S-1/A: General form of registration statement for all companies including face-amount certificate companies

Published on September 9, 2022

Table of Contents

As filed with the Securities and Exchange Commission on September 8, 2022

Registration No. 333-266417

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Benitec Biopharma Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 84-462-0206 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3940 Trust Way

Hayward, California 94545

(510) 780-0819

(Address, including zip code, and telephone number, including area code, of registrants principal executive offices)

Dr. Jerel Banks

Chief Executive Officer

3940 Trust Way

Hayward, California 94545

(510) 780-0819

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Matthew S. OLoughlin, Esq. Ben D. Orlanski, Esq. Louis Rambo, Esq. Proskauer Rose LLP 2029 Century Park East, Suite 2400 Los Angeles, CA 90067-3010 (310) 557-2900 (310) 557-2193-Facsimile |

Barry I. Grossman, Esq. Sarah Williams, Esq. Matthew Bernstein, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105 (212) 370-1300 (212) 370-7889-Facsimile |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company and emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 8, 2022

Preliminary Prospectus

$20,000,000

25,380,710 Shares of Common Stock or

Pre-funded Warrants to Purchase 25,380,710 Shares of Common Stock and

Common Warrants to Purchase 25,380,710 Shares of Common Stock

Shares of Common Stock underlying the Pre-funded Warrants and Series 1 Common Warrants

We are offering 25,380,710 shares of our common stock together with common warrants to purchase shares of our common stock (and the shares of common stock that are issuable from time to time upon exercise of the Series 1 Common Warrants (as defined below)). The common warrants will be issued separately but must be purchased together with the common stock and/or the pre-funded warrants (as described below). The combined purchase price for each share of common stock and accompanying common warrant is $ and for each pre-funded warrant and accompanying common warrant is $ . The common warrants will be exercisable beginning on the date of issuance (the Series 1 Common Warrants) or, as applicable (as further described herein), the date on which we (a) receive approval from our stockholders (the Stockholder Approval) to increase the number of shares of common stock we are authorized to issue (a Capital Event) and (b) effect such Capital Event by filing with the Secretary of State of the State of Delaware a certificate of amendment to our amended and restated certificate of incorporation (each such date, an Initial Exercise Date) (the Series 2 Common Warrants), at an exercise price of $ per share and will expire on the five-year anniversary of the Initial Exercise Date.

We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers so choose, pre-funded warrants in lieu of shares of common stock that would otherwise result in any such purchasers beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each pre-funded warrant will be exercisable for one share of our common stock and will be exercisable at any time after its original issuance until exercised in full. The purchase price of each pre-funded warrant will be equal to the price at which a share of common stock are sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. This offering also relates to the shares of common stock issuable upon exercise of the Series 1 Common Warrants or any pre-funded warrants sold in this offering.

Our common stock is listed on The Nasdaq Capital Market under the symbol BNTC. On September 8, 2022, the last reported sale price of our common stock on The Nasdaq Capital Market was $0.7880. There is no established public trading market for the pre-funded warrants or common warrants, and we do not expect a market to develop. We do not intend to apply for listing of the pre-funded warrants or common warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the pre-funded warrants or common warrants will be limited.

The public offering price per share of common stock and/or any pre-funded warrant, together with the common warrant that accompanies common stock or a pre-funded warrant will be determined between us, the underwriter and purchasers based on market conditions at the time of pricing, and may be at a discount to the current market

Table of Contents

price. Therefore, the recent market price used throughout this prospectus may not be indicative of the actual public offering price for our common stock, our pre-funded warrants and the common warrants. There is no established public trading market for the pre-funded warrants or common warrants, and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the pre-funded warrants or common warrants on any national securities exchange. Without an active trading market, the liquidity of the common warrants and the pre-funded warrants will be limited.

You should read this prospectus, together with additional information described under the heading Where You Can Find More Information, carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See Risk Factors beginning on page 28.

|

Per Share of Common Stock and Common Warrant(1) |

Per Pre-Funded Warrant and Common Warrant |

Total(3) | ||||||||||

| Public offering price |

$ | $ | $ | |||||||||

| Underwriting discounts and commissions(2) |

$ | $ | $ | |||||||||

| Proceeds to us (before expenses) |

$ | $ | $ | |||||||||

| (1) | Based on an assumed public offering price of $ per share of common stock and common warrant. The final public offering price per share of common stock or pre-funded warrant, together with the common warrant that accompanies common stock or a pre-funded warrant, as the case may be, will be determined by us, the underwriter and the purchasers in this offering and may be a discount to the current market price of our common stock. |

| (2) | We have agreed to reimburse certain expenses of the underwriter which are not included in the table above. See Underwriting for a description of the compensation payable to the underwriter. |

| (3) | Assumes no pre-funded warrants are issued in lieu of shares of common stock. |

We have granted the underwriter a 30-day option to purchase an aggregate of up to 3,807,106 additional shares of our common stock and/or up to 3,807,106 additional common warrants to purchase 3,807,106 shares of our common stock from us at the public offering price per share of common stock and common warrant, less the underwriting discounts and commissions. The underwriter may exercise its option to acquire additional shares for the sole purpose of covering over-allotments. See Underwriting.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Delivery of the securities offered hereby is expected to be made on or about , 2022.

Sole Book-Running Manager

JMP Securities

A CITIZENS COMPANY

The date of this prospectus is , 2022

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 5 | ||||

| 23 | ||||

| 26 | ||||

| 28 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| Market Price of Our Common Stock and Related Stockholder Matters |

38 | |||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 48 | ||||

| 57 | ||||

| 62 | ||||

| 62 | ||||

| 63 | ||||

| 63 | ||||

i

Table of Contents

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (SEC). You should rely only on the information contained in this prospectus or contained in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not, and the underwriter has not, authorized anyone to provide you with information that is different from that contained in such prospectuses. We are offering to sell securities and are seeking offers to buy securities only in jurisdictions where such offers and sales are permitted. For investors outside the United States: We have not, and the underwriter has not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside the United States. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities.

This prospectus and the information incorporated herein by reference contain summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled Where You Can Find Additional Information. We urge you to read carefully this prospectus, together with the information incorporated herein by reference before deciding whether to participate in the offering hereunder.

We further note that the representations, warranties and covenants made by us in any document that is filed as an exhibit to the registration statement of which this prospectus is a part and in any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context otherwise requires, the terms Benitec, the Company, we, us, our and similar terms used in this prospectus refer (i), prior to the Re-domiciliation (as defined herein) to Benitec Biopharma Limited (BBL), an Australian corporation, and its subsidiaries, and (ii), following the Re-domiciliation, to Benitec Biopharma Inc., a Delaware corporation, and its subsidiaries (including Benitec Limited). Any references to Benitec Limited or BBL refer to Benitec Biopharma Limited, an Australian corporation. On August 14, 2020, BBL reorganized as a Proprietary Limited company and changed its name to Benitec Biopharma Proprietary Limited.

All references to $ in this prospectus refer to U.S. dollars. All references to A$ in this prospectus mean Australian dollars. As of June 30, 2022, the rate of exchange of U.S. dollars to Australian dollars was 1.44839 AUD.

Our fiscal year-end is June 30. References to a particular fiscal year are to our fiscal year ended June 30 of that calendar year.

1

Table of Contents

This prospectus includes information with respect to market and industry conditions and market share from third-party sources or based upon estimates using such sources when available. We believe that such information and estimates are reasonable and reliable. We also believe the information extracted from publications of third-party sources has been accurately reproduced. However, we have not independently verified any of the data from third-party sources. Similarly, our internal research is based upon our understanding of industry conditions, and such information has not been verified by any independent sources.

