10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on May 12, 2021

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2021

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-39267

BENITEC BIOPHARMA INC.

(Exact name of registrant as specified in its charter)

| Delaware | 84-462-0206 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

3940 Trust Way, Hayward, California 94545

(Address of principal executive offices & zip code)

(510) 780-0819

(Registrants telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, par value $0.0001 |

BNTC | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ or No ☒

We had 7,854,416 shares of our common stock outstanding as of the close of business on May 6, 2021.

Table of Contents

BENITEC BIOPHARMA INC.

| 2 | ||||||

| 4 | ||||||

| ITEM 1. |

4 | |||||

| Consolidated Balance Sheets as of March 31, 2021 (Unaudited) and June 30, 2020 |

4 | |||||

| 5 | ||||||

| 6 | ||||||

| Consolidated Statements of Cash Flows for the Nine Months Ended March 31, 2021 and 2020 (Unaudited) |

8 | |||||

| 9 | ||||||

| ITEM 2. |

Managements Discussion and Analysis of Financial Condition and Results of Operations |

24 | ||||

| ITEM 3. |

40 | |||||

| ITEM 4. |

40 | |||||

| ITEM 1. |

41 | |||||

| ITEM 1A. |

41 | |||||

| ITEM 2. |

41 | |||||

| ITEM 3. |

41 | |||||

| ITEM 4. |

41 | |||||

| ITEM 5. |

41 | |||||

| ITEM 6. |

42 | |||||

| 43 | ||||||

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Our forward-looking statements relate to future events or our future performance and include, but are not limited to, statements concerning our business strategy, future commercial revenues, market growth, capital requirements, new product introductions, expansion plans and the adequacy of our funding. All statements, other than statements of historical fact included in this Report, are forward-looking statements. When used in this Report, the words could, believe, anticipate, intend, estimate, expect, may, continue, predict, potential, project, or the negative of these terms, and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following:

| | the success of our plans to develop and potentially commercialize our product candidates; |

| | the timing of the initiation and completion of preclinical studies and clinical trials; |

| | the timing and sufficiency of patient enrollment and dosing in any future clinical trials; |

| | the timing of the availability of data from clinical trials; |

| | the timing and outcome of regulatory filings and approvals; |

| | unanticipated delays; |

| | sales, marketing, manufacturing and distribution requirements; |

| | market competition and the acceptance of our products in the marketplace; |

| | regulatory developments in the United States of America; |

| | the development of novel AAV vectors; |

| | the plans of licensees of our technology; |

| | the clinical utility and potential attributes and benefits of ddRNAi and our product candidates, |

| | including the potential duration of treatment effects and the potential for a one shot cure; |

| | our dependence on our relationships with collaborators and other third parties; |

| | expenses, ongoing losses, future revenue, capital needs and needs for additional financing; |

| | the length of time over which we expect our cash and cash equivalents to be sufficient to execute on our business plan; |

| | our intellectual property position and the duration of our patent portfolio; |

| | the impact of local, regional, and national and international economic conditions and events; and |

| | the impact of the current COVID-19 pandemic, the disease caused by the SARS-CoV-2 virus, which may adversely impact our business and preclinical and future clinical trials; |

as well as other risks detailed under the caption Risk Factors in this Report and in other reports filed with the SEC. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Report, we caution you that these statements are based on a combination of facts and important factors currently known by us and our expectations of the future, about which we cannot be certain.

2

Table of Contents

We have based the forward-looking statements included in this Report on information available to us on the date of this Report or on the date thereof. Except as required by law we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we may make directly to you or through reports that we, in the future, may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

All forward-looking statements included herein or in documents incorporated herein by reference are expressly qualified in their entirety by the cautionary statements contained or referred to elsewhere in this Report.

3

Table of Contents

PART I FINANCIAL INFORMATION

| ITEM 1. | Financial Statements |

Consolidated Balance Sheets

(in thousands, except par value and share amounts)

| March 31, | June 30, | |||||||

| 2021 | 2020 | |||||||

| (Unaudited) | ||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 11,988 | $ | 9,801 | ||||

| Trade and other receivables |

10 | 59 | ||||||

| Other current assets |

409 | 949 | ||||||

|

|

|

|

|

|||||

| Total current assets |

12,407 | 10,809 | ||||||

| Property and equipment, net |

563 | 374 | ||||||

| Deposits |

9 | 9 | ||||||

| Other assets |

197 | | ||||||

| Right-of-use assets |

252 | 395 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 13,428 | $ | 11,587 | ||||

|

|

|

|

|

|||||

| Liabilities and Stockholders Equity |

||||||||

| Current liabilities: |

||||||||

| Trade and other payables |

$ | 2,005 | $ | 741 | ||||

| Accrued employee benefits |

231 | 203 | ||||||

| Lease liabilities, current portion |

208 | 192 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

2,444 | 1,136 | ||||||

| Lease liabilities, less current portion |

54 | 213 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

2,498 | 1,349 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 12) |

||||||||

| Stockholders equity: |

||||||||

| Common stock, $0.0001 par value10,000,000 shares authorized; 4,818,050 and 1,108,374 shares issued and outstanding at March 31, 2021 and June 30, 2020, respectively |

5 | 1 | ||||||

| Additional paid-in capital |

138,632 | 128,826 | ||||||

| Accumulated deficit |

(126,116 | ) | (116,636 | ) | ||||

| Accumulated other comprehensive loss |

(1,591 | ) | (1,953 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders equity |

10,930 | 10,238 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders equity |

$ | 13,428 | $ | 11,587 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements.

4

Table of Contents

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(in thousands, except share and per share amounts)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| March 31, | March 31, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| Revenue: |

||||||||||||||||

| Revenues from customers |

$ | 1 | $ | 28 | $ | 57 | $ | 137 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

1 | 28 | 57 | 137 | ||||||||||||

| Operating expenses |

||||||||||||||||

| Royalties and license fees |

7 | 47 | 122 | (233 | ) | |||||||||||

| Research and development |

2,758 | 805 | 4,700 | 2,095 | ||||||||||||

| General and administrative |

1,029 | 1,287 | 4,976 | 3,669 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

3,794 | 2,139 | 9,798 | 5,531 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(3,793 | ) | (2,111 | ) | (9,741 | ) | (5,394 | ) | ||||||||

| Other income (loss): |

||||||||||||||||

| Foreign currency transaction gain (loss) |

(112 | ) | (7 | ) | (167 | ) | 4 | |||||||||

| Interest income (expense), net |

(2 | ) | 16 | (5 | ) | 52 | ||||||||||

| Other income, net |

| | 37 | | ||||||||||||

| Unrealized loss on investment |

(2 | ) | | (3 | ) | (1 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other income (loss), net |

