10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on May 16, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2022

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission File Number 001-39267

(Exact name of registrant as specified in its charter)

-0206 |

||

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

(Address of principal executive offices & zip code)

(510 ) 780-0819

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation Yes ☒ No ☐

S-T

(§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2

of the Exchange Act. | Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer |

☒ | Smaller reporting company | ||||

| Emerging growth company | ||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule ☒

12b-2

of the Exchange Act). Yes ☐ or No We had 8,171,690 shares of our common stock outstanding as of the close of business on May

16

, 2022. BENITEC BIOPHARMA INC.

INDEX TO FORM

10-Q

| 2 | ||||||

| 3 | ||||||

| 3 | ||||||

| 3 | ||||||

| 4 | ||||||

| 5 | ||||||

| 7 | ||||||

| 8 | ||||||

| 17 | ||||||

| 32 | ||||||

| 32 | ||||||

| 33 | ||||||

| 33 | ||||||

| 33 | ||||||

| 33 | ||||||

| 33 | ||||||

| 33 | ||||||

| 33 | ||||||

| 34 | ||||||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Our forward-looking statements relate to future events or our future performance and include, but are not limited to, statements concerning our business strategy, future commercial revenues, market growth, capital requirements, new product introductions, expansion plans and the adequacy of our funding. All statements, other than statements of historical fact included in this Report, are forward-looking statements. When used in this Report, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project,” or the negative of these terms, and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following:

| • | the success of our plans to develop and potentially commercialize our product candidates; |

| • | the timing of the initiation and completion of preclinical studies and clinical trials; |

| • | the timing and sufficiency of patient enrollment and dosing in any future clinical trials; |

| • | the timing of the availability of data from clinical trials; |

| • | the timing and outcome of regulatory filings and approvals; |

| • | unanticipated delays; |

| • | sales, marketing, manufacturing and distribution requirements; |

| • | market competition and the acceptance of our products in the marketplace; |

| • | regulatory developments in the United States of America; |

| • | the development of novel AAV vectors; |

| • | the plans of licensees of our technology; |

| • | the clinical utility and potential attributes and benefits of ddRNAi and our product candidates, including the potential duration of treatment effects and the potential for a “one shot” cure; |

| • | our dependence on our relationships with collaborators and other third parties; |

| • | expenses, ongoing losses, future revenue, capital needs and needs for additional financing, and our ability to access additional financing given market conditions and other factors, including our capital structure; |

| • | the length of time over which we expect our cash and cash equivalents to be sufficient to execute on our business plan; |

| • | our intellectual property position and the duration of our patent portfolio; |

| • | the impact of local, regional, and national and international economic conditions and events; and |

| • | the impact of the current COVID-19 pandemic, the disease caused by the SARS-CoV-2 |

as well as other risks detailed under the caption “Risk Factors” in this Report and in other reports filed with the SEC. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Report, we caution you that these statements are based on a combination of facts and important factors currently known by us and our expectations of the future, about which we cannot be certain. We have based the forward-looking statements included in this Report on information available to us on the date of this Report or on the date thereof. Except as required by law we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we may make directly to you or through reports that we, in the future, may file with the SEC, including annual reports on Form

10-K,

quarterly reports on Form 10-Q

and current reports on Form 8-K.

All forward-looking statements included herein or in documents incorporated herein by reference are expressly qualified in their entirety by the cautionary statements contained or referred to elsewhere in this Report.

2

PART I—FINANCIAL INFORMATION

ITEM 1. Financial Statements

BENITEC BIOPHARMA INC.

Consolidated Balance Sheets

(in thousands, except par value and share amounts)

March 31, |

June 30, |

|||||||

2022 |

2021 |

|||||||

(Unaudited) |

||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | $ | ||||||

| Trade and other receivables |

||||||||

| Prepaid and other assets |

||||||||

| |

|

|

|

|||||

| Total current assets |

||||||||

| Property and equipment, net |

||||||||

| Deposits |

||||||||

| Other assets |

||||||||

| Right-of-use |

||||||||

| |

|

|

|

|||||

| Total assets |

$ | $ | ||||||

| |

|

|

|

|||||

| Liabilities and Stockholders’ Equity |

||||||||

| Current liabilities: |

||||||||

| Trade and other payables |

$ | $ | ||||||

| Accrued employee benefits |

||||||||

| Lease liabilities, current portion |

||||||||

| |

|

|

|

|||||

| Total current liabilities |

||||||||

| Lease liabilities, less current portion |

|

|||||||

| |

|

|

|

|||||

| Total liabilities |

||||||||

| |

|

|

|

|||||

| Commitments and contingencies (Note 10) |

|

|

||||||

| Stockholders’ equity: |

||||||||

| Common stock, $ value- shares authorized; |

||||||||

| Additional paid-in capital |

||||||||

| Accumulated deficit |

( |

) | ( |

) | ||||

| Accumulated other comprehensive loss |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total stockholders’ equity |

||||||||

| |

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | $ | ||||||

| |

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements.

3

BENITEC BIOPHARMA INC.

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(in thousands, except share and per share amounts)

Three Months Ended |

Nine Months Ended |

|||||||||||||||

March 31, |

March 31, |

|||||||||||||||

2022 |

2021 |

2022 |

2021 |

|||||||||||||

| Revenue: |

||||||||||||||||

| Licensing revenues from customers |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total revenues |

||||||||||||||||

| Operating expenses |

||||||||||||||||

| Royalties and license fees |

|

|

||||||||||||||

| Research and development |

||||||||||||||||

| General and administrative |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Other income (loss): |

||||||||||||||||

| Foreign currency transaction gain (loss) |

( |

) | ( |

) | ||||||||||||

| Interest expense, net |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Other income (expense), net |

( |

) |

|

( |

) | |||||||||||

| Unrealized loss on investment |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total other income (loss), net |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| |

|

|

|

|

|

|

|

|||||||||

| Other comprehensive income: |

||||||||||||||||

| Unrealized foreign currency translation (loss) gain |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total other comprehensive (loss) income |

( |

) | ( |

) | ( |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total comprehensive loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss per share: |

||||||||||||||||

| Basic and diluted |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| |

|

|

|

|

|

|

|

|||||||||

| Weighted average number of shares outstanding: basic and diluted |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

BENITEC BIOPHARMA INC.

Consolidated Statements of Stockholders’ Equity

(Unaudited)

(in thousands, except share amounts)

Common Stock |

Additional Paid-in

Capital |

Accumulated Deficit |

Accumulated Other Comprehensive Loss |

Total Stockholders’ Equity |

||||||||||||||||||||

Shares |

Amount |

|||||||||||||||||||||||

| Balance at June 30, 2020 |

$ | $ | $ | ( |

) | $ | ( |

) | $ | |||||||||||||||

| Share-based compensation |

— | — | — | — | ||||||||||||||||||||

| Forfeiture of share-based payments |

— | — | ( |

) | — | — | ||||||||||||||||||

| Foreign currency translation gain |

— | — | — | — | ||||||||||||||||||||

| Net loss |

— | — | — | ( |

) | ( |

) | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at September 30, 2020 |

( |

) | ( |

) | ||||||||||||||||||||

| Issuance of common stock and pre-funded warrants sold for cash, net of issuance costs of $ |

— | — | ||||||||||||||||||||||

| Exercise of pre-funded warrants |

— | — | — | — | — | |||||||||||||||||||

| Share-based compensation |

— | — | — | — | ||||||||||||||||||||

| Forfeiture of share-based payments |

— | — | ( |

) | — | — | ||||||||||||||||||

| Foreign currency translation gain |

— | — | — | — | ||||||||||||||||||||

| Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at December 31, 2020 |

( |

) | ( |

) | ||||||||||||||||||||

| Exercise of pre-funded warrants |

— | — | ||||||||||||||||||||||

| Share-based compensation |

— | — | — | — | ||||||||||||||||||||

| Foreign currency translation loss |

— | — | — | — | ( |

) | ( |

) | ||||||||||||||||

| Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at March 31, 2021 |

$ | $ | |

$ | ( |

) | $ | ( |

) | $ | |

|||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

5

BENITEC BIOPHARMA INC.