We have proprietary and licensed rights to trademarks used in this prospectus which are important to our business, many of which are registered under applicable intellectual property laws. These trademarks include:

| | BENITEC BIOPHARMA® |

| | BENITEC® |

| | GIVING DISEASE THE SILENT TREATMENT® |

| | SILENCING GENES FOR LIFE® |

Solely for convenience, trademarks and trade names referred to in this prospectus appear without the ® or symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name or service mark of any other company appearing in this prospectus is the property of its respective holder.

2

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Our forward-looking statements relate to future events or our future performance and include, but are not limited to, statements concerning our business strategy, future commercial revenues, market growth, capital requirements, new product introductions, expansion plans and the adequacy of our funding. All statements, other than statements of historical fact included in this prospectus, are forward-looking statements. When used in this prospectus, the words could, believe, anticipate, intend, estimate, expect, may, continue, predict, potential, project, or the negative of these terms, and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following:

| | the success of our plans to develop and potentially commercialize our product candidates; |

| | the timing of the initiation and completion of preclinical studies and clinical trials; |

| | the timing and sufficiency of patient enrollment and dosing in any future clinical trials; |

| | the timing of the availability of data from clinical trials; |

| | the timing and outcome of regulatory filings and approvals; |

| | unanticipated delays; |

| | sales, marketing, manufacturing and distribution requirements; |

| | market competition and the acceptance of our products in the marketplace; |

| | regulatory developments in the United States, France and Canada; |

| | the development of novel AAV (as defined below) vectors; |

| | the plans of licensees of our technology; |

| | the clinical utility and potential attributes and benefits of ddRNAi and our product candidates, including the potential duration of treatment effects and the potential for a one shot cure; |

| | our dependence on our relationships with collaborators and other third parties; |

| | expenses, ongoing losses, future revenue, capital needs and needs for additional financing, and our ability to access additional financing given market conditions and other factors, including our capital structure; |

| | our ability to continue as a going concern; |

| | the length of time over which we expect our cash and cash equivalents to be sufficient to execute on our business plan; |

| | our intellectual property position and the duration of our patent portfolio; |

| | the impact of local, regional, and national and international economic conditions and events; |

| | the impact of the current COVID-19 pandemic, the disease caused by the SARS-CoV-2 virus, which may adversely impact our business and preclinical and future clinical trials; and |

| | our ability to receive Stockholder Approval and effect the Capital Event. |

as well as other risks detailed under the caption Risk Factors in this prospectus and in other reports filed with the SEC. Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus, we caution you that these statements are based on a combination of facts and important factors

3

Table of Contents

currently known by us and our expectations of the future, about which we cannot be certain. We have based the forward-looking statements included in this prospectus and in the documents incorporated herein by reference on information available to us on the date of this prospectus or on the date thereof. Except as required by law we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we may make directly to you or through reports that we, in the future, may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

All forward-looking statements included herein or in documents incorporated herein by reference are expressly qualified in their entirety by the cautionary statements contained or referred to elsewhere in this prospectus.

4

Table of Contents

This summary highlights information contained in other parts of this prospectus and in the documents incorporated by reference herein and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus and the documents incorporated by reference herein, including our consolidated financial statements and the related notes, and the information set forth under the section titled Risk Factors, as well as those risk factors included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 and any subsequent Quarterly Report on Form 10-Q. Some of the statements in this prospectus and the documents incorporated by reference herein constitute forward-looking statements that involve risks and uncertainties. See the information set forth under the section Special Note Regarding Forward-Looking Statements.

Company Overview

We endeavor to become the leader in discovery, development, and commercialization of therapeutic agents capable of addressing significant unmet medical need via the application of the silence and replace approach to the treatment of genetic disorders.

Benitec Biopharma Inc. (Benitec or the Company or in the third person, we or our) is a development-stage biotechnology company focused on the advancement of novel genetic medicines with headquarters in Hayward, California. The proprietary platform, called DNA-directed RNA interference, or ddRNAi, combines RNA interference, or RNAi, with gene therapy to create medicines that facilitate sustained silencing of disease-causing genes following a single administration. The Company is developing a ddRNAi-based therapeutic (BB-301) for the treatment of Oculopharyngeal Muscular Dystrophy (OPMD), a chronic, life-threatening genetic disorder.

BB-301 is a ddRNAi-based genetic medicine currently under development by Benitec. BB-301 is an AAV-based gene therapy designed to simultaneously silence the expression of the mutant, disease-causing gene (to slow, or halt, the biological mechanisms underlying disease progression in OPMD) and replace the mutant gene with a wild type gene (to drive restoration of function in diseased cells). This fundamental therapeutic approach to disease management is called silence and replace. The silence and replace mechanism offers the potential to restore the normative physiology of diseased cells and tissues and to improve treatment outcomes for patients suffering from the chronic, and potentially fatal, effects of OPMD. BB-301 has been granted Orphan Drug Designation in the United States and the European Union.

The targeted gene silencing effects of RNAi, in conjunction with the durable transgene expression achievable via the use of modified viral vectors, imbues the silence and replace approach with the potential to produce long-term silencing of disease-causing genes along with simultaneous replacement of wild type gene function following a single administration of the proprietary genetic medicine. We believe that this novel mechanistic profile of the current and future investigational agents developed by Benitec could facilitate the achievement of robust and durable clinical activity while greatly reducing the frequency of drug administration traditionally expected for medicines employed for the management of chronic diseases. Additionally, the achievement of long-term gene silencing and gene replacement may significantly reduce the risk of patient non-compliance during the course of medical management of potentially fatal clinical disorders.

We will require additional financing to progress our product candidates through to key inflection points.

5

Table of Contents

Recent Developments

On September 6, 2022, we received a letter from the Listing Qualifications Department of the Nasdaq Stock Market notifying us that the minimum bid price per share for our common stock fell below $1.00 for a period of 30 consecutive business days and that therefore we did not meet the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2).

The letter also states that we will be provided 180 calendar days, or until March 6, 2023, to regain compliance with the minimum bid price requirement. In accordance with Rule 5810(c)(3)(A), we can regain compliance if at any time during the 180-day period the closing bid price of our common stock is at least $1.00 for a minimum of 10 consecutive business days. If by January 6, 2020, we cannot demonstrate compliance with the Rule 5550(a)(2), we may be eligible for additional time. To qualify for additional time, we will be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for The Nasdaq Capital Market, with the exception of the bid price requirement, and we will need to provide written notice of our intention to cure the deficiency during the second compliance period. If we are not eligible for the second compliance period, then the Nasdaq Staff will provide notice that our securities will be subject to delisting. At such time, we may appeal the delisting determination to a Hearings Panel.

We intend to monitor the closing bid price of our common stock and may, if appropriate, consider implementing available options to regain compliance with the minimum bid price requirement. These options include completing a reverse stock split of our common stock for the purpose of meeting the closing bid price requirement. We have previously completed reverse stock splits in connection with complying with our listing requirement and any such option we undertake will not, in of itself, cause us to remain in compliance.

