any such amendment or termination may not adversely affect any awards then outstanding without the participants consent. Material amendments of the Amended Plan will be subject to stockholder approval, including amendments for which stockholder approval is required by applicable laws, regulations or stock exchange rules. Unless terminated earlier by the Board, no grants will be made under the Amended Plan after December 9, 2030.

Federal Tax Aspects

The following is a general discussion of certain U.S. federal income tax consequences relating to certain of the awards that may be issued under the Amended Plan, based on U.S. federal income tax laws in effect on the date of this Proxy Statement. This discussion is general in nature only, and is not intended to be specific income tax advice on which we or any participant will rely. This summary does not describe all of the possible federal income tax consequences that could result from the acquisition, holding, exercise or disposition of any award or of any shares of common stock received pursuant to any award granted under the Amended Plan, and it does not describe any state, local or foreign tax consequences or any gift, estate or excise tax consequences.

Tax Consequences to Participants.

Incentive Stock Options. A participant will not recognize income upon the grant of an option intended to be an incentive stock option. Furthermore, a participant will not recognize ordinary income upon the exercise of an incentive stock option if he or she satisfies certain employment and holding period requirements, although the exercise may be subject to alternative minimum tax. To satisfy the employment requirement, a participant must exercise the option not later than three months after he or she ceases to be our employee (one year if he or she is disabled). To satisfy the holding period requirement, a participant must hold the shares acquired upon exercise of the incentive stock option for more than two years from the grant of the option and more than one year after the shares are transferred to him or her. If these requirements are satisfied, a participant will be taxed on the difference between his or her basis in the shares and the net proceeds of the sale at capital gain rates on the sale of the shares.

If the employment requirement is not met, the option will be taxed as a non-qualified stock option at time of exercise. If a participant disposes of shares of our common stock acquired upon the exercise of an incentive stock option without satisfying the holding period requirement, that participant generally will recognize ordinary income as of the date of disposition equal to the lesser of (i) the difference between the fair market value of the shares on the date of exercise and the exercise price, or (ii) the difference between the selling price and the exercise price.

Non-Qualified Stock Options. In general, a participant will not recognize income at the time an option is granted. At the time of exercise of the option, the participant will recognize ordinary income if the shares are not subject to a substantial risk of forfeiture (as defined in Section 83 of the Code). The amount of such income will be equal to the difference between the option exercise price and the fair market value of the shares of our common stock on the date of exercise. At the time of the sale of the shares of our common stock acquired pursuant to the exercise of an option, appreciation in value of the shares after the date of exercise will be treated as either short-term or long-term capital gain, and depreciation in value will be treated as short-term or long-term capital loss, depending on how long the shares have been held. Long-term capital gains may be eligible for reduced rates if the participant has satisfied applicable holding period requirements.

18

Table of Contents

Stock Appreciation Rights. In general, a participant will not recognize income at the time a stock appreciation right is granted. Upon exercise of the right, the participant will recognize ordinary income in an amount equal to the excess of the fair market value of the underlying shares on the exercise date over the exercise price, whether such amount is payable in cash or in shares of common stock. If the participant receives such excess value in common stock, any additional gain or any loss recognized upon later disposition of any shares received on exercise will be capital gain or loss.