(116 | ) | 9 | (138 | ) | 55 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (3,909 | ) | $ | (2,102 | ) | $ | (9,879 | ) | $ | (5,339 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other comprehensive income (loss): |

||||||||||||||||

| Unrealized foreign currency translation gain (loss) |

(24 | ) | (901 | ) | 362 | (869 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other comprehensive income (loss) |

(24 | ) | (901 | ) | 362 | (869 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total comprehensive loss |

$ | (3,933 | ) | $ | (3,003 | ) | $ | (9,517 | ) | $ | (6,208 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (3,909 | ) | $ | (2,102 | ) | $ | (9,879 | ) | $ | (5,339 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share: |

||||||||||||||||

| Basic and diluted |

$ | (0.82 | ) | $ | (1.96 | ) | $ | (2.93 | ) | $ | (5.36 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average number of shares outstanding: basic and diluted |

4,747,059 | 1,070,957 | 3,375,228 | 995,246 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these consolidated financial statements.

5

Table of Contents

Consolidated Statements of Stockholders Equity

(Unaudited)

(in thousands, except share amounts)

| Common Stock | Additional Paid-in |

Accumulated | Accumulated Other Comprehensive |

Total Stockholders |

||||||||||||||||||||

| Shares | Amount | Capital | Deficit | Loss | Equity | |||||||||||||||||||

| Balance at June 30, 2019 |

856,765 | $ | 1 | $ | 127,327 | $ | (108,870 | ) | $ | (1,864 | ) | $ | 16,594 | |||||||||||

| Common stock sold for cash, net of issuance costs of $240 |

186,666 | | 1,720 | | | 1,720 | ||||||||||||||||||

| Issuance of pre-purchased warrants, net of issuance costs of $240 |

| | 50 | | | 50 | ||||||||||||||||||

| Share-based compensation |

| | 55 | | | 55 | ||||||||||||||||||

| Forfeiture of share-based payments |

| | (61 | ) | 61 | | | |||||||||||||||||

| Foreign currency translation loss |

| | | | (304 | ) | (304 | ) | ||||||||||||||||

| Net loss |

| | | (1,147 | ) | (1,147 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at September 30, 2019 |

1,043,431 | $ | 1 | $ | 129,091 | $ | (109,956 | ) | $ | (2,168 | ) | $ | 16,968 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Exercise of pre-funded warrants |

27,526 | | | | | | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Share-based compensation |

| | 37 | | | 37 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Forfeiture of share-based payments |

| | (319 | ) | 319 | | | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Foreign currency translation gain |

| | | | 336 | 336 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

| | | (2,090 | ) | | (2,090 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at December 31, 2019 |

1,070,957 | $ | 1 | $ | 128,809 | $ | (111,727 | ) | $ | (1,832 | ) | $ | 15,251 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Share-based compensation |

| | 88 | | | 88 | ||||||||||||||||||

| Foreign currency translation gain |

| | | | (901 | ) | (901 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

| | | (2,102 | ) | | (2,102 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at March 31, 2020 |

1,070,957 | $ | 1 | $ | 128,897 | $ | (113,829 | ) | $ | (2,733 | ) | $ | 12,336 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

6

Table of Contents

BENITEC BIOPHARMA INC.

Consolidated Statements of Stockholders Equity

(Unaudited)

(in thousands, except share amounts)

| Common Stock | Additional Paid-in |

Accumulated | Accumulated Other Comprehensive |

Total Stockholders |

||||||||||||||||||||

| Shares | Amount | Capital | Deficit | Loss | Equity | |||||||||||||||||||

| Balance at June 30, 2020 |

1,108,374 | $ | 1 | $ | 128,826 | $ | (116,636 | ) | $ | (1,953 | ) | $ | 10,238 | |||||||||||

| Share-based compensation |

| | 38 | | | 38 | ||||||||||||||||||

| Forfeiture of share-based payments |

| | (14 | ) | 14 | | | |||||||||||||||||

| Foreign currency translation gain |

| | | | 178 | 178 | ||||||||||||||||||

| Net loss |

| | | (2,718 | ) | (2,718 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at September 30, 2020 |

1,108,374 | $ | 1 | $ | 128,850 | $ | (119,340 | ) | $ | (1,775 | ) | $ | 7,736 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Issuance of common stock and pre-funded warrants sold for cash, net of issuance costs of $1,643 |

3,150,514 | 3 | 9,848 | | | 9,851 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Exercise of pre-funded warrants |

281,581 | | | | | | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Share-based compensation |

| | 82 | | | 82 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Forfeiture of share-based payments |

| | (385 | ) | 385 | | | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Foreign currency translation gain |

| | | | 208 | 208 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

| | | (3,252 | ) | | (3,252 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at December 31, 2020 |

4,540,469 | $ | 4 | $ | 138,395 | $ | (122,207 | ) | $ | (1,567 | ) | $ | 14,625 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Exercise of pre-funded warrants |

277,581 | 1 | 2 | | | 3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Share-based compensation |

| | 235 | | | 235 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Foreign currency translation loss |

| | | | (24 | ) | (24 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

| | | (3,909 | ) | | (3,909 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at March 31, 2021 |

4,818,050 | $ | 5 | $ | 138,632 | $ | (126,116 | ) | $ | (1,591 | ) | $ | 10,930 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

7

Table of Contents

Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

| Nine Months Ended | ||||||||

| March 31, | ||||||||

| 2021 | 2020 | |||||||

| Cash flows from operating activities: |

||||||||

| Net loss |

$ | (9,879 | ) | $ | (5,339 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Depreciation and amortization |

179 | 150 | ||||||

| Amortization of right-of-use assets |

143 | 138 | ||||||

| Loss on disposal of fixed assets |

| 1 | ||||||

| Unrealized loss on investment |

3 | 1 | ||||||

| Share-based compensation expense |

355 | 180 | ||||||

| Changes in operating assets and liabilities: |

||||||||

| Trade and other receivables |

21 | 2,494 | ||||||

| Other assets |

377 | (69 | ) | |||||

| Trade and other payables |

1,214 | (1,197 | ) | |||||

| Accrued employee benefits |

55 | | ||||||

| Lease liabilities |

(143 | ) | (749 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in operating activities |

(7,675 | ) | (4,390 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchases of property and equipment |

(362 | ) | (82 | ) | ||||

| Proceeds from disposal of property and equipment |

| 1 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(362 | ) | (81 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Proceeds from issues of shares and pre-funded warrants |

11,497 | 2,250 | ||||||

| Shares and pre-funded warrant issuance costs |

(1,643 | ) | (480 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

9,854 | 1,770 | ||||||

|

|

|

|

|

|||||

| Effects of exchange rate changes on cash and cash equivalents |

370 | (1,617 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in cash and cash equivalents |

2,187 | (4,318 | ) | |||||

|

|

|

|

|

|||||

| Cash and cash equivalents, beginning of period |

9,801 | 15,718 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 11,988 | $ | 11,400 | ||||

|

|

|

|

|

|||||

| Supplemental disclosure of cash flow information: |

||||||||

| Initial measurement of operating lease right-of-use assets and liabilities |

$ | | $ | (579 | ) | |||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements.