Our Strengths

We believe that the combination of our proprietary ddRNAi technology and our deep expertise in the design and development of genetic medicines, and specifically ddRNAi-based therapeutics, will enable us to achieve and maintain a leading position in gene silencing and gene therapy for the treatment of human disease. Our key strengths include:

| | A first mover advantage for ddRNAi-based therapeutics; |

| | A proprietary ddRNAi-based silence and replace technology platform that may potentially enable the serial development of single-administration therapeutics capable of facilitating sustained, long-term silencing of disease-causing genes and concomitant replacement of wild type gene function; |

| | A proprietary AAV vector technology which improves the endosomal escape capability of virus produced in insect cells using a baculovirus system. This technology has broad application in AAV-based gene therapies; |

| | The capabilities to drive the development of a pipeline of programs focused on chronic diseases with either large patient populations, or rare diseases, which may potentially support the receipt of Orphan Drug Designation, including OPMD; and |

| | A growing portfolio of patents protecting improvements to our ddRNAi, and silence and replace, technology and product candidates through at least 2036, with additional patent life anticipated through at least 2040. |

Our Strategy

We endeavor to become the leader in discovery, development, and commercialization of therapeutic agents capable of addressing significant unmet medical need via the application of the silence and replace approach to the treatment of genetic disorders. We apply the following general strategy to drive the Company towards these goals:

| | Selectively develop proprietary and partnered programs; and |

6

Table of Contents

| | Continue to explore and secure research and development partnerships with global biopharmaceutical companies supported by the differentiated nature of our scientific platform and intellectual property portfolio. |

Our senior leadership team will continue to explore partnership opportunities with global biopharmaceutical companies, as we expect that the unique attributes of the proprietary ddRNAi and silence and replace approaches, and the breadth of potential clinical indications amenable to our proprietary methods, to support the formation of collaborations over a broad range of diseases with significant unmet medical need.

We seek to actively protect our intellectual property and proprietary technology. These efforts are central to the growth of our business and include:

| | Seeking and maintaining patents claiming our ddRNAi and silence and replace technologies and other inventions relating to our specific products in development or that are otherwise commercially and/or strategically important to the development of our business; |

| | Protecting and enforcing our intellectual property rights; and |

| | Strategically licensing intellectual property from third parties to advance development of our product candidates. |

Our TechnologyddRNAi and Silence and Replace

Our proprietary technology platforms are designated as DNA-directed RNA interference, or ddRNAi, and silence and replace. ddRNAi is designed to produce long-term silencing of disease-causing genes, by combining RNA interference, or RNAi, with viral delivery agents typically associated with the field of gene therapy (i.e., viral vectors). Modified AAV vectors are employed to deliver genetic constructs which encode short hairpin RNAs that are, then, serially expressed and processed to produce siRNA molecules within the transduced cell for the duration of the life of the target cell. These newly introduced siRNA molecules drive long-term, and potentially permanent, silencing of the expression of the disease-causing gene. The silence and replace approach further bolsters the biological benefits of long-term silencing of disease-causing genes by incorporating multifunctional genetic constructs within the modified AAV vectors to create an AAV-based gene therapy agent that is designed to both silence the expression of mutated, disease-causing genes (to slow, or halt, the underlying mechanism of disease progression) and, simultaneously, replace the mutant genes with normal, wild type genes (to drive restoration of function in diseased cells). This fundamentally distinct therapeutic approach to disease management offers the potential to restore the underlying physiology of the treated tissues and, in the process, improve treatment outcomes for patients suffering from the chronic and, potentially, fatal effects of diseases like Oculopharyngeal Muscular Dystrophy (OPMD).

Traditional gene therapy is defined by the introduction of an engineered transgene to correct the pathophysiological derangements derived from mutated or malfunctioning genes. Mutated genes can facilitate the intracellular production of disease-causing proteins or hamper the production of critical, life-sustaining, proteins. The introduction of a new transgene can facilitate the restoration of production of normal proteins within the diseased cell, thus, restoring natural biological function. Critically, the implementation of this traditional method of gene therapy cannot eliminate the expression, or the potential deleterious effects of, the underlying mutant gene (as mutant proteins may be continually expressed and aggregate or drive the aggregation of other native proteins within the diseased cell). In this regard, the dual capabilities of the proprietary silence and replace approach to silence a disease-causing gene via ddRNAi and simultaneously replace the wild type activity of a mutant gene via the delivery of an engineered transgene could facilitate the development of differentially efficacious treatments for a range of genetic disorders.

7

Table of Contents

Overview of RNAi and the siRNA Approach

The mutation of a single gene can cause a chronic disease via the resulting intracellular production of a disease-causing protein (i.e. an abnormal form of the protein of interest), and many chronic and/or fatal disorders are known to result from the inappropriate expression of a single gene or multiple genes. In some cases, genetic disorders of this type can be treated exclusively by silencing the intracellular production of the disease-causing protein through well-validated biological approaches like RNA interference (RNAi). RNAi employs small nucleic acid molecules to activate an intracellular enzyme complex, and this biological pathway temporarily reduces the production of the disease-causing protein. In the absence of the disease-causing protein, normal cellular function is restored and the chronic disease that initially resulted from the presence of the mutant protein is partially or completely resolved. RNAi is potentially applicable to over 20,000 human genes and a large number of disease-causing microorganism-specific genes.

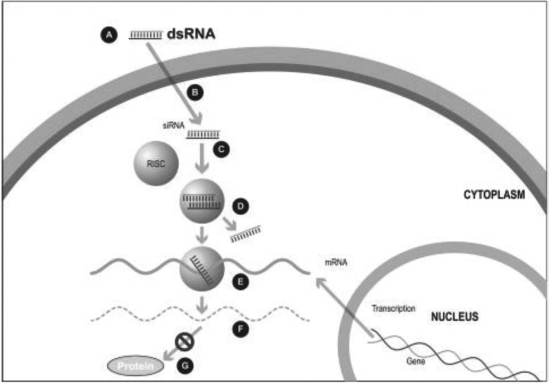

Figure 1. The siRNA Approach

A small double stranded RNA, or dsRNA, molecule (A, Figure 1), comprising one strand known as the sense strand and another strand known as the antisense strand, which are complementary to each other, is synthesized in the laboratory. These small dsRNAs are called small interfering RNAs, or siRNAs. The sequence of the sense strand corresponds to a short region of the target gene mRNA. The siRNA is delivered to the target cell (B, Figure 1), where a group of enzymes, referred to as the RNA-Induced Silencing Complex, or RISC, process the siRNA (C, Figure 1), where one of the strands (usually the sense strand) is released (D, Figure 1). RISC uses the antisense strand to find the mRNA that has a complementary sequence (E, Figure 1) leading to the cleavage of the target mRNA (F, Figure 1). As a consequence, the output of the mRNA (protein production) does not occur (G, Figure 1). Several companies, including Alnylam Pharmaceuticals Inc. (Alnylam) and Arbutus Biopharma Corp. (Arbutus), utilize this approach in their RNAi product candidates.

8

Table of Contents

Importantly, many genetic disorders are not amenable to the traditional gene silencing approach outlined in Figure 1, as the diseased cells may produce a mixture of the wild type protein of interest and the disease-causing mutant variant of the protein, and the underlying genetic mutation may be too small to allow for selective targeting of the disease-causing variant of the protein through the use of siRNA-based approaches exclusively. In these cases, it is extraordinarily difficult to selectively silence the disease-causing protein without simultaneously silencing the wild type intracellular protein of interest whose presence is vital to the conduct of normal cellular functions.

Our proprietary silence and replace technology utilizes the unique specificity and robust gene silencing capabilities of RNAi while overcoming many of the key limitations of siRNA-based approaches to disease management.