Consolidated Statements of Stockholders’ Equity

(Unaudited)

(in thousands, except share amounts)

Common Stock |

Additional Paid-in

Capital |

Accumulated Deficit |

Accumulated Other Comprehensive Loss |

Total Stockholders’ Equity |

||||||||||||||||||||

Shares |

Amount |

|||||||||||||||||||||||

| Balance at June 30, 2021 |

$ | $ | $ | ( |

) | $ | ( |

) | $ | |||||||||||||||

| Share-based compensation |

— | — | — | — | ||||||||||||||||||||

| Foreign currency translation gain |

— | — | — | — | ||||||||||||||||||||

| Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at September 30, 2021 |

( |

) | ( |

) | ||||||||||||||||||||

| Share-based compensation |

— | — | — | — | ||||||||||||||||||||

| Foreign currency translation loss |

— | — | — | — | ( |

) | ( |

) | ||||||||||||||||

| Net loss |

— | — | — | ( |

) | — | ( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at December 31, 2021 |

( |

) | ( |

) | ||||||||||||||||||||

| Share-based compensation |

— | — | — | |||||||||||||||||||||

| Foreign currency translation loss |

— | — | — | — | ( |

) | ( |

) | ||||||||||||||||

| Net loss |

— | — | — | ( |

) | ( |

) | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at March 31, 2022 |

$ | $ | |

$ | ( |

) | $ | ( |

) | $ | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

6

BENITEC BIOPHARMA INC.

Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

Nine Months Ended |

||||||||

March 31, |

||||||||

2022 |

2021 |

|||||||

| Cash flows from operating activities: |

||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Depreciation and amortization |

||||||||

| Amortization of right-of-use |

||||||||

| Unrealized loss on investment |

||||||||

| Share-based compensation expense |

||||||||

| Changes in operating assets and liabilities: |

||||||||

| Trade and other receivables |

||||||||

| Other assets |

||||||||

| Trade and other payables |

||||||||

| Accrued employee benefits |

||||||||

| Lease liabilities |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net cash used in operating activities |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchases of property and equipment |

|

( |

) | |||||

| |

|

|

|

|||||

| Net cash used in investing activities |

|

( |

) | |||||

| |

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Proceeds from issues of shares and pre-funded warrants |

|

|||||||

| Shares and pre-funded warrant issuance costs |

|

( |

) | |||||

| |

|

|

|

|||||

| Net cash provided by financing activities |

|

|||||||

| |

|

|

|

|||||

| Effects of exchange rate changes on cash and cash equivalents |

( |

) | ||||||

| |

|

|

|

|||||

| Net increase (decrease) in cash and cash equivalents |

( |

) | ||||||

| Cash and cash equivalents, beginning of period |

||||||||

| |

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | $ | ||||||

| |

|

|

|

|||||

| Supplemental disclosure of cash flow information: |

||||||||

| Re-measurement of operating lease right-of-use |

$ | $ | |

|||||

| |

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements.

7

BENITEC BIOPHARMA INC.

Notes to Consolidated Financial Statements

(Unaudited)

1. Business

Benitec Biopharma Inc. (the “Company”) is a corporation formed under the laws of Delaware, United States of America, on November 22, 2019 and listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “BNTC”. Benitec Biopharma Inc. is the parent entity of a number of subsidiaries including the previous parent entity Benitec Biopharma Limited (“BBL”). BBL was incorporated under the laws of Australia in 1995 and was listed on the Australian Securities Exchange, or ASX, from 1997 until April 15, 2020. On August 14, 2020, BBL reorganized as a Proprietary Limited company and changed its name to Benitec Biopharma Proprietary Limited. The Company’s business focuses on the development of novel genetic medicines. Our proprietary platform, called

DNA-directed

RNA interference, or ddRNAi, combines RNA interference, or RNAi, with gene therapy to create medicines that facilitate sustained silencing of disease-causing genes. During the year ended June 30, 2021, the Company completed an organization restructuring as part of the commercial desire to provide a more efficient structure for the future as the Company transitioned its operations to the

United State

s.

The Company’s fiscal year end is June 30. References to a particular “fiscal year” are to our fiscal year end June 30 of that calendar year.

The consolidated financial statements of Benitec Biopharma Inc. are presented in United States dollars and consist of Benitec Biopharma Inc. and its wholly owned subsidiaries:

Principal place of business/country of incorporation | ||

| Benitec Biopharma Proprietary Limited (“BBL”) |

||

| Benitec Australia Proprietary Limited |

||

| Benitec Limited |

||

| Benitec, Inc. |

||

| Benitec LLC |

||

| RNAi Therapeutics, Inc. |

||

| Tacere Therapeutics, Inc. |

||

| Benitec IP Holdings, Inc. |

2. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation

The Company’s consolidated financial statements contained in this Quarterly Report on Form

Accordingly, certain information and disclosures required by GAAP for annual financial statements have been omitted. In the opinion of management, all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation have been included. Interim financial results are not necessarily indicative of results anticipated for the full year. These consolidated financial statements should be read in conjunction with the Company’s audited financial statements and accompanying notes included in the Company’s Annual Report on Form

10-Q

have been prepared in accordance with generally accepted accounting principles in the U.S. (“GAAP”) for interim financial information and with the instructions to Form 10-Q

and Article 8 of U.S. Securities and Exchange Commission (“SEC”) Regulation

S-X.

10-K

for the year ended June 30, 2021. Reference is frequently made herein to the Financial Accounting Standards Board (the “FASB”) Accounting Standards Codification (“ASC”). This is the source of authoritative GAAP recognized by the FASB to be applied to

non-governmental

entities. Principles of Consolidation

The consolidated financial statements include the Company’s accounts and the accounts of its wholly-owned subsidiaries. All intercompany transactions and balances have been eliminated.

Use of Estimates

The preparation of the Company’s consolidated financial statements requires management to make estimates and assumptions that impact the reported amounts of assets, liabilities and expenses and the disclosure of contingent assets and liabilities in the Company’s consolidated financial statements and accompanying notes. The most significant estimates and assumptions in the Company’s

8

consolidated financial statements include the estimates of useful lives of property and equipment, valuation of the operating lease liability and related asset, allowance for uncollectable receivables, foreign currency translation due to certain average exchange rates applied in lieu of spot rates on transaction dates, and accrued research and development expenses. These estimates and assumptions are based on current facts, historical experience and various other factors believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the recording of expenses that are not readily apparent from other sources. Actual results may differ materially and adversely from these estimates. To the extent there are material differences between the estimates and actual results, the Company’s future results of operations will be affected.

right-of-use

Risks and Uncertainties

The Company is subject to risks and uncertainties common to early-stage companies in the biotechnology industry, including, but not limited to, development by competitors of new technological innovations, protection of proprietary technology, dependence on key personnel, reliance on single-source vendors and collaborators, availability of raw materials, patentability of the Company’s products and processes and clinical efficacy and safety of the Company’s products under development, compliance with government regulations and the need to obtain additional financing to fund operations.