8

Table of Contents

Notes to Consolidated Financial Statements

(Unaudited)

1. Business

Benitec Biopharma Inc. (the Company) is a corporation formed under the laws of Delaware, United States of America, on November 22, 2019 and listed on the Nasdaq Capital Market (Nasdaq) under the symbol BNTC. Benitec Biopharma Inc. is the parent entity of a number of subsidiaries including the previous parent entity Benitec Biopharma Limited (BBL). BBL was incorporated under the laws of Australia in 1995 and was listed on the Australian Securities Exchange, or ASX, from 1997 until April 15, 2020. On August 14, 2020, BBL reorganized as a Proprietary Limited company and changed its name to Benitec Biopharma Proprietary Limited. The Companys business focuses on the development of novel genetic medicines. Our proprietary platform, called DNA-directed RNA interference, or ddRNAi, combines RNA interference, or RNAi, with gene therapy to create medicines that facilitate sustained silencing of disease-causing genes.

On November 27, 2019, BBL announced its intention to re-domicile from Australia to the United States of America. BBL implemented a Scheme of Arrangement pursuant to which Benitec Biopharma Inc, a newly incorporated company for the purpose of effecting the re-domiciliation, acquired all BBL shares and BBL became a wholly-owned subsidiary of Benitec Biopharma Inc.. BBL shareholders received one Benitec Biopharma Inc. share for every 300 BBL shares. Holders of BBLs American Depository Shares, or ADSs (each of which represented 200 ordinary shares), received two shares of the Companys common stock for every three ADSs held. The re-domiciliation was completed on April 15, 2020 following approval by BBL shareholders at a Scheme Meeting held on March 26, 2020 and by the Supreme Court of Queensland on March 30, 2020.

In accordance with the U.S. Securities and Exchange Commissions (SEC) Staff Accounting Bulletin Topic 4C, all issued and outstanding shares of the Companys common stock have been retroactively adjusted in these consolidated financial statements to reflect the 300:1 ratio and share consolidation as if it occurred on July 1, 2019.

The terms the Company, we, us, our and similar terms used herein refer (i), prior to the re-domiciliation to BBL, an Australian corporation, and its subsidiaries, and (ii), following the re-domiciliation, to Benitec Biopharma Inc., a Delaware corporation, and its subsidiaries (including BBL).

The Companys fiscal year end is June 30. References to a particular fiscal year are to our fiscal year end June 30 of that calendar year.

The consolidated financial statements of Benitec Biopharma Inc. are presented in United States dollars and consist of Benitec Biopharma Inc. and its wholly owned subsidiaries:

|

Principal place of business/country of incorporation |

Ownership Fiscal Year 2020 |

Ownership Fiscal Year 2019 |

||||||||

| Benitec Biopharma Proprietary Limited (BBL) |

Australia | 100 | % | | ||||||

| Benitec Australia Proprietary Limited |

Australia | 100 | % | 100 | % | |||||

| Benitec Limited |

United Kingdom | 100 | % | 100 | % | |||||

| Benitec, Inc. |

USA | 100 | % | 100 | % | |||||

| Benitec LLC |

USA | 100 | % | 100 | % | |||||

| RNAi Therapeutics, Inc. |

USA | 100 | % | 100 | % | |||||

| Tacere Therapeutics, Inc. |

USA | 100 | % | 100 | % | |||||

9

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

The Company is continuing to monitor the impact of the pandemic of the novel strain of coronavirus COVID-19 (COVID-19) on all aspects of its business, including how it will impact our employees, suppliers, vendors and business partners. While the Company did experience some disruption from COVID-19 including disruption of the timing and completion of certain pre-clinical trials we are unable to predict the overall impact that COVID-19 will have on our financial position and operating results due to numerous uncertainties.

2. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation

The Companys consolidated financial statements contained in this Quarterly Report on Form 10-Q have been prepared in accordance with generally accepted accounting principles in the U.S. (GAAP) for interim financial information and with the instructions to Form 10-Q and Article 8 of SEC Regulation S-X. Accordingly, certain information and disclosures required by GAAP for annual financial statements have been omitted. In the opinion of management, all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation have been included. Interim financial results are not necessarily indicative of results anticipated for the full year. These consolidated financial statements should be read in conjunction with the Companys audited financial statements and accompanying notes included in the Companys Annual Report on Form 10-K for the year ended June 30, 2020.

Reference is frequently made herein to the Financial Accounting Standards Board (the FASB) Accounting Standards Codification (ASC). This is the source of authoritative US GAAP recognized by the FASB to be applied to non-governmental entities.

Principles of Consolidation

The consolidated financial statements include the Companys accounts and the accounts of its wholly-owned subsidiaries. All intercompany transactions and balances have been eliminated.

Use of Estimates

The preparation of the Companys consolidated financial statements requires management to make estimates and assumptions that impact the reported amounts of assets, liabilities and expenses and the disclosure of contingent assets and liabilities in the Companys consolidated financial statements and accompanying notes. The most significant estimates and assumptions in the Companys consolidated financial statements include the estimates of useful lives of property and equipment, valuation of the operating lease liability and related right-of-use asset, allowance for uncollectable receivables, valuation of equity based instruments issued for other than cash, the valuation allowance on deferred tax assets and foreign currency translation due to certain average exchange rates applied in lieu of spot rates on transaction dates. These estimates and assumptions are based on current facts, historical experience and various other factors believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the recording of expenses that are not readily apparent from other sources. Actual results may differ materially and adversely from these estimates. To the extent there are material differences between the estimates and actual results, the Companys future results of operations will be affected.

10

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

Segment Reporting

Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision-maker in making decisions regarding resource allocation and assessing performance. The Company views its operations and manages its business in one operating segment.

Foreign Currency Translation and Other Comprehensive Income (Loss)

The Companys functional currency and reporting currency is the United States dollar. BBLs functional currency is the Australian dollar (AUD). Assets and liabilities are translated at the exchange rate in effect at the balance sheet date. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period. Equity transactions are translated at each historical transaction date spot rate. Translation adjustments arising from the use of different exchange rates from period to period are included as a component of stockholders equity as Accumulated other comprehensive income (loss). Gains and losses resulting from foreign currency translation are included in the consolidated statements of operations and comprehensive income (loss) as other comprehensive income (loss).