In the standard RNAi approach, double-stranded siRNA is produced synthetically and, subsequently, introduced into the target cell via chemical modification of the RNA or alternative methods of delivery. While efficacy has been demonstrated in several clinical indications through the use of this approach, siRNA-based approaches maintain a number of limitations, including:

| | Clinical management requires repeat administration of the siRNA-based therapeutic agent for multiple cycles to maintain efficacy; |

| | Long-term patient compliance challenges due to dosing frequencies and treatment durations; |

| | Therapeutic concentrations of siRNA are not stably maintained because the levels of synthetic siRNA in the target cells decrease over time; |

| | Novel chemical modifications or novel delivery materials are typically required to introduce the siRNA into the target cells, making it complicated to develop a broad range of therapeutics agents; |

| | Potential adverse immune responses, resulting in serious adverse effects; |

| | Requirement for specialized delivery formulations for genetic disorders caused by mutations of multiple genes; and |

| | siRNA acts only to silence genes and cannot be used to replace defective genes with normally functioning genes. |

Our Approach to the Treatment of Genetic DiseasesddRNAi and Silence and Replace

Our proprietary silence and replace approach to the treatment of genetic diseases combines RNAi with wild type gene replacement to drive sustained silencing of disease-causing genes and concomitant restoration of functional wild type genes following a single administration of the therapeutic agent. Benitec employs ddRNAi in combination with classical gene therapy (i.e. transgene delivery via viral vectors) to overcome several of the fundamental limitations of RNAi.

The silence and replace approach to the treatment of genetic disorders employs adeno-associated viral vectors (AAVs) to deliver genetic constructs which may, after a single administration to the target tissues:

| | Chronically express RNAi molecules inside of the target, diseased, cells (to serially silence the intracellular production of mutant, disease-causing, protein and the wild type protein of interest); |

| | Simultaneously drive the expression of a wild type variant of the protein of interest (to restore native intracellular biological processes); and |

| | AAV vectors can accommodate the multi-functional DNA expression cassettes containing the engineered wild type transgenes and the novel genes encoding short hairpinRNA/microRNA molecules (shRNA/miRNA) that are required to support the development of therapeutic agents capable of the achievement of the goals of the silence and replace approach to therapy. |

9

Table of Contents

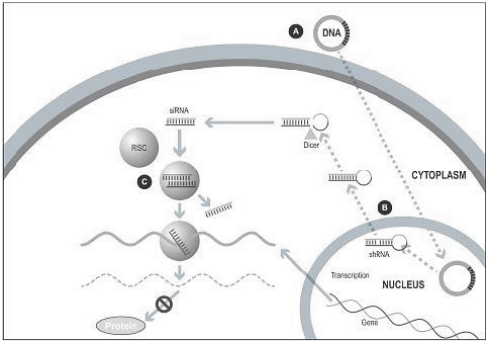

Our silence and replace technology utilizes proprietary DNA expression cassettes to foster continuous production of gene silencing shRNAs and wild type proteins (via expression of the wild type transgene). A range of viral and non-viral gene therapy vectors can be used to deliver the DNA construct into the nucleus of the target cell and, upon delivery, shRNA molecules are expressed and subsequently processed by intracellular enzymes into siRNA molecules that silence the expression of the mutant, disease-causing protein (Figure 2).

In the silence and replace approach (Figure 2):

| | A DNA construct is delivered to the nucleus of the target cell by a gene therapy vector (A) such as an AAV vector; |

| | Once inside of the nucleus, the DNA construct drives the continuous production of shRNA molecules (B) which are processed by an enzyme called Dicer into siRNAs (C); |

| | The processed siRNA is incorporated into RISC and silences the target gene using the same mechanism shown in Figure 1; and |

| | When the DNA expression cassette is additionally comprised of a wild type transgene, upon entry of the DNA construct into the nucleus of the target cell via the use of the AAV vector, the DNA construct also drives the continuous production of wild type protein (to restore native intracellular biological processes). |

Figure 2. The Silence and Replace Approach

Our strategy is to discover, develop and commercialize treatments that leverage the capabilities of ddRNAi and the silence and replace approach to disease management.

For selected product candidates, at the appropriate stage, we may collaborate with large biopharmaceutical companies to further co-develop and, if approved, commercialize our ddRNAi-based and silence and replace-based products to achieve broad clinical and commercial distribution. For specific clinical indications that we

10

Table of Contents

deem to be outside of our immediate areas of focus, we will continue to out-license, where appropriate, applications of our ddRNAi and silence and replace technology to facilitate the development of differentiated therapeutics, which could provide further validation of our proprietary technology and approach to disease management.

Our cash and cash equivalents will be deployed to advance our product candidate BB-301 for OPMD, including the natural history lead-in study and Phase 1b/2a BB 301 treatment study, for the continued advancement of development activities for other existing and new product candidates, for general corporate purposes and for strategic growth opportunities.

Oculopharyngeal Muscular DystrophyOPMD

OPMD is an insidious, autosomal-dominant, late-onset degenerative muscle disorder that typically presents in patients at 40-to-50 years of age. The disease is characterized by progressive swallowing difficulties (dysphagia) and eyelid drooping (ptosis). OPMD is caused by a specific mutation in the poly(A)-binding protein nuclear 1, or PABPN1, gene. OPMD is a rare disease; however, patients have been diagnosed with OPMD in at least 33 countries. Patient populations suffering from OPMD are well-identified, and significant geographical clustering has been noted for patients with this disorder, which could simplify clinical development and global commercialization efforts.

BB-301 is an AAV-based gene therapy designed to both silence the expression of mutated, disease-causing genes (to slow, or halt, the underlying mechanism of disease progression) and simultaneously replace the mutant genes with normal, wild type genes (to drive restoration of function in diseased cells). This fundamental therapeutic approach to disease management is called silence and replace and this biological mechanism offers the potential to restore the underlying physiology of the treated tissues and, in the process, improve treatment outcomes for patients suffering from the chronic and, potentially, fatal effects of Oculopharyngeal Muscular Dystrophy (OPMD). BB-301 has been granted Orphan Drug Designation in the United States and the European Union.

On July 9, 2018, the Company entered into a License and Collaboration Agreement with Axovant. Pursuant to the Agreement, the Company granted Axovant an exclusive worldwide license to develop, manufacture, and commercialize products containing the Companys product known as BB-301, which was designed for the potential treatment of Oculopharyngeal Muscular Dystrophy. As of September 3, 2019, the License and Collaboration Agreement with Axovant was terminated. As a result, all rights and licenses which Benitec had granted to Axovant to develop and commercialize BB-301 and related gene therapy product candidates terminated. We are now solely responsible for the costs in connection with the development and commercialization of the BB-301 product candidates.

Prior to such termination, the Benitec team endeavored to conduct several additional exploratory nonclinical analyses in order to potentially improve the biological efficacy of BB-301 via further optimization of the route of administration employed to dose the target muscle tissues.

Our Pipeline

The following table sets forth the current product candidate and the development status:

Table 1. Pipeline: Oculopharyngeal Muscular Dystrophy

11

Table of Contents

BB-301

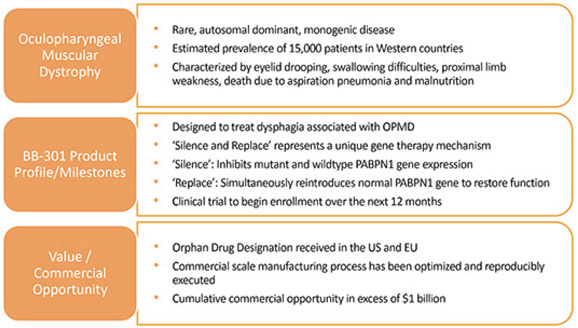

We are developing BB-301 for the treatment of Oculopharyngeal Muscular Dystrophy (OPMD), and BB-301 is currently undergoing evaluation in CTA-enabling and IND-enabling studies. BB-301 is the lead investigational agent under development by Benitec, and the key attributes of OPMD and BB-301 are outlined in Figure 3.