There can be no assurance that the Company’s research and development will be successfully completed, that adequate protection for the Company’s intellectual property will be obtained or maintained, that any products developed will obtain necessary government regulatory approval or that any approved products will be commercially viable. Even if the Company’s product development efforts are successful, it is uncertain when, if ever, the Company will generate significant revenue from product sales. The Company operates in an environment of rapid technological change and substantial competition from other pharmaceutical and biotechnology companies. In addition, the Company is dependent upon the services of its employees, consultants and other third parties.

Moreover, the current

COVID-19

pandemic, which is impacting worldwide economic activity, poses risks that the Company or its employees, contractors, suppliers, and other partners may be prevented or inhibited from conducting business activities for an indefinite period of time which may delay the start-up

and conduct of the Company’s clinical trials, and negatively impact manufacturing and testing activities performed by third parties. Any significant delays may impact the use and sufficiency of the Company’s existing cash reserves, and the Company may be required to raise additional capital earlier than it had previously planned. The Company may be unable to raise additional capital if and when needed, which may result in delays or suspension of its development plans. The extent to which the pandemic will impact the Company’s business will depend on future developments that are highly uncertain and cannot be predicted at this time. Segment Reporting

Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision-maker in making decisions regarding resource allocation and assessing performance. The Company views its operations and manages its business in one operating segment.

Foreign Currency Translation and Other Comprehensive Income (Loss)

The Company’s functional currency and reporting currency is the United States dollar. BBL’s functional currency is the Australian dollar (AUD). Assets and liabilities are translated at the exchange rate in effect at the balance sheet date. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period. Equity transactions are translated at each historical transaction date spot rate. Translation adjustments arising from the use of different exchange rates from period to period are included as a component of stockholders’ equity as “Accumulated other comprehensive loss.” Gains and losses resulting from foreign currency translation are included in the consolidated statements of operations and comprehensive loss as other comprehensive income (loss).

Other comprehensive income for all periods presented includes both foreign currency translation gains and losses.

9

Fair Value Measurements

The Company measures its financial assets and liabilities in accordance with GAAP using ASC 820, For certain financial instruments, including cash and cash equivalents, accounts receivable, and accounts payable, the carrying amounts approximate fair value due to their short maturities.

Fair Value Measurements.

The Company follows accounting guidance for financial assets and liabilities. ASC 820 defines fair value, provides guidance for measuring fair value and requires certain disclosures. The guidance utilizes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The following is a brief description of those three levels:

| Level 1: | Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| Level 2: | Inputs, other than quoted prices that are observable, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active. |

| Level 3: | Unobservable inputs in which little or no market data exists, therefore developed using estimates and assumptions developed by us, which reflect those that a market participant would use. |

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand and at banks, short-term deposits with an original maturity of three months or less with financial institutions, and bank overdrafts. Bank overdrafts are reflected as a current liability on the consolidated balance sheets. There were no cash equivalents as of March 31, 2022 and June 30, 2021.

Concentrations of Risk

Financial instruments that potentially subject the Company to significant concentration of credit risk consist primarily of cash and cash equivalents. The Company maintains deposits at federally insured financial institutions in excess of federally insured limits. The Company has not experienced any losses in such accounts, and management believes that the Company is not exposed to significant credit risk due to the financial position of the depository institutions in which those deposits are held.

Trade and Other Receivables

As amounts become uncollectible, they will be charged to an allowance and operations in the period when a determination of collectability is made. Any estimates of potentially uncollectible customer accounts receivable will be made based on an analysis of individual customer and historical

write-off

experience. The Company’s analysis includes the age of the receivable account, creditworthiness of the customer and general economic conditions. Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation and amortization. Expenditures for maintenance and repairs are expensed as incurred; additions, renewals, and improvements are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation and amortization are removed from the respective accounts, and any gain or loss is included in operations. Depreciation and amortization of property and equipment is calculated using the straight-line basis over the following estimated useful lives:

| Software |

4 | |

| Lab equipment |

7 | |

| Computer hardware |

5 | |

| Leasehold improvements |

Impairment of Long-Lived Assets

Property and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of long-lived assets to be held and used is measured by a comparison of the carrying amount of an asset to the estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated undiscounted future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the assets. Fair value is generally determined using the asset’s expected future discounted cash flows or market value, if readily determinable.

10

Trade and other payables

These amounts represent liabilities for goods and services provided to the Company prior to the end of the period and which are unpaid. Due to their short-term nature, they are measured at amortized cost and are not discounted. The amounts are unsecured and are usually paid within 30 days of recognition.

Leases

At lease commencement, the Company records a lease liability based on the present value of lease payments over the expected lease term. The Company calculates the present value of lease payments using the discount rate implicit in the lease, unless that rate cannot be readily determined. In that case, the Company uses its incremental borrowing rate, which is the rate of interest that the Company would have to pay to borrow on a collateralized basis an amount equal to the lease payments over the expected lease term. The Company records a corresponding lease asset based on the lease liability, adjusted for any lease incentives received and any initial direct costs paid to the lessor prior to the lease commencement date.

right-of-use

After lease commencement, the Company measures its leases as follows: (i) the lease liability based on the present value of the remaining lease payments using the discount rate determined at lease commencement; and (ii) the lease asset based on the remeasured lease liability, adjusted for any unamortized lease incentives received, any unamortized initial direct costs and the cumulative difference between rent expense and amounts paid under the lease agreement. Any lease incentives received and any initial direct costs are amortized on a straight-line basis over the expected lease term. Rent expense is recorded on a straight-line basis over the expected lease term.

right-of-use

Basic and Diluted Net Loss Per Share

Basic net loss per share is calculated by dividing net loss by the weighted-average number of common shares outstanding during the period. Diluted net loss per share is calculated by dividing net loss by the weighted-average number of common shares outstanding plus potential common shares. Stock options, warrants and convertible instruments are considered potential common shares and are included in the calculation of diluted net loss per share using the treasury stock method when their effect is dilutive. Potential common shares are excluded from the calculation of diluted net income (loss) per share when their effect is anti-dilutive. As of March 31, 2022, and June 30, 2021, there were 845,159 and 809,159 potential common shares, respectively, that were excluded from the calculation of diluted net loss per share because their effect was anti-dilutive.

Revenue Recognition

The Company recognizes revenue in accordance with that core principle by applying the following steps:

Step 1: Identify the contract(s) with a customer.

Step 2: Identify the performance obligations in the contract.

Step 3: Determine the transaction price.

Step 4: Allocate the transaction price to the performance obligations in the contract.

Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation.

The Company applies judgement in determining whether contracts entered into fall within the scope of ASC 606— (“ASC 606”). In doing so, management considers the commercial substance of the transaction and how risks and benefits of the contract accrue to the various parties to the contract.