Other Comprehensive Income (Loss) for all periods presented includes only foreign currency translation gains (losses).

Fair Value Measurements

The Company measures its financial assets and liabilities in accordance with US GAAP using ASC 820, Fair Value Measurements. For certain financial instruments, including cash and cash equivalents, accounts receivable, and accounts payable, the carrying amounts approximate fair value due to their short maturities.

The Company follows accounting guidance for financial assets and liabilities. ASC 820 defines fair value, provides guidance for measuring fair value and requires certain disclosures. The guidance utilizes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The following is a brief description of those three levels:

| Level 1: | Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| Level 2: | Inputs, other than quoted prices that are observable, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active. |

| Level 3: | Unobservable inputs in which little or no market data exists, therefore developed using estimates and assumptions developed by us, which reflect those that a market participant would use. |

As of March 31, 2021, and June 30, 2020, the Company had no financial assets or liabilities measured at fair value on a recurring basis.

11

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand and at banks, short-term deposits with an original maturity of three months or less with financial institutions, and bank overdrafts. Bank overdrafts are reflected as a current liability on the consolidated balance sheets.

Concentrations of Risk

Financial instruments that potentially subject the Company to significant concentration of credit risk consist primarily of cash and cash equivalents. The Company maintains deposits at federally insured financial institutions in excess of federally insured limits. The Company has not experienced any losses in such accounts, and management believes that the Company is not exposed to significant credit risk due to the financial position of the depository institutions in which those deposits are held.

Trade and Other Receivables

As amounts become uncollectible, they will be charged to an allowance and operations in the period when a determination of collectability is made. Any estimates of potentially uncollectible customer accounts receivable will be made based on an analysis of individual customer and historical write-off experience. The Companys analysis includes the age of the receivable account, creditworthiness of the customer and general economic conditions.

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation and amortization. Expenditures for maintenance and repairs are expensed as incurred; additions, renewals, and improvements are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation and amortization are removed from the respective accounts, and any gain or loss is included in operations. Depreciation and amortization of property and equipment is calculated using the straight-line basis over the following estimated useful lives:

| Software | 3-4 years | |

| Lab equipment | 3-7 years | |

| Computer hardware | 3-5 years | |

| Leasehold improvements | shorter of the lease term or estimated useful lives |

12

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

Impairment of Long-Lived Assets

Property and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of long-lived assets to be held and used is measured by a comparison of the carrying amount of an asset to the estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated undiscounted future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the assets. Fair value is generally determined using the assets expected future discounted cash flows or market value, if readily determinable.

Trade and other payables

These amounts represent liabilities for goods and services provided to the Company prior to the end of the period and which are unpaid. Due to their short-term nature, they are measured at amortized cost and are not discounted. The amounts are unsecured and are usually paid within 30 days of recognition.

Leases

At lease commencement, the Company records a lease liability based on the present value of lease payments over the expected lease term. The Company calculates the present value of lease payments using the discount rate implicit in the lease, unless that rate cannot be readily determined. In that case, the Company uses its incremental borrowing rate, which is the rate of interest that the Company would have to pay to borrow on a collateralized basis an amount equal to the lease payments over the expected lease term. The Company records a corresponding right-of-use lease asset based on the lease liability, adjusted for any lease incentives received and any initial direct costs paid to the lessor prior to the lease commencement date.

After lease commencement, the Company measures its leases as follows: (i) the lease liability based on the present value of the remaining lease payments using the discount rate determined at lease commencement; and (ii) the right-of-use lease asset based on the remeasured lease liability, adjusted for any unamortized lease incentives received, any unamortized initial direct costs and the cumulative difference between rent expense and amounts paid under the lease agreement. Any lease incentives received and any initial direct costs are amortized on a straight-line basis over the expected lease term. Rent expense is recorded on a straight-line basis over the expected lease term.

Basic and Diluted Net Income (Loss) Per Share

Basic net income (loss) per share is calculated by dividing net income (loss) by the weighted-average number of common shares outstanding during the period. Diluted net income (loss) per share is calculated by dividing net income (loss) by the weighted-average number of common shares outstanding plus potential common shares. Stock options, warrants and convertible instruments are considered potential common shares and are included in the calculation of diluted net income (loss) per share using the treasury stock method when their effect is dilutive. Potential common shares are excluded from the calculation of diluted net income (loss) per share when their effect is anti-dilutive. As of March 31, 2021, and 2020, there were 694,388 and 324,903 potential common shares, respectively, that were excluded from the calculation of diluted net income (loss) per share because their effect was anti-dilutive.

13

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

Revenue Recognition

The Company recognizes revenue in accordance with that core principle by applying the following steps:

Step 1: Identify the contract(s) with a customer.

Step 2: Identify the performance obligations in the contract.

Step 3: Determine the transaction price.

Step 4: Allocate the transaction price to the performance obligations in the contract.

Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation.

The Company applies judgement in determining whether contracts entered into fall within the scope of ASC 606 Revenue from Contracts with Customers (ASC 606). In doing so, management considers the commercial substance of the transaction and how risks and benefits of the contract accrue to the various parties to the contract.

Management has also made the judgement that the grant of the license and transfer of associated know-how and materials are accounted for as one performance obligation as they are not considered to be distinct; they are highly interrelated and could not provide benefits to the customer independently from each other. Judgements were made in relation to the transfer of the license and know-how and whether this should be recognized over time or a point in time. The point in time has been determined with regard to the point at which the transfer of know-how has substantially been completed and the customer has control of the asset and the ability to direct the use of and receive substantially all of the remaining benefits.

Licensing revenues

Revenue from licensees of the Companys intellectual property reflects the transfer of a right to use the intellectual property as it exists at the point in time in which the license is transferred to the customer. Consideration can be variable and is estimated using the most likely amount method. Subsequently, the estimate is constrained until it is highly probable that a significant revenue reversal will not occur when the uncertainty is resolved. Revenue is recognized as or when the performance obligations are satisfied.

The Company recognizes contract liabilities for consideration received in respect of unsatisfied performance obligations and reports these amounts as other liabilities in the consolidated balance sheet. Similarly, if the Company satisfies a performance obligation before it receives the consideration, the Company recognizes either a contract asset or a receivable in its consolidated balance sheet, depending on whether something other than the passage of time is required before the consideration is due.

Royalties

Revenue from licensees of the Companys intellectual property reflect a right to use the intellectual property as it exists at the point in time in which the license is granted. Where consideration is based on sales of product by the licensee, revenue is recognized when the customers subsequent sales of products occur.