Figure 3. Overview of the BB-301 Program

BB-301 is a first-in-class genetic medicine employing the silence and replace approach for the treatment of OPMD. OPMD is an insidious, autosomal-dominant, late-onset, degenerative muscle disorder that typically presents in patients at 40-to-50 years of age. The disease is characterized by progressive swallowing difficulties (dysphagia) and eyelid drooping (ptosis). OPMD is caused by a specific mutation in the poly(A)-binding protein nuclear 1 gene (PABPN1).

OPMD is a rare disease, however, patients have been diagnosed with OPMD in at least 33 countries. Patient populations suffering from OPMD are well-identified, and significant geographical clustering has been noted for patients with this disorder. Each of these attributes could facilitate efficient clinical development and global commercialization of BB-301.

PABPN1 is a ubiquitous factor that promotes the interaction between the poly(A) polymerase and CPSF (cleavage and polyadenylation specificity factor) and, thus, controls the length of mRNA poly(A) tails, mRNA export from the nucleus, and alternative poly(A) site usage. The characteristic genetic mutation underlying OPMD results in trinucleotide repeat expansion(s) within exon 1 of PABPN1 and results in an expanded poly-alanine tract at the N-terminal end of PABPN1. The mutation generates a protein with an N-terminal expanded poly-alanine tract of up to 18 contiguous alanine residues, and the mutant protein is prone to the formation of intranuclear aggregates designated as intranuclear inclusions (INIs). The INIs that sequester wild type PABPN1 may contribute to the loss of function phenotype associated with OPMD.

12

Table of Contents

No therapeutic agents are approved for the treatment of OPMD. Additionally, there are no surgical interventions available to OPMD patients that modify the natural history of the disease, which is principally comprised of chronic deterioration of swallowing function. BB-301 has received Orphan Drug Designation in the United States and the European Union and, upon achievement of regulatory approval for BB-301 in these respective jurisdictions, the Orphan Drug Designations would provide commercial exclusivity independent of intellectual property protection. While OPMD is a rare medical disorder, we believe the commercial opportunity for a safe and efficacious therapeutic agent in this clinical indication exceeds $1 billion over the course of the commercial life of the product.

Benitec has previously outlined the core CTA-enabling and IND-enabling studies required by global regulatory agencies to support the initiation of BB-301 clinical trials in OPMD patients, and these studies include a BB-301 Pilot Dosing Study (the Pilot Dosing Study) in large animals and a classical 12-week GLP Toxicology and Biodistribution Study for BB-301. In these large animal studies, BB-301 is directly injected into the pharyngeal muscles known to underlie the morbidity and mortality which characterizes the natural history of OPMD in human subjects.

As referenced above, the BB-301 Pilot Dosing Study in large animals was the first of two CTA-enabling and IND-enabling studies conducted by Benitec. This study was carried out under the guidance of the scientific team at Benitec, with key elements of the design and execution of the study conducted in close collaboration with a team of experts in both medicine and surgery that have been deeply engaged in the treatment of OPMD patients for decades. The BB-301 Pilot Dosing Study and the GLP Toxicology and Biodistribution Study for BB-301 were conducted in canine subjects in order to:

| | Support the validation and optimization of the newly designed route and method of BB-301 administration, |

| | Confirm the efficiency of vector transduction and transgene expression in the key tissue compartments underlying the morbidity and mortality that comprises the natural history of OPMD, |

| | Confirm the optimal BB-301 doses in advance of initiation of human clinical studies, and |

| | Facilitate the observation of key toxicological data-points. |

The BB-301 Pilot Dosing Study was designed as an 8-week study in Beagle dogs to confirm the transduction efficiency of BB-301 upon administration via direct intramuscular injection into specific anatomical regions of the pharynx through the use of an open surgical procedure. This new method and route of BB-301 administration was developed in collaboration with key surgical experts in the field of Otolaryngology, and this novel method of BB-301 dosing will significantly enhance the ability of treating physicians to accurately administer the AAV-based investigational agent to the muscles that underlie the characteristic deficits associated with disease progression in OPMD. It is important to note that prior BB-301 non-clinical studies have reproducibly validated the robust biological activity achieved following direct intramuscular injection of the AAV-based agent. As an example, direct injection of BB-301 into the tibialis anterior muscles of A17 mice facilitated robust transduction of the targeted skeletal muscle cells and supported complete remission of the OPMD disease phenotype in this animal model.

Benitec conducted the BB-301 Pilot Dosing Study in Beagle dog subjects to demonstrate that direct intramuscular injection of BB-301 via the use of a proprietary dosing device in an open surgical procedure could safely achieve the following goals:

| | Biologically significant and dose-dependent levels of BB-301 tissue transduction (i.e., delivery of the multi-functional BB-301 genetic construct into the target pharyngeal muscle cells), |

| | Broad-based and dose-dependent expression of the three distinct genes comprising the BB-301 gene construct within the pharyngeal muscle cells, and |

13

Table of Contents

| | Biologically significant levels of target gene knock-down (i.e., inhibition of the expression of the gene of interest) within the pharyngeal muscle cells. |

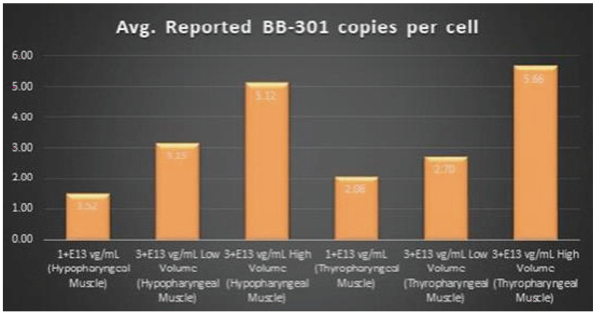

The Pilot Dosing Study evaluated the safety and biological activity of two concentrations of BB-301 (1.0+E13 vg/mL and 3.0+E13 vg/mL) across three distinct doses (1.0+E13 vg/mL and 3.0+E13 vg/mL with a low injection volume, and 3.0+E13 vg/mL with a high injection volume) following direct intramuscular injection into the Hypopharyngeus (HP) muscles and the Thyropharyngeus (TP) muscles of Beagle dogs via the use of a proprietary delivery device employed in an open surgical procedure. The HP muscle in Beagle dogs corresponds to the Middle Pharyngeal Constrictor muscle in human subjects, and the TP muscle in Beagle dogs corresponds to the Inferior Pharyngeal Constrictor muscle in human subjects. BB-301 was injected only on Day 1 of the Pilot Dosing Study, and the corresponding canine pharyngeal muscles were harvested for molecular analyses after 8 weeks of observation post-injection. BB-301 dosing was carried out independently by a veterinary surgeon and an Otolaryngologist with extensive experience regarding the provision of palliative surgical care for OPMD patients.

Molecular analyses have been completed for the canine subjects treated in the BB-301 Pilot Dosing Study. Key interim data-sets derived from the analyses of pharyngeal muscle tissues isolated from the Beagle dog subjects are highlighted below. The final data-set derived from the completed molecular analyses of the pharyngeal muscle tissues of the canine subjects treated on the Pilot Dosing Study will be presented in a peer-reviewed format.