Revenue from Contracts with Customers

Management has also made the judgement that the grant of the license and transfer of associated

know-how

and materials are accounted for as one performance obligation as they are not considered to be distinct; they are highly interrelated and could not provide benefits to the customer independently from each other. Judgements were made in relation to the transfer of the license and know-how

and whether this should be recognized over time or a point in time. The point in time has been determined with regard to the point at which the transfer of know-how

has substantially been completed and the customer has control of the asset and the ability to direct the use of and receive substantially all of the remaining benefits. Licensing revenues

Revenue from licensees of the Company’s intellectual property reflects the transfer of a right to use the intellectual property as it exists at the point in time in which the license is transferred to the customer. Consideration can be variable and is estimated using the most likely amount method and is constrained to the extent that it is probable that a significant reversal will not occur. Revenue is recognized as or when the performance obligations are satisfied.

11

The Company recognizes contract liabilities for consideration received in respect of unsatisfied performance obligations and reports these amounts as other liabilities in the consolidated balance sheet. Similarly, if the Company satisfies a performance obligation before it receives the consideration, the Company recognizes either a contract asset or a receivable in its consolidated balance sheet, depending on whether something other than the passage of time is required before the consideration is due.

Royalties

Revenue from licensees of the Company’s intellectual property reflect a right to use the intellectual property as it exists at the point in time in which the license is granted. Where consideration is based on sales of product by the licensee, revenue is recognized when the customer’s subsequent sales of products occur.

Services revenue

Revenue is earned (constrained by variable considerations) from the provision of research and development services to customers. Services revenue is recognized when performance obligations are either satisfied over time or at a point in time. Generally, the provision of research and development services under a contract with a customer will represent satisfaction of a performance obligation over time where the Company retains the right to payment for services performed but not yet completed.

Research and Development Expense

Research and development costs are expensed when incurred. Research and development expenses relate primarily to the cost of conducting clinical and

pre-clinical

trials. Pre-clinical

and clinical development costs are a significant component of research and development expenses. Estimates have been used in determining the expense liability under certain clinical trial contracts where services have been performed but not yet invoiced. Generally, the costs, and therefore estimates, associated with clinical trial contracts are based on the number of patients, drug administration cycles, the type of treatment and the outcome since the length of time before actual amounts can be determined will vary depending on length of the patient cycles and the timing of the invoices by the clinical trial partners. Share-based Compensation Expense

The Company records share-based compensation in accordance with ASC 718, . ASC 718 requires the fair value of all share-based compensation awarded to employees and

Stock Compensation

non-employees

to be recorded as an expense over the shorter of the service period or the vesting period. The Company determines employee and non-employee

share-based compensation based on the grant-date fair value using the Black-Scholes Option Pricing Model. Income Taxes

The Company is subject to Australia and United States income tax laws. The Company follows ASC 740 , when accounting for income taxes, which requires an asset and liability approach to financial accounting and reporting for income taxes. Deferred income tax assets and liabilities are computed annually for temporary differences between the financial statements and tax bases of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount more likely than not to be realized.

Accounting for Income Taxes

For uncertain tax positions that meet a “more likely than not” threshold, the Company recognizes the benefit of uncertain tax positions in the consolidated financial statements. The Company’s practice is to recognize interest and penalties, if any, related to uncertain tax positions in income tax expense in the consolidated statements of operations.

Recent Accounting Pronouncements

In June 2016, the FASB issued ASU (Topic 326). This ASU represents a significant change in the accounting for credit losses model by requiring immediate recognition of management’s estimates of current expected credit losses (CECL). Under the prior model, losses were recognized only as they were incurred. The Company has determined that it has met the criteria of a smaller reporting company (“SRC”) as of November 15, 2019. As such, ASU amended the effective date for the Company to be for reporting periods beginning after December 15, 2022. The Company will adopt this ASU effective July 1, 2023.

No. 2016-13:

Financial Instruments—Credit Losses

2019-10:

Financial Instruments-Credit Losses, Derivatives and Hedging, and Leases: Effective Dates

3. Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. For the nine months ended March 31, 2022, and 2021, the Company incurred a net loss of $13.1 million and $9.9 million and used net cash of $11.0 million and $7.7 million in operations, respectively. The Company expects to continue to incur additional operating losses in the foreseeable future.

12

The Company’s business focuses on the development of novel genetic medicines and, at this stage in the Company’s development, the Company has not established a source of revenue to cover its full operating costs, and as such, is dependent on funding operations through capital financing activitiesAs of March 31, 2022, the Company had $8.6 million in cash and cash equivalents. The Company does not have adequate liquidity to fund its operations for the next 12 months without raising additional funds and the success of raising such additional capital is not solely within the control of the Company. These factors raise substantial doubt about its ability to continue as a going concern.

.

The financial statements do not include any adjustments that might result from the outcome of this condition. If the Company is unable to raise additional funds, or the Company’s anticipated operating results are not achieved, management believes planned expenditures may need to be reduced or delayed in order to extend the time period that existing resources can fund the Company’s operations. The Company intends to fund ongoing activities by utilizing its current cash on hand and by raising additional capital. If the Company is unable to obtain the necessary capital, it may have a material adverse effect on the operations of the Company and the development of its technology (including delaying certain development milestones), or the Company may have to cease operations altogether

.

4. Prepaid and other assets

(US$’000) |

March 31, 2022 |

June 30, 2021 |

||||||

Prepaid expenses |

$ | $ | ||||||

Security deposit |

||||||||

Market value of listed shares |

||||||||

Total other assets |

||||||||

Less: non-current portion |

( |

) | ( |

) | ||||

Current portion |

$ | $ | ||||||

5. Property and equipment, net

(US$’000) |

March 31, 2022 |

June 30, 2021 |

||||||

Software |

$ | $ | ||||||

Lab equipment |

||||||||

Computer hardware |

||||||||

Leasehold improvements |

||||||||

Total property and equipment, gross |

||||||||

Accumulated depreciation and amortization |

( |

) | ( |

) | ||||

Total property and equipment, net |

$ | $ | ||||||

Depreciation expense was $54 thousand and $161 thousand for the three and nine months ended March 31, 2022, and $67 thousand and $179 thousand, respectively, for the same periods in 2021.

6. Trade and other payables

(US$’000) |

March 31, 2022 |

June 30, 2021 |

||||||

Trade payable |

$ | $ | ||||||

Accrued license fees |

||||||||

Accrued professional fees |

||||||||

Accrued research and development |

||||||||

Other payables |

||||||||

Total |

$ | $ | ||||||

13

7. Leases

The Company has entered into an operating lease for office space under an agreement that expires in 2022. The lease requires the Company to pay utilities, insurance, taxes and other operating expenses. The Company’s lease does not contain any residual value guarantees or material restrictive covenants. During August 2021, the Company extended the lease through June 2025 .