14

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

Services revenue

Revenue is earned (constrained by variable considerations) from the provision of research and development services to customers. Services revenue is recognized when performance obligations are either satisfied over time or at a point in time. Generally, the provision of research and development services under a contract with a customer will represent satisfaction of a performance obligation over time where the Company retains the right to payment for services performed but not yet completed.

Government Research and Development Grants

Government grants are recognized at fair value where there is reasonable assurance that the grant will be received, and all grant conditions will be met. Grants relating to expense items are recognized as income over the periods necessary to match the grant costs they are compensating.

Grant income is generated through the Australian federal governments Research and Development Tax Incentive program, under which the government provides a cash refund for 43.5% of eligible research and development expenditures. This grant is available for our research and development activities in Australia, as well as activities in the United States to the extent such U.S.-based expenses relate to our activities in Australia, do not exceed half the expenses for the relevant activities and are approved by the Australian government. Grants are recorded when a reliable estimate can be made.

The Company will not be claiming the Australian Government research and development grants going forward.

Research and Development Expense

Research and development costs are expensed when incurred. These costs have been recognized as an expense when incurred. Research and development expenses relate primarily to the cost of conducting clinical and pre-clinical trials. Pre-clinical and clinical development costs are a significant component of research and development expenses. Estimates have been used in determining the expense liability under certain clinical trial contracts where services have been performed but not yet invoiced. Generally, the costs, and therefore estimates, associated with clinical trial contracts are based on the number of patients, drug administration cycles, the type of treatment and the outcome being the length of time before actual amounts can be determined will vary depending on length of the patient cycles and the timing of the invoices by the clinical trial partners.

Share-based Compensation Expense

The Company records share-based compensation in accordance with ASC 718, Stock Compensation. ASC 718 requires the fair value of all share-based employee compensation awarded to employees to be recorded as an expense over the shorter of the service period or the vesting period. The Company values employee and non-employee share-based compensation at fair value using the Black-Scholes Option Pricing Model.

The Company adopted FASB Accounting Standard Update (ASU) 2018-07 and accounts for non-employee share-based awards in accordance with the measurement and recognition criteria of ASC 718 and recognizes the fair value of such awards over the service period.

15

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

Income Taxes

The Company is governed by Australia and United States income tax laws. The Company follows ASC 740 Accounting for Income Taxes, when accounting for income taxes, which requires an asset and liability approach to financial accounting and reporting for income taxes. Deferred income tax assets and liabilities are computed annually for temporary differences between the financial statements and tax bases of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount more likely than not to be realized.

For uncertain tax positions that meet a more likely than not threshold, the Company recognizes the benefit of uncertain tax positions in the consolidated financial statements. The Companys practice is to recognize interest and penalties, if any, related to uncertain tax positions in income tax expense in the consolidated statements of operations.

Recent Accounting Pronouncements

In June 2016, the FASB issued ASU No. 2016-13: Financial Instruments Credit Losses (Topic 326). This ASU represents a significant change in the accounting for credit losses model by requiring immediate recognition of managements estimates of current expected credit losses (CECL). Under the prior model, losses were recognized only as they were incurred. The Company has determined that it has met the criteria of a smaller reporting company (SRC) as of November 15, 2019. As such, ASU 2019-10: Financial Instruments-Credit Losses, Derivatives and Hedging, and Leases: Effective Dates amended the effective date for the Company to be for reporting periods beginning after December 15, 2022. The Company will adopt this ASU effective July 1, 2023.

3. Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. For the nine months ended March 31, 2021, and 2020, the Company incurred a net loss of $9.9 million and $5.3 million and used net cash of $7.7 million and $4.4 million in operations, respectively. The Company expects to continue to incur additional operating losses in the foreseeable future.

As of March 31, 2021, the Company had $12 million in cash and cash equivalents. The Company has performed a review of the cash flow forecasts and believes that the current funding will be sufficient for a period of at least twelve months from the date of this Report.

The Companys ability to continue as a going concern is dependent upon its ability to generate revenue and obtain adequate financing. While the Company believes in its ability to generate revenue and raise additional funds, there can be no assurances to that effect. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary if the Company is unable to continue as a going concern due to unsuccessful product development or commercialization, or the inability to obtain adequate financing in the future.

16

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

4. Revenue

| Three Months Ended | Nine Months Ended | |||||||||||||||

| Revenues from customers (US$000) |

March 31, 2021 |

March 31, 2020 |

March 31, 2021 |

March 31, 2020 |

||||||||||||

| Licensing revenue |

$ | 1 | $ | | $ | 57 | $ | 60 | ||||||||

| Royalty revenue |

| 28 | | 73 | ||||||||||||

| Service revenue |

| | | 4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 1 | $ | 28 | $ | 57 | $ | 137 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Three Months Ended March 31, 2021 | ||||||||||||||||

| Disaggregated revenue (US$000) |

Licensing | Royalties | Development activities | Total | ||||||||||||

| Services transferred at a point in time |

$ | | $ | | $ | | $ | | ||||||||

| Services transferred over time |

1 | | | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 1 | $ | | $ | | $ | 1 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Nine Months Ended March 31, 2021 | ||||||||||||||||

| Disaggregated revenue (US$000) |

Licensing | Royalties | Development activities | Total | ||||||||||||

| Services transferred at a point in time |

$ | | $ | | $ | | $ | | ||||||||

| Services transferred over time |

57 | | | 57 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 57 | $ | | $ | | $ | 57 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

17

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

| Three Months Ended March 31, 2020 | ||||||||||||||||

| Disaggregated revenue (US$000) |

Licensing | Royalties | Development activities | Total | ||||||||||||

| Services transferred at a point in time |

$ | | $ | | $ | | $ | | ||||||||

| Services transferred over time |

| 28 | | 28 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | | $ | 28 | $ | | $ | 28 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Nine Months Ended March 31, 2020 | ||||||||||||||||

| Disaggregated revenue (US$000) |

Licensing | Royalties | Development activities | Total | ||||||||||||

| Services transferred at a point in time |

$ | | $ | 73 | $ | | $ | 73 | ||||||||

| Services transferred over time |

60 | | 4 | 64 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 60 | $ | 73 | $ | 4 | $ | 137 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