The key interim data-sets are summarized below:

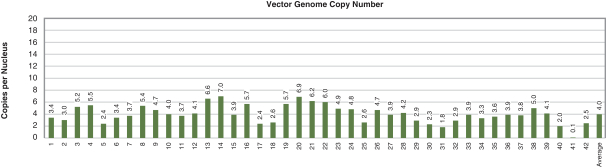

Figure 4. Pharyngeal Muscle Tissue Transduction Levels Achieved by BB-301

14

Table of Contents

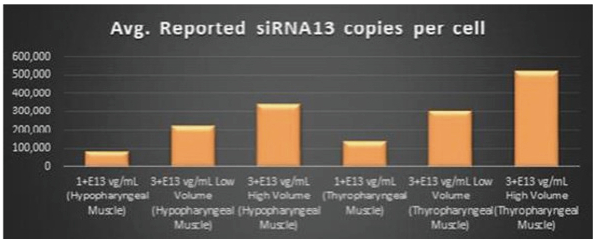

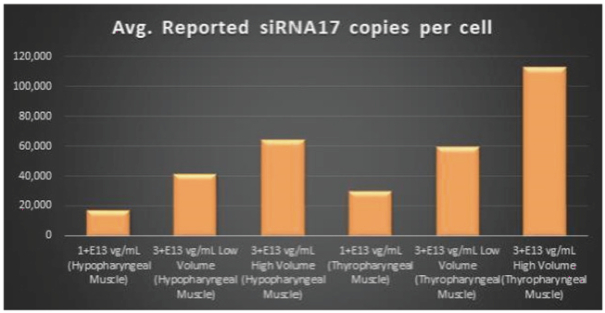

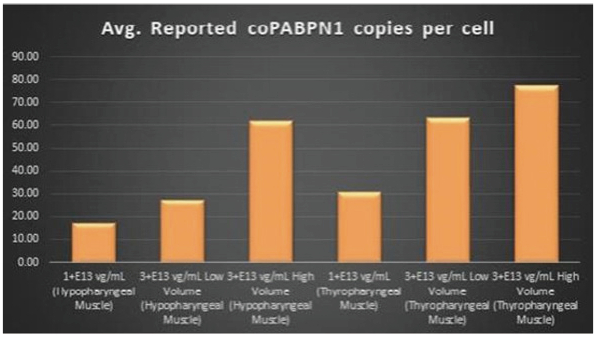

Regarding Gene Expression Levels Observed for BB-301 Within the Pharyngeal Muscle Tissues (Figure 5, Figure 6, Figure 7):

| | BB-301 encodes two distinct siRNA species (i.e., siRNA13 and siRNA17) which are each, independently, capable of inhibiting (i.e., silencing) the expression of the mutant form of the PABPN1 protein and the wild type (i.e., endogenous) form of the PABPN1 protein (importantly, the mutant form of the PABPN1 protein underlies the development, and progression, of OPMD). |

| | BB-301 also codes for a wild type version of the PABPN1 protein whose intracellular expression is unaffected by the inhibitory activities of siRNA13 and siRNA17; this codon optimized transcript drives the expression of a PABPN1 protein (i.e., coPABPN1) which serves to replenish the endogenous form of the PABPN1 protein and to replace the mutant form of PABPN1 that underlies the development and progression of OPMD in diseased tissues. |

| | For comparative purposes, it should be noted that the average range of expression for wild type PABPN1 within the pharyngeal muscle cells of Beagle dogs is 4.5 copies per cell-to-7.8 copies per cell. |

Figure 5. siRNA13 Expression Levels Achieved by BB-301 within Pharyngeal Muscle Tissues

15

Table of Contents

Figure 6. siRNA17 Expression Levels Achieved by BB-301 within Pharyngeal Muscle Tissues

Figure 7. coPABPN1 Expression Levels Achieved by BB-301 within Pharyngeal Muscle Tissues

16

Table of Contents

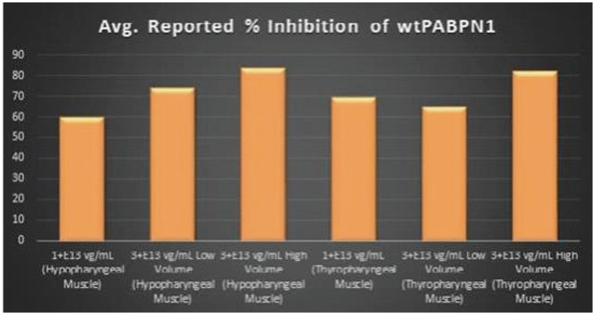

Regarding Wild Type PABPN1 Silencing (i.e., target knock-down) Observed for BB-301 Within the Pharyngeal Muscle Tissues (Figure 8):

| | As noted above, BB-301 encodes two distinct siRNA species (i.e., siRNA13 and siRNA17) which are each, independently, capable of inhibiting (i.e., silencing) the expression of all forms of the PABPN1 protein (siRNA13 and siRNA17 silence the expression of both wild type PABPN1 (wtPABPN1) and mutant PABPN1). |

| | While the Beagle dog subjects treated in the BB-301 Pilot Dosing Study do not express mutant PABPN1, the level of BB-301-driven gene silencing for the PABPN1 target can be indirectly assessed in these study subjects due to the equivalent inhibitory effects of siRNA13 and siRNA17 on both wtPABPN1 and mutant PABPN1. |

| | Thus, the wtPABPN1 silencing activity observed in the BB-301 Pilot Dosing Study serves as a surrogate for the silencing activity that would be anticipated in the presence of mutant PABPN1. |

| | BB-301 has been evaluated in prior non-clinical studies in animals that express mutant PABPN1 and, as a result, manifest the symptomatic phenotype of OPMD; in the symptomatic animal model of OPMD (i.e. the A17 mouse model), the achievement of PABPN1 silencing levels of 31% inhibition (or higher) following BB-301 administration led to resolution of OPMD disease symptoms and the elimination of the histopathological hallmarks of OPMD. |

Figure 8. PABPN1 Silencing (i.e., target knock-down) Achieved by BB-301 within Pharyngeal Muscle Tissues

There are key methodological distinctions between the current BB-301 Pilot Dosing Study conducted by Benitec as compared to the prior BB-301 Beagle dog dosing study carried out independently by the previous BB-301 licensee. The BB-301 dosing study conducted by the prior BB-301 licensee employed non-ideal routes and methods of BB-301 administration to the target pharyngeal muscle tissues and employed similarly limited analytical methods at the completion of the dosing phase of the study. Subsequently, the Benitec team worked to

17

Table of Contents

optimize the route and method of administration of BB-301 and to refine the core analytical methods employed following the completion of dosing of the large animal subjects.

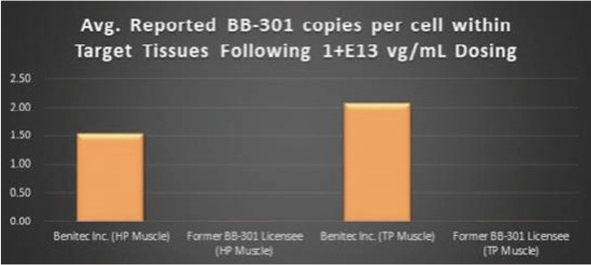

The current proprietary method of BB-301 delivery to the key pharyngeal muscles of study subjects, and the proprietary molecular analytical methods employed to assay the pharyngeal muscle tissues of study subjects, with both methods having been developed by the Benitec team, led to the observation of broad-based transduction of the targeted pharyngeal muscle tissues (Figure 9, represents individual sections of the TP muscle following BB-301 dosing). Critically, the Benitec-developed methods also facilitated the achievement of a 228-fold improvement (+22,647%) in BB-301 transduction of the HP muscle and a 113-fold improvement (+11,163%) in BB-301 transduction of the TP muscle relative to the levels of BB-301 transduction observed by the previous BB-301 licensee at identical BB-301 doses in identical canine study populations (Figure 10).