The tables below show the changes during the nine months ended March 31,

2022

: (US$’000) |

Operating lease right-of-

use assets |

|||

Balance at July 1, 2021 |

$ | |||

Re-measurement during the period |

||||

Amortization of right of use asset |

( |

) | ||

Operating lease right-of-use |

$ | |||

(US$’000) |

Operating lease liabilities |

|||

Balance at July 1, 2021 |

$ | |||

Re-measurement during the period |

||||

Principal payments on operating lease liabilities |

( |

) | ||

Operating lease liabilities at March 31, 2022 |

||||

Less: non-current portion |

( |

) | ||

Current portion at March 31, 2022 |

$ | |||

As of March 31, 2022, the Company’s operating lease has a remaining lease term of 3.21 years and a discount rate of 4.67 %. The maturities of the operating lease liabilities are as follows:

(US$’000) |

March 31, 202 2

|

|||

2022 |

$ |

|||

2023 |

||||

2024 |

||||

2025 |

||||

Total operating lease payments |

||||

Less imputed interest |

( |

) | ||

Present value of operating lease liabilities |

$ | |||

The Company recorded lease liabilities and lease assets for the lease based on the present value of lease payments over the expected lease term, discounted using the Company’s incremental borrowing rate. Rent expense was $0.1 million and $0.2 million for the three and nine months ended March 31, 2022, respectively, and $0.1 million and $0.2 million, respectively, for the same periods in 2021.

right-of-use

8. Stockholders’ equity

Common Stock

On October 6, 2020, the Company announced the closing of an underwritten public offering of 2,666,644 shares of its common stock at a price to the public of $3.10 per share. The Company also announced that the underwriter fully exercised its over-allotment option to purchase 483,870 additional shares of its common stock at the offering price of $3.10 per share. The gross and net proceeds were $11.5 million and $9.9 million, respectively.

On April 30, 2021, the Company announced the closing of an underwritten public offering of 3,036,366 shares of its common stock at a price to the public of $4.25 per share. The Company also announced that the underwriter exercised the over-allotment option to purchase 317,274 additional shares of its common stock at the offering price of $4.25 per share. The gross and net proceeds were $14.3 million and $12.7 million, respectively.

14

On December 8, 2021, the stockholders of the Company approved an amendment (the “Charter Amendment”) to the Company’s Amended and Restated Certificate of Incorporation to increase the total number of authorized shares of common stock of the Company from 10,000,000 to 40,000,000 . The Charter Amendment was filed with the Secretary of State of the State of Delaware and became effective on December 17, 2021.

Warrants

On December 6, 2019, the Investors were issued 4 Purchase Warrants that were exercisable into 214,190 fully paid shares of common stock should the Purchase Warrants be exercised in full (“Purchase Warrants”). The exercise price for the Purchase Warrants is US$10.50 per share issued on exercise of a Purchase Warrant. The Purchase Warrants are exercisable, in whole or in part, any time from the date of issue until the anniversary of the date of issue (December 6, 2024 ). On April 22, 2020, the Company issued 37,417 shares of common stock in connection with a cashless exercise of Purchase Warrants exercisable for 107,095 shares of common stock. The Company did not have an effective registration statement registering the resale of the Warrant Shares by the Holder at the time the Holder wanted to exercise the warrant, therefore, the Holder carried out a cashless exercise. The formula for conducting a cashless exercise was outlined in the Warrant agreement. Based on this formula, the Holder would have been entitled to receive 107,095 shares of common stock if they had exercised the Purchase Warrants for cash. Because of the cashless exercise, the holder received 37,417 shares. As of March 31, 2022, there were 107,095 of the warrants still outstanding.

On October 6, 2020, the Company announced the closing of an underwritten public offering of 559,162 shares of common stock underlying 3.09 per share and immediately exercisable at $0.01 per share 559,162

pre-funded

warrants initially purchased for $(“Pre-Funded

Warrants”). All Pre-Funded

Warrants issued had been exercised as of June 30, 2021. The activity related to warrants during for the

nine

months ended March 31, 2022, is summarized as follows: | Common Stock from Warrants |

Weighted- average Exercise Price (per share) |

|||||||

| Outstanding at July 1, 2021 |

$ | |||||||

| |

|

|

|

|||||

| Outstanding and exercisable at March 31, 2022 |

$ | |||||||

Equity Incentive Plan

Employee Share Option Plan

In connection with its

re-domiciliation

to the United States, the Company assumed BBL’s obligations with respect to the settlement of options that were issued by BBL prior to the re-domiciliation

pursuant to the Benitec Officers’ and Employees’ Share Option Plan (the “Share Option Plan”). This includes the Company’s assumption of the Share Option Plan and all award agreements pursuant to which each of the options were granted. Each option when exercised entitles the option holder to one share in the Company. Options are exercisable on or before an expiry date, do not carry any voting or dividend rights and are not transferable except on death of the option holder or in certain other limited circumstances. Employee options vest one third on each anniversary of the applicable grant date for three years. If an employee dies, retires or otherwise leaves the Company and certain exercise conditions have been satisfied, generally, the employee has 12 months to exercise their options or the options are cancelled. Since the re-domiciliation,

no new options have been or will be issued under the Share Option Plan. Equity and Incentive Compensation Plan

On December 9, 2020, the Company’s stockholders approved the Company’s 2020 Equity and Incentive Compensation Plan and, on December 8, 2021, the Company’s stockholders approved an amendment to increase the maximum number of shares that may be issued under such plan to 1,850,000 (as amended, the “2020 Plan”). The 2020 Plan provides for the grant of various equity awards. Currently, only stock options are issued under the 2020 Plan. Each option when exercised entitles the option holder to one share of the Company’s common stock. Options are exercisable on or before an expiry date, do not carry any voting or dividend rights, and are not transferable except on death of the option holder or in certain other limited circumstances. Employee stock options vest in increments of

one-third

on each anniversary of the applicable grant date for three years. Non-employee

director options vest in increments of one-third

on the day prior to each of the Company’s next three annual stockholder meetings following the grant date. If an option holder dies or terminates employment or service due to Disability (as defined in the 2020 Plan) and certain exercise conditions have been satisfied, generally, the option holder has 12 months to exercise their options or the options are cancelled. If an option holder 15

otherwise leaves the Company, other than for a termination by the Company for Cause (as defined in the 2020 Plan) and certain exercise conditions have been satisfied, generally, the option holder has 90 days to exercise their options or the options are cancelled. Future equity grants will be made under the 2020 Plan.

Equity Awards

The activity related to equity awards, which are comprised of stock options during the nine months ended March 31, 2022 is summarized as follows:

| Stock Options |

Weighted- average Exercise Price |

Weighted- average Remaining Contractual Term |

Aggregate Intrinsic Value |

|||||||||||||

| Outstanding at July 1, 2021 |

$ |

|

$ | — | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding at September 30, 2021 |

|

$ | — | |||||||||||||

| Granted |

|

$ | — | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding at March 31, 2022 |

|

$ | — | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exercisable at March 31, 2022 |

$ |

|

$ | — | ||||||||||||

| |

|

|

|

|||||||||||||

Share-Based Compensation Expense

The classification of share-based compensation expense is summarized as follows:

Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||

(US$’000) |

2022 |

2021 |

2022 |

2021 |

||||||||||||

| Research and development |

$ | $ | $ | $ | ||||||||||||

| General and administrative |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total share-based compensation expense |

$ | $ | $ | $ | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

As of March 31, 2022, there was $0.6 million of unrecognized share-based compensation expense related to stock options issued under the Share Option Plan and the 2020 Plan.

9. Income taxes

For the three and nine months ended March 31, 2022, and 2021, the Company did not recognize a provision or benefit for income taxes as it has incurred net losses. In addition, the net deferred tax assets generated from net operating losses are fully offset by a valuation allowance as the Company believes it is more likely than not that the benefit will not be realized.

10. Commitments and contingencies

Contract commitments

The Company enters into contracts in the normal course of business with third-party contract research organizations, contract development and manufacturing organizations and other service providers and vendors. These contracts generally provide for termination on notice and, therefore, are cancellable contracts and not considered contractual obligations and commitments.