5. Cash and Cash equivalents

| (US$000) |

March 31, 2021 |

June 30, 2020 |

||||||

| Cash at Bank |

$ | 11,988 | $ | 5,231 | ||||

| Term Deposit |

| 4,570 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 11,988 | $ | 9,801 | ||||

|

|

|

|

|

|||||

18

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

6. Other current assets

| (US$000) |

March 31, 2021 |

June 30, 2020 |

||||||

| Prepaid expenses |

$ | 587 | $ | 861 | ||||

| Security deposit |

15 | 69 | ||||||

| Other deposit |

| 18 | ||||||

| Market value of listed shares |

4 | 1 | ||||||

|

|

|

|

|

|||||

| Total other assets |

606 | 949 | ||||||

| Less: non-current portion |

(197 | ) | | |||||

|

|

|

|

|

|||||

| Current portion |

$ | 409 | $ | 949 | ||||

|

|

|

|

|

|||||

7. Property and equipment, net

| (US$000) |

March 31, 2021 |

June 30, 2020 |

||||||

| Software |

$ | 14 | $ | 11 | ||||

| Lab equipment |

1,471 | 1,109 | ||||||

| Computer hardware |

26 | 26 | ||||||

| Leasehold improvements |

24 | 24 | ||||||

|

|

|

|

|

|||||

| Total property and equipment, gross |

1,535 | 1,170 | ||||||

| Accumulated depreciation and amortization |

(972 | ) | (796 | ) | ||||

|

|

|

|

|

|||||

| Total property and equipment, net |

$ | 563 | $ | 374 | ||||

|

|

|

|

|

|||||

Depreciation expense was $67,000 and $179,000 for the three months and nine months ended March 31, 2021, respectively, and $48,000 and $150,000, respectively, for the same periods in 2020.

8. Trade and other payables

| (US$000) |

March 31, 2021 |

June 30, 2020 |

||||||

| Trade payable |

$ | 1,640 | $ | 282 | ||||

| Accrued license fees |

142 | 54 | ||||||

| Accrued professional fees |

42 | 155 | ||||||

| Other payables |

181 | 250 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 2,005 | $ | 741 | ||||

|

|

|

|

|

|||||

19

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

9. Leases

The Company has entered into an operating lease for office space under an agreement that expires in 2022. The lease requires the Company to pay utilities, insurance, taxes and other operating expenses. The Companys lease does not contain any residual value guarantees or material restrictive covenants.

As of March 31, 2021, the Companys operating lease has a remaining lease term of 1.21 years and a discount rate of 4.67%. The maturities of the operating lease liabilities are as follows:

| (US$000) |

March 31, 2021 |

|||

| 2021 |

$ | 52 | ||

| 2022 |

218 | |||

|

|

|

|||

| Total operating lease payments |

270 | |||

| Less imputed interest |

(8 | ) | ||

|

|

|

|||

| Present value of operating lease liabilities |

$ | 262 | ||

|

|

|

|||

The Company recorded lease liabilities and right-of-use lease assets for the lease based on the present value of lease payments over the expected lease term, discounted using the Companys incremental borrowing rate. Rent expense was $52,000 and $156,000 for the three months and nine months ended March 31, 2021, respectively, and $52,000 and $156,000, respectively, for the same periods in 2020.

10. Stockholders equity

Common Stock

On October 6, 2020, the Company announced the closing of an underwritten public offering of 2,666,644 shares of its common stock at a price to the public of $3.10 per share. The Company also announced that the underwriter fully exercised its over-allotment option to purchase 483,870 additional shares of its common stock at the offering price of $3.10 per share.

Warrants

On October 6, 2020, the Company announced the closing of an underwritten public offering of 559,162 shares of common stock underlying pre-funded warrants initially purchased for $3.09 per share and immediately exercisable at $0.01 per share (Pre-Funded Warrants). All 559,162 Pre-Funded Warrants issued had been exercised as of March 31, 2021.

20

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

The activity related to warrants during for the three and nine months ended March 31, 2021, is summarized as follows:

| Common Stock from Warrants |

Weighted- average Exercise Price (per share) |

|||||||

| Outstanding at July 1, 2020 |

145,424 | $ | 29.48 | |||||

| Granted |

| | ||||||

| Exercised |

| | ||||||

| Forfeited |

(38,326 | ) | 82.50 | |||||

|

|

|

|

|

|||||

| Outstanding and exercisable at September 30, 2020 |

107,098 | $ | 10.50 | |||||

| Granted |

559,162 | 3.09 | ||||||

| Exercised |

(281,581 | ) | 3.10 | |||||

| Forfeited |

| | ||||||

|

|

|

|

|

|||||

| Outstanding and exercisable at December 31, 2020 |

384,679 | $ | 5.15 | |||||

| Granted |

| | ||||||

| Exercised |

(277,581 | ) | 3.10 | |||||

| Forfeited |

| | ||||||

|

|

|

|

|

|||||

| Outstanding and exercisable at March 31, 2021 |

107,098 | $ | 10.50 | |||||

|

|

|

|

|

|||||

Equity Incentive Plan

Employee Share Option Plan

Upon the re-domiciliation, the Company assumed BBLs obligations with respect to the settlement of options that were issued by BBL prior to the re-domiciliation pursuant to the Benitec Officers and Employees Share Option Plan (the Share Option Plan). This includes the Companys assumption of the Share Option Plan and all award agreements pursuant to which each of the options were granted. Each option when exercised entitles the option holder to one share in the Company. Options are exercisable on or before an expiry date, do not carry any voting or dividend rights and are not transferable except on death of the option holder or in certain other limited circumstances. Employee options vest one third on each anniversary of the applicable grant date for three years. If an employee dies, retires or otherwise leaves the Company and certain exercise conditions have been satisfied, generally, the employee has 12 months to exercise their options or the options are cancelled. After the re-domiciliation, no new options have been or will be issued under the Share Option Plan.

Equity and Incentive Compensation Plan

On December 9, 2020, the Companys stockholders approved the Companys 2020 Equity and Incentive Compensation Plan (the 2020 Plan). The 2020 Plan provides for the grant of various equity awards. Currently, only stock options are outstanding under the 2020 Plan. Each option when exercised entitles the option holder to one share of the Companys common stock. Options are exercisable on or before an expiry date, do not carry any voting or dividend rights, and are not transferable except on death of the option holder or in certain other limited circumstances. Employee stock options vest in increments of one-third on each anniversary of the applicable grant date for three years. Non-employee director options vest in increments of one-third on the day prior to each of the Companys next three annual stockholder meetings following the grant date. If an option holder dies or terminates employment or service due to Disability (as defined in the 2020 Plan) and certain exercise conditions have been satisfied, generally, the option holder has 12 months to exercise their options or the options are cancelled. If an option holder otherwise leaves the Company, other than for a termination by the Company for Cause (as defined in the 2020 Plan) and certain exercise conditions have been satisfied, generally, the option holder has 90 days to exercise their options or the options are cancelled. Any future equity grants will be made under the 2020 Plan.