Figure 9. BB-301 Transduction Levels Achieved for Individual Sections of the TP Muscle Following BB-301 dosing

Figure 10. Impact of the Methodological Improvements to the BB-301 Large Animal Dosing Study Design on the Relative Pharyngeal Muscle Tissue Transduction Levels Achieved by Benitec vs. the Former BB-301 Licensee

18

Table of Contents

Following the disclosure of the positive interim BB-301 Pilot Dosing Study results, Benitec completed pre-CTA and pre-IND meetings with regulatory agencies in France, Canada, and the United States.

Summary of Regulatory Interactions:

| | Benitec successfully completed the regulatory interactions required to support initiation of the BB-301 clinical development program in 2022 |

| | Successful regulatory engagement comprised the completion of the following meetings: |

| | Pre-Clinical Trial Application (Pre-CTA) Consultation Meeting with Health Canada |

| | Scientific Advice Meeting with The National Agency for the Safety of Medicines and Health Products in France (LAgence nationale de sécurité du médicament et des produits de santé or ANSM) |

| | Type C Meeting with the U.S. Food and Drug Administration (the FDA) |

Benitec will begin the clinical development program for BB-301 in 2022.

Summary of the BB-301 Clinical Development Program:

| | The BB-301 clinical development program will begin in 2022, and the conduct of the development program will comprise approximately 76-weeks of follow-up for each OPMD study participant, inclusive of: |

| | 6-month pre-treatment observation periods employing quantitative radiographic imaging techniques for evaluation of the baseline disposition and natural history of OPMD-derived dysphagia in each study participant |

| | 1 day of BB-301 dosing to initiate participation in the Phase 1b/2a single-arm, open-label, sequential, dose escalation cohort study |

| | 52-weeks of post-dosing follow-up for conclusive evaluation of the primary and secondary endpoints of the Phase 1b/2a BB-301 treatment study |

| | The OPMD Natural History Study will begin in the second half of 2022, and this study will facilitate the characterization of OPMD patient disposition at baseline and assess subsequent rates of progression of dysphagia (swallowing impairment) in subjects with OPMD via the use of quantitative radiographic measures of global swallowing function and pharyngeal constrictor muscle function along with clinical assessments and patient-reported self-assessments of swallowing function |

| | Videofluoroscopic Swallowing Studies (VFSS) will be conducted to complete the following methodological assessments: |

| | Dynamic Imaging Grade of Swallowing Toxicity Scale (DIGEST) |

| | Pharyngeal Area at Maximum Constriction (PhAMPC) |

| | Pharyngeal Constriction Ratio (PCR) |

| | Clinical measures of global swallowing capacity and oropharyngeal dysphagia will be carried out |

| | Patient-reported measures of oropharyngeal dysphagia will be assessed |

| | The natural history of dysphagia observed for each OPMD study participant, as characterized by the quantitative radiographic measures and the clinical and patient self-reported assessments outlined above, will serve as the baseline for comparative assessments of safety and efficacy of BB-301 upon rollover of OPMD study subjects from the Natural History Study into the Phase 1b/2a BB-301 treatment study |

19

Table of Contents

| | Upon the achievement of 6-months of follow-up in the Natural History Study, OPMD Natural History Study participants can become eligible for enrollment into the Phase 1b/2a treatment study with the investigational genetic medicine, BB-301, which uses an AAV9-based gene therapy approach for the treatment of OPMD-derived dysphagia |

| | This first-in-human (FIH) clinical trial will be a Phase 1b/2a, open-label, dose escalation study to evaluate the safety and clinical activity of intramuscular doses of BB-301 administered to the pharyngeal muscles of subjects with OPMD |

| | Upon rollover from the Natural History Study into the Phase 1b/2a BB-301 treatment study, the follow-up of OPMD study participants will continue for 52-weeks, and the primary endpoints (safety and tolerability) and secondary endpoints (comprising the quantitative radiographic measures of global swallowing function and pharyngeal constrictor muscle function, and the clinical and patient-reported assessments noted above) will be evaluated during each 90-day period following Day 1 (Day 1 represents the day of BB-301 intramuscular injection). |

Summary of Risk Factors

An investment in our securities involves a high degree of risk. Any of the factors set forth herein under Risk Factors and the risk factors included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 and any subsequent Quarterly Report on Form 10-Q may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and in the documents incorporated by reference herein and, in particular, should evaluate the specific factors set forth herein under Risk Factors and the risk factors included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 and any subsequent Quarterly Report on Form 10-Q in deciding whether to invest in our securities. These risk factors include, among others:

| | We have incurred significant losses since inception and anticipate that we will continue to incur losses for the foreseeable future. If we are unable to achieve or sustain profitability, the market value of our common stock will likely decline; |

| | We have never generated any revenue from product sales and may never be profitable; |

| | Even if this offering is successful, we will need to continue our efforts to raise additional funding, which may not be available on acceptable terms, or at all. Failure to obtain capital when needed may negatively impact our ability to continue as a going concern; |

| | Our auditors report expresses substantial doubt about our ability to continue as a going concern; |

| | Our product candidates are based on ddRNAi and silence and replace technology. Currently, no product candidates utilizing ddRNAi technology or silence and replace technology have been approved for commercial sale and our approach to the development of ddRNAi technology and silence and replace technology may not result in safe, effective or marketable products; |

| | We are early in our product development efforts and our lead product candidate, BB-301, is in preclinical development. We may not be able to obtain regulatory approvals for the commercialization of BB-301 or other product candidates; |

| | Issues that may impact delivery of our therapeutics to the cell could adversely affect or limit our ability to develop and commercialize product candidates; |

| | We face competition from entities that have developed or may develop product candidates for our target disease indications, including companies developing novel treatments and technology platforms based on modalities and technology similar to ours; |

20

Table of Contents

| | If we are unable to obtain or protect sufficient intellectual property rights related to our product candidates, we may not be able to obtain exclusivity for our product candidates or prevent others from developing similar competitive products; |

| | You will experience immediate dilution as a result of this offering and may experience additional dilution in the future; |

| | There is no public market for the pre-funded warrants or the common warrants being offered by us in this offering; |

| | Holders of the pre-funded warrants or the common warrants offered hereby will have no rights as common stockholders with respect to the common stock underlying the pre-funded warrants or the common warrants, as applicable, until such holders exercise their pre-funded warrants or common warrants, as applicable, and acquire our common stock, except as otherwise provided in the pre-funded warrants or the common warrants, as applicable; |

| | Provisions of the common warrants and the pre-funded warrants offered by this prospectus could discourage an acquisition of us by a third party; |

| | The common warrants are speculative in nature; |

| | We may not receive any additional funds upon the exercise of the pre-funded warrants and the common warrants; |

| | Significant holders or beneficial holders of our common stock may not be permitted to exercise warrants that they hold; |

| | This offering could cause our stock price to fall, which could result in us being delisted from The Nasdaq Capital Market; |

| | Future sales of our common stock, or the perception that such sales may occur, could depress the trading price of our common stock; |

| | We have broad discretion in the use of the net proceeds we receive from this offering and may not use them effectively; and |

| | We do not have enough authorized shares of common stock to issue upon the exercise of all of the common warrants and we require Stockholder Approval of the Capital Event and the subsequent filing with the Secretary of State of the State of Delaware a certificate of amendment to our amended and restated certificate of incorporation to effect such Capital Event in order to have a sufficient number of shares of common stock available for issuance upon exercise of the Series 2 Common Warrants. There is no assurance that such Stockholder Approval will be obtained which could materially and adversely impact the rights of the Series 2 Common Warrant holders. |

COVID-19 Pandemic

COVID-19 has been declared a pandemic by the World Health Organization and has spread to nearly every country, including Australia and the United States. The impact of this pandemic has been, and will likely continue to be, extensive in many aspects of society, which has resulted in, and will likely continue to result in, significant disruptions to businesses and capital markets around the world. The extent to which the coronavirus impacts us will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and its variants, and the actions to contain the coronavirus or treat its impact, including the effectiveness and adoption of vaccines for the virus, among others.