Contingencies

From time to time, the Company may become subject to claims and litigation arising in the ordinary course of business. The Company is not a party to any material legal proceedings, nor is it aware of any material pending or threatened litigation.

11. Related party transactions

During the nine months ended March 31, 2022, the Company had entered into a related party transaction with Francis Abourizk Lightowlers for legal fees totaling $1 thousand. Peter Francis, a 0 and $2 thousand, respectively, included in trade and other payables on the accompanying consolidated balance sheet.

non-executive

director of the Company is a partner at Francis Abourizk Lightowlers. As of March 31, 2022 and June 30, 2021 there were amounts due to this related party of $16

12. Subsequent events

The Company has evaluated subsequent events through the filing of this Quarterly Report on Form

10-Q,

and determined that there have been no events that have occurred that would require adjustments or disclosures in the consolidated financial statements. Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of financial condition and operating results together with our consolidated financial statements and the related notes and other financial information included elsewhere in this document.

Overview

We endeavor to become the leader in discovery, development, and commercialization of therapeutic agents capable of addressing significant unmet medical need via the application of the silence and replace approach to the treatment of genetic disorders.

Benitec Biopharma Inc. (“Benitec” or the “Company” or in the third person, “we” or “our”) is a development-stage biotechnology company focused on the advancement of novel genetic medicines with headquarters in Hayward, California. The proprietary platform, called

DNA-directed

RNA interference, or ddRNAi, combines RNA interference, or RNAi, with gene therapy to create medicines that facilitate sustained silencing of disease-causing genes following a single administration. The Company is developing a ddRNAi-based therapeutic (BB-301)

for the treatment of Oculopharyngeal Muscular Dystrophy (OPMD), a chronic, life-threatening genetic disorder. BB-301

is a ddRNAi-based genetic medicine currently under development by Benitec. BB-301

is an AAV-based

gene therapy designed to simultaneously silence the expression of the mutant, disease-causing gene (to slow, or halt, the biological mechanisms underlying disease progression in OPMD) and replace the mutant gene with a wild type gene (to drive restoration of function in diseased cells). This fundamental therapeutic approach to disease management is called “silence and replace”. The silence and replace mechanism offers the potential to restore the normative physiology of diseased cells and tissues and to improve treatment outcomes for patients suffering from the chronic, and potentially fatal, effects of OPMD. BB-301

has been granted Orphan Drug Designation in the United States and the European Union. The targeted gene silencing effects of RNAi, in conjunction with the durable transgene expression achievable via the use of modified viral vectors, imbues the silence and replace approach with the potential to produce long-term silencing of disease-causing genes along with simultaneous replacement of wild type gene function following a single administration of the proprietary genetic medicine. We believe that this novel mechanistic profile of the current and future investigational agents developed by Benitec could facilitate the achievement of robust and durable clinical activity while greatly reducing the frequency of drug administration traditionally expected for medicines employed for the management of chronic diseases. Additionally, the achievement of long-term gene silencing and gene replacement may significantly reduce the risk of patient

non-compliance

during the course of medical management of potentially fatal clinical disorders. COVID-19

COVID-19

has been declared a pandemic by the World Health Organization and has spread to nearly every country, including Australia and the United States. The impact of this pandemic has been, and will likely continue to be, extensive in many aspects of society, which has resulted in, and will likely continue to result in, significant disruptions to businesses and capital markets around the world. The extent to which the coronavirus impacts us will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and its variants, and the actions to contain the coronavirus or treat its impact, including the effectiveness and adoption of vaccines for the virus, among others. Certain elements of our research and development efforts are conducted globally, including the ongoing development of our silence and replace therapeutic for the treatment of Oculopharyngeal Muscular Dystrophy (OPMD), and will be dependent upon our ability to initiate preclinical and clinical studies despite the ongoing

COVID-19

pandemic. As we continue to actively advance our development programs, including our ongoing Toxicology and Biodistribution study for

BB-301,

we are in close contact with our principal investigators and preclinical trial sites, which are primarily located in France, and are assessing the impact of COVID-19

on our studies and the expected development timelines and costs on an ongoing basis. In light of developments relating to the COVID-19

global pandemic since the beginning of the outbreak, the focus of healthcare providers and hospitals on fighting the virus, and consistent with the FDA’s industry guidance for conducting clinical trials, we have experienced delays to the original timeline regarding the initiation and anticipated completion of the ongoing BB-301

Clinical Trial Application (CTA)-enabling and Investigational New Drug Application (IND)-enabling development work. The initiation of the BB-301

Pilot Dosing Study in Beagle dogs, which represents a key component of the CTA-enabling

and IND-enabling

work, was delayed by several months, however, the study has been completed without incident. The acquisition of chemical reagents, biological reagents and laboratory supplies which are essential for the conduct of basic laboratory research, the conduct of nonclinical studies and the 17

completion of GMP manufacturing of

BB-301,

has also become challenging due to the disruption of global supply chains inherent to the production of these materials. We will continue to evaluate the impact of the COVID-19

pandemic on our business and we expect to reevaluate the timing of our anticipated preclinical and clinical milestones as we learn more and the impact of COVID-19

on our industry becomes clearer. We have also implemented a halt of

non-essential

business travel and a rotation system whereby staff work from home and attend the laboratory on designated days which may result in a reduction of laboratory work. As we transition our employees back to our premises, there is a risk that COVID-19

infections occur at our offices or laboratory facilities and significantly affect our operations. Additionally, if any of our critical vendors are impacted, our business could be affected if we become unable to procure essential equipment in a timely manner or obtain supplies or services in adequate quantities and at acceptable prices. Development Programs

Our Pipeline

The following table sets forth the current product candidate and the development status:

Table 1. Pipeline: Oculopharyngeal Muscular Dystrophy

BB-301

We are developing

BB-301

for the treatment of Oculopharyngeal Muscular Dystrophy (OPMD), and BB-301

is currently undergoing evaluation in CTA-enabling

and IND-enabling

studies. BB-301

is the lead investigational agent under development by Benitec, and the key attributes of OPMD and BB-301

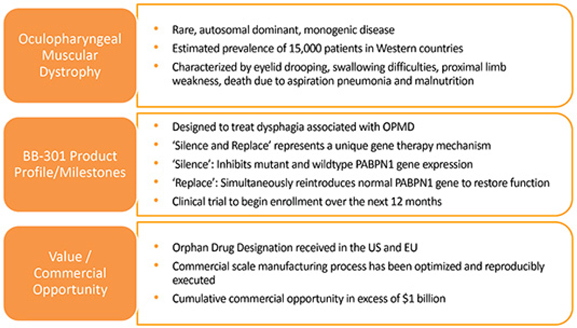

are outlined in Figure 3. Figure 3. Overview of the

BB-301

Program

BB-301

is a first-in-class

40-to-50

18

OPMD is a rare disease, however, patients have been diagnosed with OPMD in at least 33 countries. Patient populations suffering from OPMD are well-identified, and significant geographical clustering has been noted for patients with this disorder. Each of these attributes could facilitate efficient clinical development and global

ommercialization of c

BB-301.