21

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

Equity Awards

The activity related to equity awards, which comprised of stock options during the three and nine months ended March 31, 2021, is summarized as follows:

| Stock Options |

Weighted- average Exercise Price |

Weighted- average Remaining Contractual Term |

Aggregate Intrinsic Value |

|||||||||||||

| Outstanding at June 30, 2020 |

70,154 | $ | 60.42 | 2.89 years | $ | | ||||||||||

| Granted |

| | ||||||||||||||

| Exercised |

| | ||||||||||||||

| Forfeited |

(444 | ) | 69.32 | |||||||||||||

|

|

|

|

|

|||||||||||||

| Outstanding at September 30, 2020 |

69,710 | $ | 60.00 | 2.65 years | | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Granted |

525,547 | 2.98 | 9.95 years | |||||||||||||

| Exercised |

| | ||||||||||||||

| Forfeited |

(7,967 | ) | 153.78 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Outstanding at December 31, 2020 |

587,290 | 7.64 | 9.2 years | | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Outstanding at March 31, 2021 |

587,290 | 7.64 | 8.9 years | | ||||||||||||

| Exercisable at March 31, 2021 |

41,686 | $ | 47.34 | 2.3 years | $ | | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Share-Based Compensation Expense

The classification of share-based compensation expense is summarized as follows:

|

Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||

| (US$000) |

2021 | 2020 | 2021 | 2020 | ||||||||||||

| Research and development |

$ | 18 | $ | 18 | $ | 33 | $ | 53 | ||||||||

| General and administrative |

217 | 70 | 322 | 127 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total share-based compensation expense |

$ | 235 | $ | 88 | $ | 355 | $ | 180 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

As of March 31, 2021, there was $1,159,000 of unrecognized share-based compensation expense related to stock options issued under the Share Option Plan and the 2020 Plan.

22

Table of Contents

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

11. Income taxes

For the three and nine months ended March 31, 2021, and 2020, the Company did not recognize a provision or benefit for income taxes as it has incurred net losses. In addition, the net deferred tax assets generated from net operating losses are fully offset by a valuation allowance as the Company believes it is more likely than not that the benefit will not be realized.

12. Commitments and contingencies

Contract commitments

The Company enters into contracts in the normal course of business with third-party contract research organizations, contract development and manufacturing organizations and other service providers and vendors. These contracts generally provide for termination on notice and, therefore, are cancellable contracts and not considered contractual obligations and commitments.

Contingencies

From time to time, the Company may become subject to claims and litigation arising in the ordinary course of business. The Company is not a party to any material legal proceedings, nor is it aware of any material pending or threatened litigation.

13. Subsequent events

On April 30, 2021, the Company closed an underwritten, firm commitment public offering of 3,036,366 shares of the Companys common stock at a public offering price of $4.25 per share resulting in gross proceeds to the Company of approximately $12.9 million. In addition, the Company granted the underwriter an option for a period of 30 days to purchase up to an additional 455,454 shares of the Companys common stock at the public offering price. On May 11, 2021, the underwriter partially exercised the overallotment option by purchasing 317,274 shares resulting in approximately $1.35 million of additional gross proceeds to the Company. The Company intends to use the net proceeds from this offering for the continued advancement of development activities for its product pipeline, general corporate purposes, and strategic growth opportunities.

23

Table of Contents

| Item 2. | Managements Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion and analysis of financial condition and operating results together with our consolidated financial statements and the related notes and other financial information included elsewhere in this document.

Overview

We endeavor to become the leader in discovery, development, and commercialization of therapeutic agents capable of addressing significant unmet medical needs via the application of the silence and replace approach to the treatment of genetic disorders.

Benitec Biopharma Inc. (Benitec or the Company or in the third person, we or our) is a development-stage biotechnology company focused on the advancement of novel genetic medicines with headquarters in Hayward, California. The proprietary platform, called DNA-directed RNA interference, or ddRNAi, combines RNA interference, or RNAi, with gene therapy to create medicines that facilitate sustained silencing of disease-causing genes following a single administration. The Company is developing ddRNAi-based therapeutics for chronic and life-threatening human conditions including Oculopharyngeal Muscular Dystrophy (OPMD), and Chronic Hepatitis B.

BB-301 is the most advanced ddRNAi-based genetic medicine currently under development by Benitec. BB-301 is an internally optimized, AAV-based gene therapy agent that is designed to both silence the expression of mutated, disease-causing genes (to slow, or halt, the underlying mechanism of disease progression) and replace the mutant genes with normal, wild type genes (to drive restoration of function in diseased cells). This fundamental approach to disease management is called silence and replace and this biological mechanism offers the potential to restore the underlying physiology of the treated tissues and, in the process, improve treatment outcomes for patients suffering from the chronic and, potentially, fatal effects of Oculopharyngeal Muscular Dystrophy (OPMD). BB-301 has been granted Orphan Drug Designation in the United States and the European Union.

Through the combination of the targeted gene silencing effects of RNAi and the durable transgene expression achievable via the use of modified viral vectors, the silence and replace approach has the potential to produce long-term silencing of disease-causing genes along with simultaneous replacement of wild type gene function following a single administration of the proprietary genetic medicine. We believe this novel attribute of the investigational agents under development by Benitec may facilitate the achievement of robust clinical activity while greatly reducing the dosing frequencies traditionally expected for medicines employed for the management of chronic diseases. Additionally, the establishment of chronic gene silencing and gene replacement may significantly reduce the risk of patient non-compliance during the course of medical management of potentially fatal clinical disorders.

Unless otherwise indicated, all dollar amounts in this section are provided in thousands.

Re-domiciliation

On April 15, 2020, (the Implementation Date), the re-domiciliation of Benitec Biopharma Limited (the Re-domiciliation), a public company incorporated under the laws of the State of Western Australia, or BBL, was completed in accordance with the Scheme Implementation Agreement, as amended and restated as of January 30, 2020, between BBL and us. As a result of the Re-domiciliation, the jurisdiction of incorporation was changed from Australia to Delaware, and BBL became our wholly owned subsidiary.

The Re-domiciliation was effected pursuant to a statutory scheme of arrangement under Australian law, or the Scheme, whereby on the Implementation Date, all of the issued and outstanding ordinary shares of BBL were exchanged for newly issued shares of our common stock, on the basis of one share of our common stock, par value $0.0001 per share, for every 300 ordinary shares of BBL issued and outstanding. Holders of BBLs American Depository Shares, or ADSs (each of which represented 200 ordinary shares), received two shares of our common stock for every three ADSs held.

24

Table of Contents

COVID-19

In December 2019, an outbreak of a novel strain of coronavirus was identified in Wuhan, China. This virus continues to spread globally, has been declared a pandemic by the World Health Organization and has spread to nearly every country, including Australia and the United States. The impact of this pandemic has been and will likely continue to be extensive in many aspects of society, which has resulted in and will likely continue to result in significant disruptions to businesses and capital markets around the world. The extent to which the coronavirus impacts us will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions to contain the coronavirus or treat its impact, among others.