Certain elements of our research and development efforts are conducted globally, including the ongoing development of our silence and replace therapeutic for the treatment of Oculopharyngeal Muscular Dystrophy

21

Table of Contents

(OPMD), and will be dependent upon our ability to initiate preclinical and clinical studies despite the ongoing COVID-19 pandemic.

As we continue to actively advance our development programs, including the completion of our ongoing Toxicology and Biodistribution study for BB-301, we are in close contact with our principal investigators and preclinical trial sites, which are primarily located in France, and are assessing the impact of COVID-19 on our studies and the expected development timelines and costs on an ongoing basis. In light of developments relating to the COVID-19 global pandemic since the beginning of the outbreak, the focus of healthcare providers and hospitals on fighting the virus, and consistent with the FDAs industry guidance for conducting clinical trials, we have experienced delays to the original timeline regarding the initiation and anticipated completion of the ongoing BB-301 Clinical Trial Application (CTA)-enabling and Investigational New Drug Application (IND)-enabling development work. The initiation of the BB-301 Pilot Dosing Study in Beagle dogs, which represents a key component of the CTA-enabling and IND-enabling work, was delayed by several months, however, the study has been completed without incident. In addition, the BB-301 GLP Toxicology and Biodistribution Study in Beagle dogs, which represents another key component of the CTA-enabling and IND-enabling work, is nearing completion. The acquisition of chemical reagents, biological reagents and laboratory supplies which are essential for the conduct of basic laboratory research, the conduct of nonclinical studies and the completion of GMP manufacturing of BB-301, has also become challenging due to the disruption of global supply chains inherent to the production of these materials. We will continue to evaluate the impact of the COVID-19 pandemic on our business and we expect to reevaluate the timing of our anticipated preclinical and clinical milestones as we learn more and the impact of COVID-19 on our industry becomes clearer.

We have also implemented a halt of non-essential business travel and a rotation system whereby staff work from home and attend the laboratory on designated days which may result in a reduction of laboratory work. As we transition our employees back to our premises, there is a risk that COVID-19 infections occur at our offices or laboratory facilities and significantly affect our operations. Additionally, if any of our critical vendors are impacted, our business could be affected if we become unable to procure essential equipment in a timely manner or obtain supplies or services in adequate quantities and at acceptable prices.

Corporate Information

We were incorporated as a Delaware corporation on November 22, 2019 and completed the re-domiciliation (the Re-domiciliation) on April 15, 2020. Our predecessor, Benitec Limited, was incorporated under the laws of Australia in 1995. Our common stock is traded on The Nasdaq Capital Market under the symbol BNTC. Our principal executive offices are located at 3940 Trust Way, Hayward, California 94545. Our telephone number is (510) 780-0819, and our Internet website is www.benitec.com. The information on, or that can be accessed through, our website is not part of this prospectus and is not incorporated by reference herein.

Implications of Being a Smaller Reporting Company

We are a smaller reporting company and will remain a smaller reporting company while either (i) the market value of our stock held by non-affiliates was less than $250 million as of the last business day of our most recently completed second fiscal quarter or (ii) our annual revenue was less than $100 million during our most recently completed fiscal year and the market value of our stock held by non-affiliates was less than $700 million as of the last business day of our most recently completed second fiscal quarter. We may rely on exemptions from certain disclosure requirements that are available to smaller reporting companies, including many of the same exemptions from disclosure requirements as those that are available to emerging growth companies, such as reduced disclosure obligations regarding executive compensation in our registration statements, prospectus and our periodic reports and proxy statements. For so long as we remain a smaller reporting company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not smaller reporting companies.

22

Table of Contents

| Common stock offered by us |

25,380,710 shares (or 29,187,816 shares, if the underwriters option to purchase additional shares is exercised in full). |

| Pre-funded warrants offered by us |

We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers so choose, pre-funded warrants in lieu of shares of common stock that would otherwise result in any such purchasers beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each pre-funded warrant will be exercisable for one share of our common stock. The exercise price of each pre-funded warrant will equal $0.0001 per share. Each pre-funded warrant will be exercisable upon issuance and will not expire prior to exercise. We are offering up to 25,380,710 shares of common stock and up to 25,380,710 pre-funded warrants, in the aggregate not exceeding more than a total of 25,380,710 shares of common stock and pre-funded warrants. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the pre-funded warrants. |

| Common warrants offered by us |

We are issuing to purchasers of shares of our common stock and/or pre-funded warrants in this offering a common warrant to purchase up to one share of our common stock for each share and/or pre-funded warrant purchased in this offering for a combined purchase price of $ for shares and accompanying common warrants and $ for pre-funded warrants and accompanying common warrants. Because a common warrant to purchase share(s) of our common stock is being sold together in this offering with each share of common stock and, in the alternative, each pre-funded warrant to purchase one share of common stock, the number of common warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold. |

| A portion of the common warrants, the Series 1 Common Warrants, will be exercisable on the date of closing at an exercise price of $ per share and will expire on the five-year anniversary of such closing. As more fully described in the Form of Common Warrant, which is filed as an exhibit to the registration statement of which this prospectus forms a part, the remainder of the common warrants that are not so exercisable on the date of closing, the Series 2 Common Warrants, will become exercisable at an exercise price of $ per share on the date on which we (a) receive Stockholder Approval for a Capital Event and (b) effect such Capital Event by filing with the Secretary of State of the State of Delaware a certificate |

23

Table of Contents

| of amendment to our amended and restated certificate of incorporation, and will expire on the five-year anniversary of the date such certificate of amendment becomes effective. See Description of Securities Common Warrants for a more detailed discussion. |

| No fractional shares of common stock will be issued in connection with the exercise of a common warrant. In lieu of fractional shares, we will round down to the next whole share. See Description of Securities Common Warrants. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the Series 1 Common Warrants. |

| Option to purchase additional shares and/or common warrants |

We have granted the underwriter a 30-day option to purchase an aggregate of up to 3,807,106 additional shares of our common stock and/or up to 3,807,106 additional common warrants to purchase 3,807,106 shares of our common stock from us at the public offering price per share of common stock and common warrant, less the underwriting discounts and commissions. The underwriter may exercise its option to acquire additional shares for the sole purpose of covering over-allotments. See Underwriting. |

Common stock outstanding prior to this offering 8,171,690 shares.

| Common stock to be outstanding immediately following this offering |

33,552,400 shares (or 37,359,506 shares, if the underwriters option to purchase additional shares is exercised in full) assuming we sell only shares of common stock in this offering and assuming none of the common warrants issued in this offering are exercised. |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $18,179,836 ($20,969,835 if the underwriters option to purchase additional shares and/or common warrants is exercised in full), based on an assumed public offering price per share of common stock and common warrant of $0.7880, the last reported sale price of our common stock on the Nasdaq Capital Market on September 8, 2022, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us and assuming we sell only shares of common stock in this offering and no exercise of the common warrants. We intend to use the net proceeds from this financing for the clinical development of BB-301, including the natural history lead-in study and the Phase 1b/2a BB-301 treatment study, for the continued advancement of development activities for other existing and new product candidates, for general corporate purposes, and for strategic growth opportunities. See Use of Proceeds. |

| Dividend policy |