PABPN1 is a ubiquitous factor that promotes the interaction between the poly(A) polymerase and CPSF (cleavage and polyadenylation specificity factor) and, thus, controls the length of mRNA poly(A) tails, mRNA export from the nucleus, and alternative poly(A) site usage. The characteristic genetic mutation underlying OPMD results in trinucleotide repeat expansion(s) within exon 1 of PABPN1 and results in an expanded poly-alanine tract at the

N-terminal

end of PABPN1. The mutation generates a protein with an N-terminal

expanded poly-alanine tract of up to 18 contiguous alanine residues, and the mutant protein is prone to the formation of intranuclear aggregates designated as intranuclear inclusions (INIs). The INIs that sequester wildtype PABPN1 may contribute to the “loss of function” phenotype associated with OPMD. No therapeutic agents are approved for the treatment of OPMD. Additionally, there are no surgical interventions available to OPMD patients that modify the natural history of the disease, which is principally comprised of chronic deterioration of swallowing function.

BB-301

has received Orphan Drug Designation in the United States and the European Union and, upon achievement of regulatory approval for BB-301

in these respective jurisdictions, the Orphan Drug Designations would provide commercial exclusivity independent of intellectual property protection. While OPMD is a rare medical disorder, we believe the commercial opportunity for a safe and efficacious therapeutic agent in this clinical indication exceeds $1 billion over the course of the commercial life of the product. Benitec has previously outlined the core

CTA-enabling

and IND-enabling

studies required by global regulatory agencies to support the initiation of BB-301

clinical trials in OPMD patients, and these studies include a BB-301

Pilot Dosing Study (the “Pilot Dosing Study”) in large animals and a classical 12-week

GLP Toxicology and Biodistribution Study for BB-301.

In these large animal studies, BB-301

is directly injected into the pharyngeal muscles known to underlie the morbidity and mortality which characterizes the natural history of OPMD in human subjects. As referenced above, the

BB-301

Pilot Dosing Study in large animals was the first of two CTA-enabling

and IND-enabling

studies conducted by Benitec. This study was carried out under the guidance of the scientific team at Benitec, with key elements of the design and execution of the study conducted in close collaboration with a team of experts in both medicine and surgery that have been deeply engaged in the treatment of OPMD patients for decades. The BB-301

Pilot Dosing Study and the GLP Toxicology and Biodistribution Study for BB-301

were conducted in canine subjects in order to: | • | Support the validation and optimization of the newly designed route and method of BB-301 administration, |

| • | Confirm the efficiency of vector transduction and transgene expression in the key tissue compartments underlying the morbidity and mortality that comprises the natural history of OPMD, |

| • | Confirm the optimal BB-301 doses in advance of initiation of human clinical studies, |

| • | Facilitate the observation of key toxicological data-points. |

The

BB-301

Pilot Dosing Study was designed as an 8-week

study in Beagle dogs to confirm the transduction efficiency of BB-301

upon administration via direct intramuscular injection into specific anatomical regions of the pharynx through the use of an open surgical procedure. This new method and route of BB-301

administration was developed in collaboration with key surgical experts in the field of Otolaryngology, and this novel method of BB-301

dosing will significantly enhance the ability of treating physicians to accurately administer the AAV-based

investigational agent to the muscles that underlie the characteristic deficits associated with disease progression in OPMD. It is important to note that prior BB-301

non-clinical

studies have reproducibly validated the robust biological activity achieved following direct intramuscular injection of the AAV-based

agent. As an example, direct injection of BB-301

into the tibialis anterior muscles of A17 mice facilitated robust transduction of the targeted skeletal muscle cells and supported complete remission of the OPMD disease phenotype in this animal model. Benitec conducted the

BB-301

Pilot Dosing Study in Beagle dog subjects to demonstrate that direct intramuscular injection of BB-301

via the use of a proprietary dosing device in an open surgical procedure could safely achieve the following goals: | • | Biologically significant and dose-dependent levels of BB-301 tissue transduction (i.e., delivery of the multi-functional BB-301 genetic construct into the target pharyngeal muscle cells), |

| • | Broad-based and dose-dependent expression of the three distinct genes comprising the BB-301 gene construct within the pharyngeal muscle cells, and |

| • | Biologically significant levels of target gene knock-down (i.e., inhibition of the expression of the gene of interest) within the pharyngeal muscle cells. |

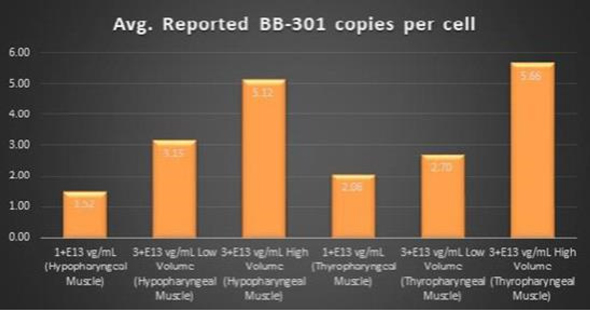

The Pilot Dosing Study evaluated the safety and biological activity of two concentrations of

BB-301

(1.0+E13 vg/mL and 3.0+E13 vg/mL) across three distinct doses (1.0+E13 vg/mL and 3.0+E13 vg/mL with a low injection volume, and 3.0+E13 19

vg/mL with a high injection volume) following direct intramuscular injection into the Hypopharyngeus (HP) muscles and the Thyropharyngeus (TP) muscles of Beagle dogs via the use of a proprietary delivery device employed in an open surgical procedure. The HP muscle in Beagle dogs corresponds to the Middle Pharyngeal Constrictor muscle in human subjects, and the TP muscle in Beagle dogs corresponds to the Inferior Pharyngeal Constrictor muscle in human subjects.

BB-301

was injected only on Day 1 of the Pilot Dosing Study, and the corresponding canine pharyngeal muscles were harvested for molecular analyses after 8 weeks of observation post-injection. BB-301

dosing was carried out independently by a veterinary surgeon and an Otolaryngologist with extensive experience regarding the provision of palliative surgical care for OPMD patients. Molecular analyses have been completed for the canine subjects treated in the

BB-301

Pilot Dosing Study. Key interim data-sets derived from the analyses of pharyngeal muscle tissues isolated from 16 Beagle dog subjects (of the 24-subject

Beagle dog study population) are highlighted below. The final data-set

derived from the completed molecular analyses of the pharyngeal muscle tissues of the canine subjects treated on the Pilot Dosing Study will be presented in a peer-reviewed format. The key interim data-sets are summarized below:

Figure 4. Pharyngeal Muscle Tissue Transduction Levels Achieved by

BB-301

Regarding Gene Expression Levels Observed for

BB-301

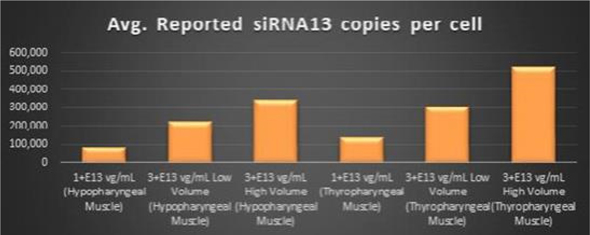

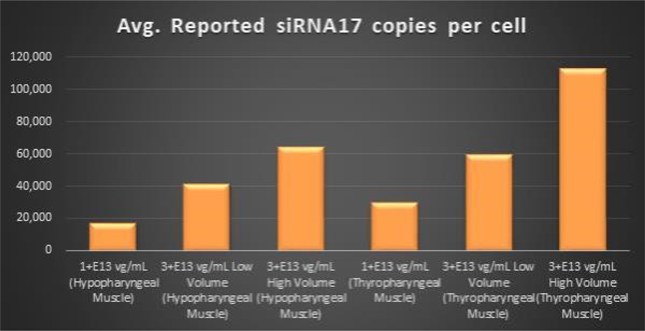

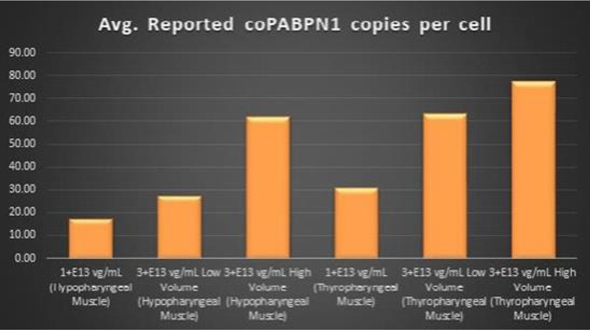

Within the Pharyngeal Muscle Tissues (Figure 5, Figure 6, Figure 7): | • | BB-301 encodes two distinct siRNA species (i.e., siRNA13 and siRNA17) which are each, independently, capable of inhibiting (i.e., “silencing”) the expression of the mutant form of the PABPN1 protein and the wild type (i.e., endogenous) form of the PABPN1 protein (importantly, the mutant form of the PABPN1 protein underlies the development, and progression, of OPMD). |

| • | BB-301 also codes for a wild type version of the PABPN1 protein whose intracellular expression is unaffected by the inhibitory activities of siRNA13 and siRNA17; this “codon optimized” transcript drives the expression of a PABPN1 protein (i.e., coPABPN1) which serves to replenish the endogenous form of the PABPN1 protein and to replace the mutant form of PABPN1 that underlies the development and progression of OPMD in diseased tissues. |

| • | For comparative purposes, it should be noted that the average range of expression for wild type PABPN1 within the pharyngeal muscle cells of Beagle dogs is 4.5 copies per cell-to-7.8 |

20

Figure 5. siRNA13 Expression Levels Achieved by

BB-301

within Pharyngeal Muscle Tissues

Figure 6. siRNA17 Expression Levels Achieved by

BB-301

within Pharyngeal Muscle Tissues

21

Figure 7. coPABPN1 Expression Levels Achieved by

BB-301

within Pharyngeal Muscle Tissues

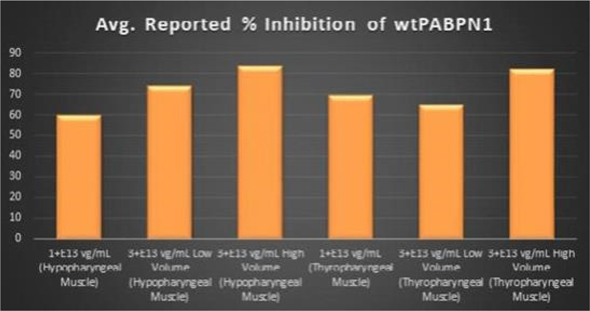

Regarding Wild Type PABPN1 Silencing (i.e., target “knock-down”) Observed for

BB-301

Within the Pharyngeal Muscle Tissues (Figure 8): | • | As noted above, BB-301 encodes two distinct siRNA species (i.e., siRNA13 and siRNA17) which are each, independently, capable of inhibiting (i.e., “silencing”) the expression of all forms of the PABPN1 protein (siRNA13 and siRNA17 silence the expression of both wild type PABPN1 [wtPABPN1] and mutant PABPN1). |

| • | While the Beagle dog subjects treated in the BB-301 Pilot Dosing Study do not express mutant PABPN1, the level of BB-301-driven |

| • | Thus, the wtPABPN1 silencing activity observed in the BB-301 Pilot Dosing Study serves as a surrogate for the silencing activity that would be anticipated in the presence of mutant PABPN1. |

| • | BB-301 has been evaluated in prior non-clinical studies in animals that express mutant PABPN1 and, as a result, manifest the symptomatic phenotype of OPMD; in the symptomatic animal model of OPMD (i.e. the A17 mouse model), the achievement of PABPN1 silencing levels of 31% inhibition (or higher) following BB-301 administration led to resolution of OPMD disease symptoms and the elimination of the histopathological hallmarks of OPMD. |

22

Figure 8. PABPN1 Silencing (i.e., “target knock-down”) Achieved by

BB-301

within Pharyngeal Muscle Tissues

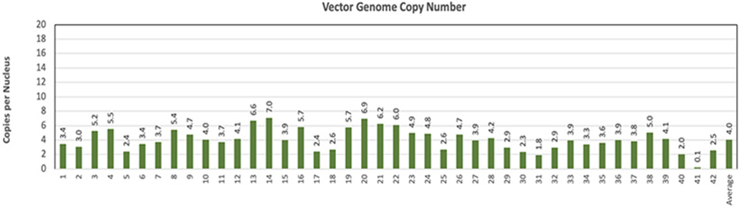

There are key methodological distinctions between the current

BB-301

Pilot Dosing Study conducted by Benitec as compared to the prior BB-301

Beagle dog dosing study carried out independently by the previous BB-301

licensee. The BB-301

dosing study conducted by the prior BB-301

licensee employed non-ideal

routes and methods of BB-301

administration to the target pharyngeal muscle tissues and employed similarly limited analytical methods at the completion of the dosing phase of the study. Subsequently, the Benitec team worked to optimize the route and method of administration of BB-301

and to refine the core analytical methods employed following the completion of dosing of the large animal subjects. The current proprietary method of

BB-301

delivery to the key pharyngeal muscles of study subjects, and the proprietary molecular analytical methods employed to assay the pharyngeal muscle tissues of study subjects, with both methods having been developed by the Benitec team, led to the observation of broad-based transduction of the targeted pharyngeal muscle tissues (Figure 9, represents individual sections of the TP muscle following BB-301

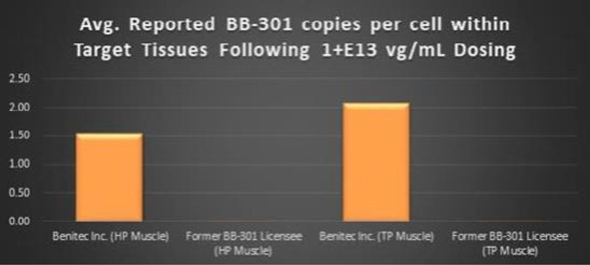

dosing). Critically, the Benitec-developed methods also facilitated the achievement of a 228-fold

improvement (+22,647%) in BB-301

transduction of the HP muscle and a 113-fold

improvement (+11,163%) in BB-301

transduction of the TP muscle relative to the levels of BB-301

transduction observed by the previous BB-301

licensee at identical BB-301

doses in identical canine study populations (Figure 10). Figure 9.

BB-301

Transduction Levels Achieved for Individual Sections of the TP Muscle Following BB-301

dosing

23

Figure 10. Impact of the Methodological Improvements to the

BB-301

Large Animal Dosing Study Design on the Relative Pharyngeal Muscle Tissue Transduction Levels Achieved by Benitec vs. the Former BB-301

Licensee

Following the disclosure of the positive interim

BB-301

Pilot Dosing Study results, Benitec completed pre-CTA

and pre-IND

meetings with regulatory agencies in France, Canada, and the United States. Summary