Certain of our research and development efforts are conducted globally, including the ongoing development of our silence and replace therapeutic for the treatment of Oculopharyngeal Muscular Dystrophy (OPMD), and will be dependent upon our ability to initiate preclinical and clinical studies despite the ongoing COVID-19 pandemic. As we continue to actively advance our preclinical programs, including our ongoing tissue transduction studies for BB-301, we are in close contact with our principal investigators and preclinical trial sites, which are primarily located in the France, and are assessing the impact of COVID-19 on our studies and the expected development timelines and costs of all of our product candidates, on an ongoing basis. In light of recent developments relating to the COVID-19 global pandemic, the focus of healthcare providers and hospitals on fighting the virus, and consistent with the FDAs updated industry guidance for conducting clinical trials issued on March 18, 2020, we have experienced delays to the original timeline regarding the initiation and anticipated completion of the ongoing BB-301 IND-enabling development work. The initiation of the BB-301 tissue transduction study, which represents a key component of the IND-enabling work, was delayed by several months, however, the study has been recently initiated and the dosing of the initial preclinical cohorts has proceeded without incident. We will continue to evaluate the impact of the COVID-19 pandemic on our business and expect to reevaluate the timing of our anticipated preclinical and clinical milestones as we learn more and the impact of COVID-19 on our industry becomes more clear.

We had also implemented work-from-home measures for some of our employees between March 2020 and March 2021, resulting in a reduction of laboratory work and a halt of non-essential business travel. As we transition our employees back to our premises, there is a risk that COVID-19 infections occur at our offices or laboratory facilities and significantly affect our operations. Additionally, if any of our critical vendors are impacted, our business could be affected if we become unable to timely procure essential equipment, supplies or services in adequate quantities and at acceptable prices.

Axovant Termination

Benitecs License and Collaboration Agreement, dated July 9, 2018, with Axovant Sciences GmbH, or Axovant, was terminated as of September 3, 2019. As a result, all rights and licenses which Benitec had granted to Axovant to develop and commercialize BB-301 and related gene therapy product candidates terminated.

Prior to such termination, the Benitec team endeavored to conduct several additional exploratory nonclinical analyses in order to potentially improve the biological efficacy of BB-301 via further optimization of the route of administration employed to dose the target muscle tissues.

Nonclinical data derived from in vivo evaluations of BB-301 in two distinct large animal species suggested the existence of an opportunity to further improve the biological efficacy of the compound via additional optimization of the proprietary delivery method employed to dose key target tissues that underlie the morbidity and mortality associated with the natural history of OPMD. The initial biological efficacy profile observed for BB-301 following in vivo testing in the A17 mouse model of OPMD, including full correction of the disease phenotype, remained unchanged. However, the Benitec management team desired to complete a series of exploratory analyses prior to the formal IND filing and the subsequent initiation of clinical testing.

Completion of the experimental work noted above would have delayed the initiation of the BB-301 clinical study beyond the timelines that were initially outlined by Axovant following the execution of the License and Collaboration Agreement between Benitec and Axovant. As such, Axovant elected to terminate the License and Collaboration Agreement between Benitec and Axovant, and all rights and licenses granted to Axovant terminated, including the rights to BB-301, which was in preclinical development for the treatment of OPMD, and all other early stage research collaboration programs that were governed by the agreement.

25

Table of Contents

Nonclinical Programs

Our Pipeline

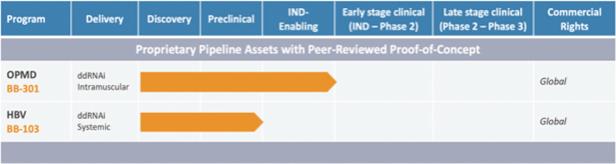

The following table sets forth our current product candidates and their development status:

Table 1. Pipeline: Oculopharyngeal Muscular Dystrophy and Chronic Hepatitis B Virus Infection

BB-301

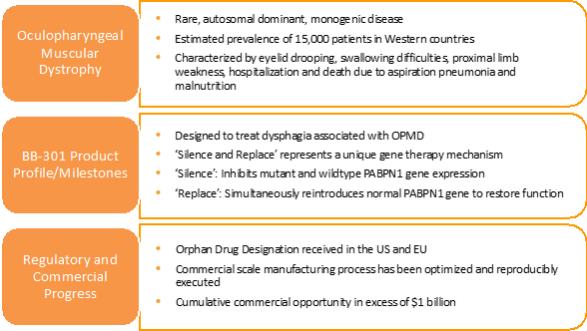

BB-301 is a late-stage nonclinical investigational agent currently in development for the treatment of Oculopharyngeal Muscular Dystrophy. BB-301 is the lead pipeline program for Benitec, and IND-enabling studies are currently being conducted. A summary of the BB-301 program is provided in Figure 3.

Figure 3. Overview of the BB-301 Program

26

Table of Contents

BB-301 is a first-in-class genetic medicine employing the silence and replace approach for the treatment of OPMD. OPMD is a chronic, life-threatening genetic disorder affecting approximately 15,000 patients in the United States, Canada, Western Europe, and Israel. OPMD is caused by a mutation in the gene encoding poly(A) binding protein nuclear 1 (PABPN1). Patients with OPMD lose the ability to swallow liquids and solids, and the natural history of the disorder is characterized by chronic malnutrition, aspiration, and fatal episodes of aspiration pneumonia.

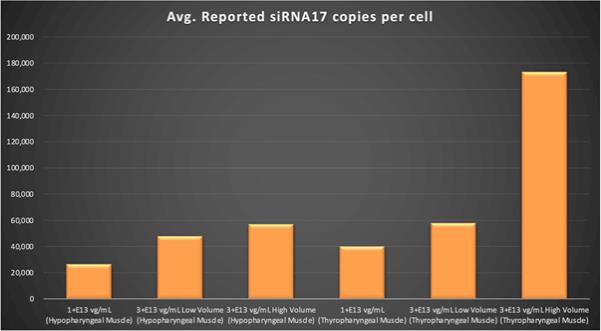

Currently, no therapeutic agents are approved for the treatment of OPMD. Additionally, no surgical interventions capable of altering the long-term natural history of OPMD are available. BB-301 has received Orphan Drug Designation in the United States and the European Union which provides commercial exclusivity independent of intellectual property protection. While OPMD is a rare disorder, we believe the commercial opportunity for a safe and efficacious therapeutic agent in this clinical indication exceeds $1 billion over the course of the commercial life of the product.